Common Stock: Vivara (VIVA3)

Current Market Price: R$ 23.52

Market Capitalization: R$ 5.5 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link. Vivara had its IPO in 2019 and some of the financial disclosures are incomplete. 2020 will be the first year the company reports a full year result.

Vivara Stock – Summary of the Company

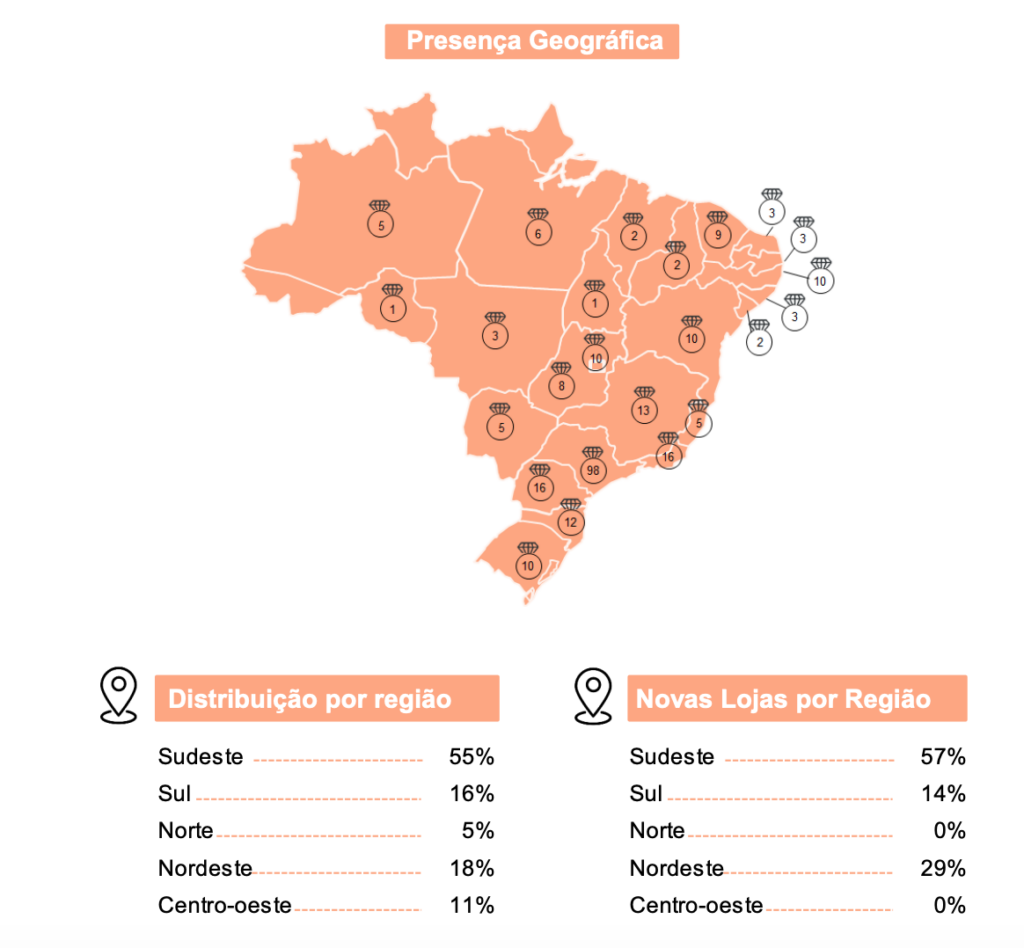

Vivara is the largest jewelry chain in Brazil. The company sells a wide range products under several different brands; Vivara, Life by Vivara, Vivara Watches, Vivara Accessories, and Vivara Fragrances. They have 250 points of sale throughout Brazil. Vivara was founded in 1962 and is headquartered in Sao Paulo, Brazil.

Revenue and Cost Analysis

Vivara had sales of R$ 1.48 billion in 2019, an increase from R$ 1.35 billion in 2018. The company had net income of R$ 318.2 million, also an increase from R$ 198.4 million.

Please note these numbers are from a company presentation, not audited financials, since the company’s audited financials do not show anything from 2018 and only partial results from 2019.

