Common Stock: Pure Gold (TSX: PGM)

Current Market Price: $.99 CAD

Market Capitalization: $320 million CAD

*Note: All values in this analysis are expressed in Canadian Dollars (CAD) unless otherwise noted.

PGM Stock – Summary of the Company

Pure Gold is a mining company focused on the exploration, development, and operation of gold mining properties primarily in Canada. The company has one keystone property, the RL Mine in Ontario, but also owns several other exploration stage properties. Pure gold was founded in 2005 and has its headquarters in Vancouver Canada.

Revenue and Cost Analysis

The development financing package for the RL Mine has been completed and the project is fully funded. However, at year end 2019, the project had yet to produce, meaning Pure Gold has no revenue.

Total operating expenses were $16.1 million in 2019. Pure gold had a comprehensive net loss of $21.8 million. The company’s expenses are primarily related to exploration expenditures.

Pure Gold – Reserves

The RL Mine has probable gold reserves of 1,013,000 ounces of gold.

PGM Stock – Royalty and Streaming Agreements

Pure Gold entered into the following streaming agreement related to the RL Mine:

- US$25 million as prepayment for 5.0% of the gold produced until 50,000 ounces of gold has been delivered;

- Reduces to 2.5% of gold production thereafter;

- Fully advanced on closing;

- Ongoing payments of 30% of the spot gold price

Pure Gold has a buyback option on this stream, where Pure Gold may elect to terminate the entire Callable Gold Stream on June 30, 2021 by paying USD $35 million; or on June 30, 2022 by paying USD $38 million.

Balance Sheet Analysis

The company’s balance sheet is currently strong, with $71 million in current assets and only $8 million in current liabilities. Although liquidity is currently sufficient, Pure Gold will likely need to raise more capital in the future, further impairing its balance sheet.

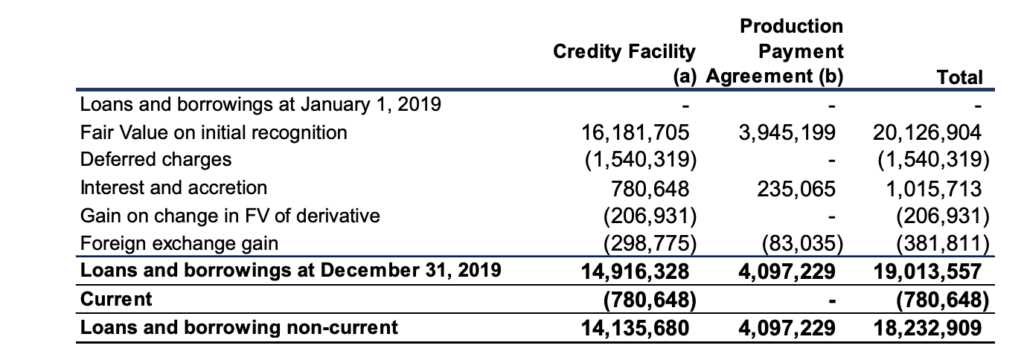

Pure Gold – Debt Analysis

The company has a USD $65 million revolving credit facility which as not fully been drawn down.

PGM Stock – Dividend

Pure Gold does not currently pay a dividend.

PGM Stock- Share Dynamics and Capital Structure

Pure Gold had 359 million common shares outstanding as of March 2020. They also have a significant amount of dilutive instruments outstanding, including 19 million options and 57.6 million warrants. Fully diluted common shares outstanding is around 436 million.

The company also has a relevant concentration of ownership, AngloGold and Eric Sprott each hold more than 10% of Pure Gold’s common shares.

Pure Gold has a dilutive capital structure and existing common shareholders will most likely be further diluted in the future. Common stock investors should carefully consider their place in the capital structure before investing.

Management – Skin in the game

Over the last 12 months’ insiders have been net buyers of PGM stock. This is usually viewed as a bullish signal for the stock since it implies alignment of interests between management and shareholders.

PGM Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

$81 million/$49.5 million = 1.63

A debt to equity ratio of 1.63 implies that the company has a significant amount of debt in its capital structure and may be reliant on further debt financing in the future.

Working Capital Ratio

Current Assets/Current Liabilities

$71 million/$8 million = 8.8

A working capital ratio of 8.8 indicates a strong short term liquidity position.

Price to Book Ratio

Current price of the common stock/ Book Value per Share

$.99/$.11=9

Based on my estimate of fully diluted shares outstanding, Pure Gold has a book value per share of $.11. At the current market price this implies a price to book ratio of 9. A price to book ratio of 9 means that PGM stock trades at a significant premium to the book value of its assets.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

PGM Stock – Summary and Conclusions

The RL Mine is a promising mine. It has produced significant amounts of gold in the past, and Pure Gold has managed to completely finance the project. However, in order to do, so common shareholder had to pay a high price. The company has a highly dilutive capital structure, with significant options and warrants outstanding. They also have a significant streaming agreement, limiting the upside for common shareholders if/when the RL mine is productive.

The balance sheet is currently strong, with sufficient liquidity. But to further finance exploration and operations, the company will likely need more capital. When this capital is raised, it will be to the detriment of existing shareholders, either via dilutive new issues, or further drawing down on its debt facility.

If the best-case scenario plays out for the RL Mine, debt investors in Pure Gold are sure to do well. However, given the company’s capital structure, it is unclear if equity investors will also participate in that upside. At the current valuation, Pure Gold is a high-risk investment and should only be considered within a well-diversified portfolio of gold stocks.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.