Common Stock: CROPS INC (TSXV: COPS)

Current Market Price: $.015 CAD

Market Capitalization: $1 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

CROPS Inc Stock – Summary of the Company

CROPS Inc is a mineral exploration company focused on the acquisition, exploration, and development of mineral properties. Their focus is their flagship Bayovar 12 phosphate project in Peru. The company was founded in 1993 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

The company has some revenue from gypsum production at its Bayovar 12 project. Total revenue in 2019 was $537 thousand, a significant increase from $173 thousand in 2018. However, production costs far exceeded revenue in both years and CROPS had an operating and net loss in both 2019 and 2018. Production costs were $855 thousand and $393 thousand in 2019 and 2018 respectively.

In 2019 CROPS had a net loss of $7.3 million, a significant increase from $2.6 million in 2018. Financing costs were significant in both years. Crops did have relevant exploration expenses of $421 thousand and $727 thousand in 2019 and 2018 respectively.

Balance Sheet Analysis

CROPS has a weak balance sheet. They have poor liquidity and liabilities, including debt, exceed the company’s assets.

CROPS Inc – Debt Analysis

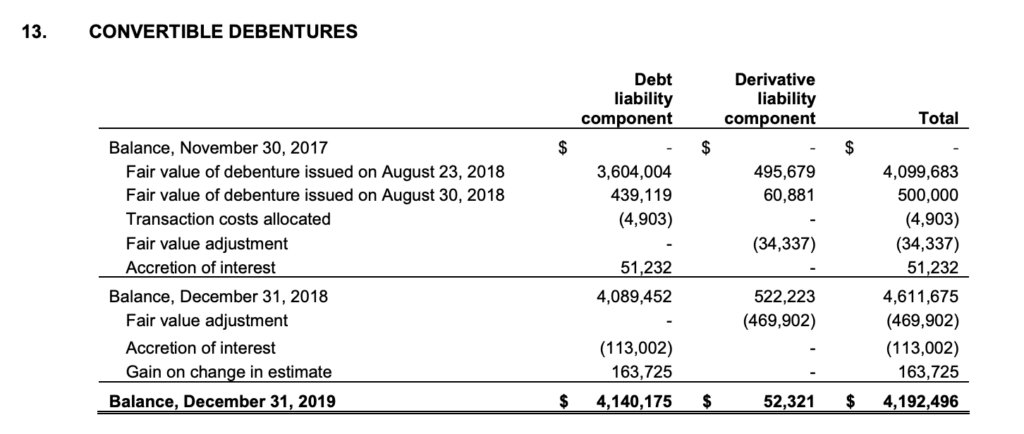

In 2015, the company received a loan from Sprott, which was restructured as convertible debt in 2018. As of year-end 2019 CROPS has $4.2 million in debt outstanding.

CROPS Inc Stock – Share Dynamics and Capital Structure

As of March 2020, the company has 70 million common shares outstanding. In addition, they have 45.6 million convertible shares outstanding, 1 million incentive stock options, and 58.7 million warrants outstanding. Fully diluted shares outstanding is around 175.3 million shares.

CROPS has a highly dilutive capital structure. Investors should carefully consider the effects of dilution before investing.

CROPS Inc Stock – Dividends

The company does not currently pay a divided.

Management – Skin in the game

There has not been any relevant activity by CROPS insiders in the recent past.

CROPS Inc Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$5.6 million/ -$5.1 million = -1.08

A debt to equity ratio of negative 1.08 indicates that CROPS has accumulated losses and has more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

$381 thousand/ $1.3 million = .28

A working capital ratio of .28 indicates a weak liquidity position. CROPS may have problems meeting its obligations.

CROPS Inc Stock – Summary and Conclusions

CROPS is in a very poor financial position. They are running operating and net losses and in addition have a significant debt burden. Their capital structure is highly dilutive, and therefore unfavorable for common shareholders.

I am not interest in phosphate projects currently, but if I was I wouldn’t invest in CROPS stock. I analyzed the company due to Radius Gold holding shares in its equity portfolio. Although I view CROPS stock as uninvestable, Radius has such a small position that it will not impact my opinion of Radius Gold Stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.