Common Stock: Semafo Mining (TSX:SMF,OTC: SEMFF)

Current Market Price: $2.75

Market Capitalization: $921 million

SMF Stock – Summary of the Company

Semafo Mining is a gold producer focused on operating gold properties in West Africa. They have 2 producing mines in Burkina Faso, The Mana mine and The Boungou mine. In addition, they have several other exploration stage properties in Burkina Faso. Semafo Mining was founded in 1994 and is headquartered in Montréal Quebec. They currently have over 1,200 full time employees and an additional 1,800 contractors.

Revenue and Cost Analysis

Semafo Mining had revenue of $475 million in 2019, a significant increase over 2018 revenue of $296.6 million. The company had operating income of $113 million in 2019, also a significant improvement over 2018 operating income of $10 million.

Net Income for 2019 was $60 million, compared to a loss of $6 million in 2018.

Royalty and Streaming agreements

Both the Boungou and Mana mines are subject to royalty payments ranging from 3% to 5% depending on the spot price of gold.

Reserves

The company estimates it has proven and probable reserves totaling 2.6 million ounces of gold.

Balance Sheet Analysis

Semafo has a strong balance sheet with a high cash balance and manageable near term liabilities. Total current assets were $250.8 million at year end 2019, including $98 million in cash. Total current liabilities were $146 million.

The company’s assets are mostly long term assets, such as property and equipment. Total long term assets were $859 million at the end of 2019. Total long term liabilities were $116 million.

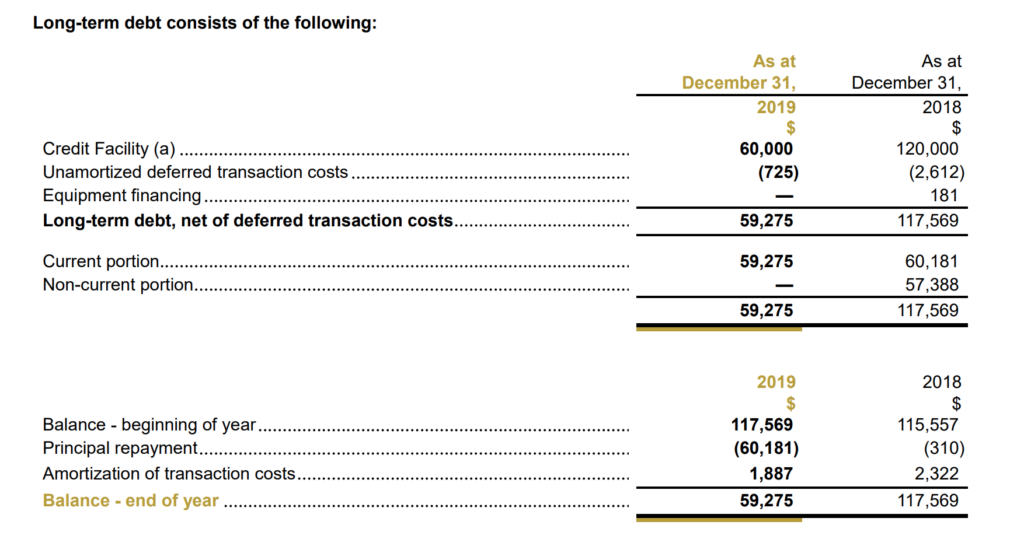

Debt Analysis

Semafo has long term debt totaling $60 million at an interest rate of LIBOR + 4.75%. Payments are made quarterly.

The debt also carries the following 2 covenants:

-Current Ratio of greater than 1.20:1.00

-Ratio of Net Debt to Trailing Two Quarter EBITDA of less than 5.00:1.00

SMF Stock – Dividends

Semafo does not currently pay a dividend and is unlikely to do so in the near future.

SMF Stock – Share Dynamics and Capital Structure

As of March 2020, the company has 334 million common shares outstanding. The company also has a small number of options outstanding related to compensation.

Although Semafo has senior debt, its debt coverage ratios are adequate, making its capital structure acceptable for common stock holders.

Management – Skin in the game

Insiders have been net sellers of SMF stock over the last 12 months. However, most this selling has been one insiders selling down his holdings. Insider ownership of SMF stock is low, less than 1%.

Insider selling and low insider ownership are generally viewed as bearish signals for the stock.

SMF Stock – 3 Metrics to Consider

Working Capital Ratio

Current Assets/Current Liabilities

$250.8 million/$146.2 million = 1.7

A working capital ratio of 1.7 indicates sufficient short term liquidity, meaning Semafo is likely to meet its short-term obligations.

Debt Coverage Ratio

Cash/Total debt and lease obligations

$98 million/$90 million = 1.08

A debt coverage ratio of 1.08 means the company has sufficient cash to meet all its debt obligations.

Price to Book Ratio

Current price of common stock/ Book value per share

$2.75/$2.53=1.08

Semafo currently has a book value per share of $2.53. Based on the current market price of SEMFF stock, Semafo has a price to book ratio of 1.08. A price to book ratio of 1.08 means the company is currently trading at roughly the book value of its assets.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

SMF Stock – Summary and Conclusions

Semafo has 2 strong operating mines, as well as several other exploration stage properties. The company’s production cost per ounce is low and its generating positive operating income and net profit.

They also have a strong balance sheet, with a good cash position and manageable debt levels. Given that debt levels are manageable, Semafo has capital structure that is acceptable for common stock holders.

The biggest risk for investors in SMF common stock is jurisdiction risk. All the company’s productive assets are located in Burkina Faso. Burkina Faso is highly unstable country and increased volatility in the country would have severe negative impacts on Semafo common stock. For example, in 2019 several Semafo buses were attacked by an armed group. It’s not hard to imagine how thigs could go very bad, very fast.

SMF common stock currently trades at a fair valuation, roughly equal to the book value of its assets. Given its strong financials, Semafo will likely benefit greatly from an increased gold price. Highly risk tolerant investors can consider a small position in Semafo within a well-diversified portfolio of gold stocks

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.