Balance Sheet Analysis

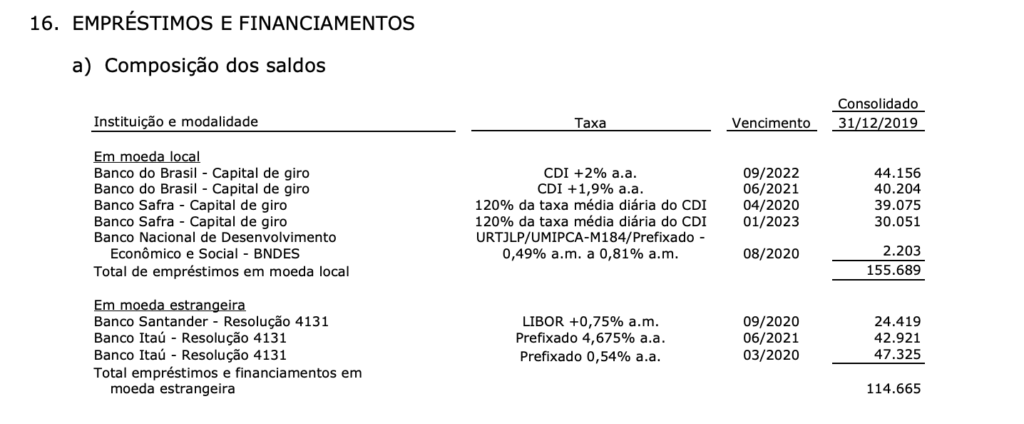

Vivara has a decent, but overly complex balance sheet. The company has sufficient liquidity and manageable liability levels. However they have significant debt denominated in foreign currency and are engaged in complex currency derivatives.

Vivara – Debt Analysis

As of year-end 2019 Vivara has R$ 270 million in total debt outstanding. R$ 114 million of this debt is denominated in foreign currency, exposing the company to the negative effects of a depreciating Brazilian Real.

Vivara Stock – Share Dynamics and Capital Structure

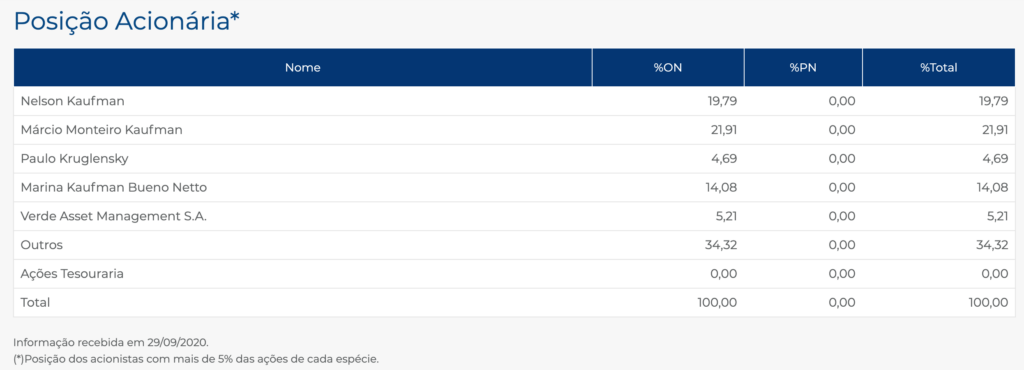

As of year-end 2019 Vivara has 236.2 million common shares outstanding. Around 65% of the company’s shares are owned by insiders and one institutional investor. The remaining 35% are held by smaller investors with an ownership position of less than 5%.

Vivara Stock – Dividends

The company paid a dividend of R$ 0.169 cents per share in 2019. At the current market price this implies a dividend yield of 0.7%.

Vivara Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 789.8 million . R$ 1 billion = .72

A debt to equity ratio of .72 indicates that Vivara uses a mix of debt and equity in its capital structure, but relies more on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 1.3 billion / R$ 458.8 million = 2.8

A working capital ratio of 2.8 indicates a sound liquidity position. Vivara should not have problems meeting its near term obligation.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 23.52 / R$ 4.61 = 5.1

Vivara has a book value per share of R$ 4.61. At the current market price this implies a price to book ratio of 5.1, meaning the company’s stock currently trades at a premium to the book value of the company.

Vivara Stock – Summary and Conclusions

Vivara had its IPO in 2019. Their only audited final report for 2019 only shows results from May 2019 to year end 2019. It does not show any of the company’s financials prior to 2019. I don’t understand why they wouldn’t show the full year’s results. This lack of disclosure certainly doesn’t make me confident in the quality of their financial reporting. I also don’t understand why a jewelry company with 100% of its revenue derived domestically is engaged in complex currency derivatives.

The company’s 2020 results likely suffered due to the corona virus crisis. Although Vivara stock is intriguing, without more complete financial disclosures and more information on how the corona virus impacted the company, Vivara stock is not investable. I will revisit the company’s 2020 results, but even then I will only had a year and a half of audited financial disclosure, still not enough to make a well informed decision. Investors should compare Vivara stock to other Brazilian jewelry companies, such as Brazilian watch company Grupo Technos.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.