Common Stock: New Gold Inc (NGD)

Current Market Price: $.85

Market Cap: $575 million

New Gold Stock – Company Summary

New Gold Inc is a mining company that develops and operates gold properties. The company owns 4 key assets, 3 in Canada and 1 in Mexico. It recently sold a property in Australia. New Gold was founded in 1980 and is headquartered in Toronto Canada. They have over 1,700 employees worldwide.

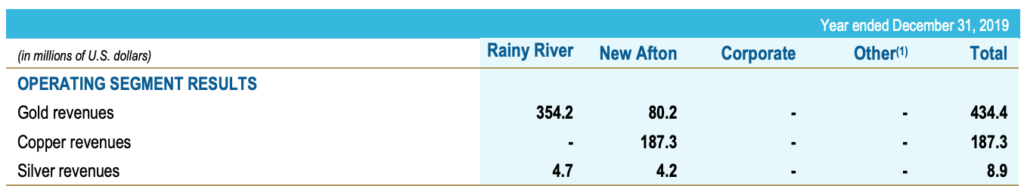

Revenue and Sales Analysis

In 2019, New Gold had total revenues of $630 million, and increase over 2018 revenues of $604 million. However, the company had an operating loss of $7.9 million and a net loss of $73.5 million.

Cash Flow from operating activities in 2019 were $263.5 million.

The company primarily sells gold. Copper sales are significant and gold sales are not significant.

New Gold’s revenue is concentrated in a few customers. Their top 5 customers accounted for 89% of revenue in 2019.

Royalties and Stream Obligations

In 2015, New Gold entered a $175 million streaming obligation with Royal Gold (RGLD). New Gold will deliver 6.5% of the gold production from their Rainy River mine to Royal Gold, as well as 60% of the mines silver production. Royal Gold will pay 25% of the average spot price for the gold and silver.

This is a significant streaming obligation with long term implications for New Gold stock holders. Its implications should be considered carefully when making an investment decision.

New Gold Stock – Balance Sheet Analysis

The company does not have a strong balance sheet. They have low liquidity and high debt levels. In addition to their debt they have significant liabilities related to streaming obligations, lease obligations, and a deferred tax liability.

Debt Analysis

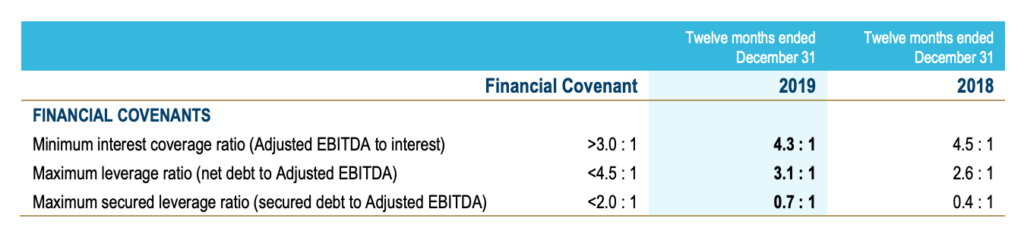

New Gold has $714 million in long term debt. $397 million of this debt is due in November of 2022 and bears an interest rate of 6.25%. The remainder of the debt is due in May of 2025. In 2019, the company paid of $100 million in principal on it 2022 notes.

The debt has covenants related to several metrics used to measure the financial health of the company. Should the company violate these covenants, they could incur penalties.

Credit Rating – Moody’s

In September of 2019 Moody’s completed a periodic review of New Gold, concluding that their B3 rating is under stress. A B3 rating is not considered investment grade, meaning New Gold’s debt is speculative grade debt.

“New Gold’s B3 rating is constrained by the execution risk it faces in achieving operational improvements at its key Rainy River mine, an expectation of negative free cash flow through 2019, driven by material capital expenditures, its small scale and mine concentration (just two mines), and the company’s sensitivity to gold and copper price volatility. The rating does benefit from its operations being located in a favorable mining jurisdiction (Canada) and long mine lives of over 10 years.”

New Gold Stock – Share Dynamics and Capital Structure

The company had 611 million common shares outstanding as of year-end 2019. This is an increase from 578 million shares outstanding at year end 2018.

The company had a total of 5.5 million options outstanding, making the fully diluted common shares outstanding around 616 million.

Although the company does have senior notes outstanding and some dilutive options outstanding, that capital structure is OK.

It is worth noting that management has proven willing to dilute common shares holders via new debt issuance, new share issuance, and the sale of streaming obligations. These factors should be considered carefully when making an investment decision.

Dividends

New Gold Inc does not pay and dividend and is unlikely to begin in the near term.

Economic Factors and Competitive Landscape.

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

New Gold Management Structure – Skin in the game

New Gold insiders have been net buyers of the stock over the past 12-18 months. This can mean increased alignment of interests with shareholders. However, the percent of the shares of New Gold held by insiders is very low, well below 1%.

New Gold Stock – Some Metrics to Consider

Cash Coverage Ratio

Cash/Current Liabilities

$83.4 million/ $171.9 million = .49

A cash coverage ratio of .49 is low, indicating low current liquidity and potential difficulties meeting near term obligations.

Working Capital Ratio

Current Assets/Current Liabilities

$228.7 million/$171.9 million = 1.33

A working capital ratio of 1.33 is adequate but not great. It indicates sufficient liquidity in the near term. However, given the nature of the company’s liabilities, particularly its debt, this ratio is likely to deteriorate over the next several years.

Price to Book

New Gold Share Price/ Book Value per Share

$.85/$1.56= .55

New Gold inc has a book value per share of $1.56 based on the fully diluted shares outstanding estimate above. A price to book ratio of .55 indicates that New Gold inc shares are currently trading at a significant discount to their book value.

New Gold Stock – Summary and Conclusions

New Gold Inc is in a very difficult financial position. They have low balance sheet liquidity and debt liabilities that will increase significantly in 2022. The company’s operating results have proven inconsistent leaving them unable to return capital to shareholders via a dividend.

The company’s assets are concentrated in a few mines and the company’s revenues are concentrated almost entirely in its top 5 customers. In addition, they have sold off a significant portion of their Rainy River production via a streaming arrangement.

Given the current state of New Gold it will be very difficult for management to right the ship. In order to stay alive, it is likely they will need to further impair their balance sheet, to the detriment of common shareholders.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.