Common Stock: Company name: Iamgold corp (IAG)

IamGold Share Price: $3.38

Market Capitalization: $1.59 billion

Summary of Iamgold

Iamgold is a mining company headquartered in Toronto, Canada. They own and operate 3 major gold mines In Africa and Canada. In addition to these mine they own various exploration and development stage properties. The company was founded in 1990 and has over 4,000 employees.

Major Mines

- Westwood Mine – Quebec, Canada

- Essakane Mine – Burkina Faso, Africa

- Rosebel Mine – Suriname, Africa

Iamgold Stock – Revenue and Sales Analysis

Iamgold produced 762,000 ounces of gold in 2019. This was a significant decrease from the prior year, when the company produced 882,000 ounces. In 2019 revenues were $1.06 billion, a 4% decrease from the prior year. This decrease in revenue is due to lower sales volume at all 3 of the company’s major mines.

Cost of sales was $950 per ounce in 2019, up 17% from the prior year. The company had operating profits of $69.6 million in 2019, a significant decrease from $136.9 million in 2018.

Iamgold had a net loss of $398 million in 2019, however most of this loss is attributable to a one-time impairment charge related to their Westwood property.

Royalty Payments

The company pays significant royalties on production at both its Essakane and Rosebel mines. These payments totaled $48.6 million in 2019.

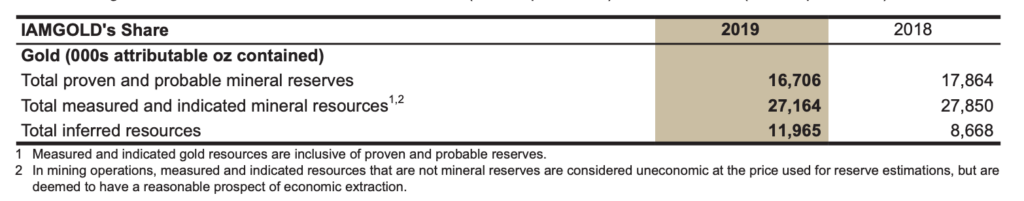

Gold Reserves

Iamgold has proven gold reserves of 16.7 million ounces as of year-end 2019. This represents a 6% decrease from 2018, due to depletion at several of the companies mines.

Iamgold Stock – Balance Sheet Analysis

The company has a strong balance sheet. It has a large cash balance of $830 million, ensuring its ability to meet not only its current liabilities, but also continue to finance its necessary CAPEX, including exploration and development stage properties.

Debt levels are reasonable, totaling $409 million. Most of which is not due until 2025.

Credit Rating – Moody’s

In October of 2019 Moody’s downgraded Iamgold to B1 due to operating challenges at some of its mines. The company still has an investment grade status.

Dividends

Iamgold did not pay a dividend in 2019 and has not paid a dividend to common shareholders since 2013.

Iamgold Stock – Share dynamics and Capital structure

The company has 469 million common shares outstanding. It also has relevant contingent share issues and stock based compensation, which could be dilutive in the future. I estimate the diluted shares outstanding to be around 491 million.

Although the company does have senior debt and some dilutive shares, the figures are relatively small, meaning the capital structure appears to be acceptable for common shareholder.

Management Structure – Skin in the game

The CEO will retire in 2020 and be succeeded by the current president and COO.

There has been a fair amount of insider selling over the past 12-18 months and insider ownership is low, at less than 1%. While this is not necessarily meaningful, it is certainly not encouraging.

Iamgold Stock – 3 Metrics to Consider

Cash Coverage Ratio

Cash/Current Liabilities

$830 million/$266 million=3.1

A cash coverage ratio of 3.1 indicates the company has very good liquidity. They have a strong cash position and are likely to be able to meet all current obligations for the foreseeable future.

Price to Book

Iamgold has a book value per share of $4.93, based on the fully diluted shares outstanding estimate above. The price to book ratio is .68, meaning Iamgold is currently trading at a significant discount to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$1.263 billion/$266 million = 4.7

A working capital ratio of 4.7 is another metric indicating strong balance sheet liquidity.

Economic factors and competitive landscape.

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Iamgold Stock – Summary and Conclusions

Iamgold operates 3 strong and proven gold mines. However, these mines are in challenging regions, and face risks related to their jurisdictions. This concentration of revenue in risky jurisdiction should be considered carefully before investing.

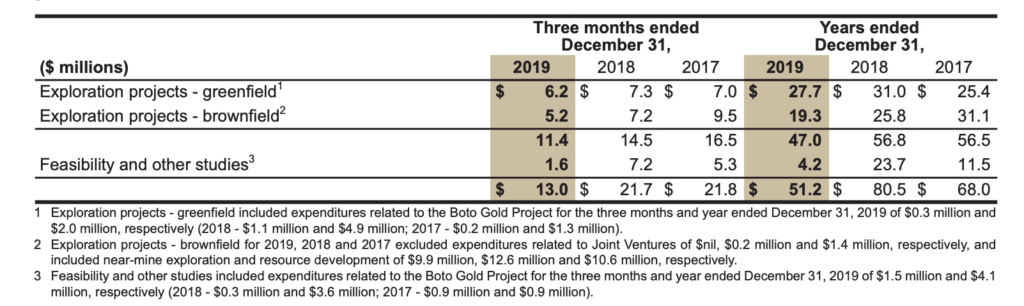

The company’s exploration projects have promise, but are not likely to be able to make up for a severe impairment of one of the company’s major assets.

The company has strong liquidity and is not likely to face financing issues in the short to medium term. However, this strong liquidity position has not translated into profits for shareholders and capital has not been paid out to common shareholders since 2013.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.