Common Stock: Radius Gold (TSXV: RDU)

Current Market Price: $.305 CAD

Market Capitalization: $26.5 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Radius Gold Stock – Summary of the Company

Radius Gold is a precious metals exploration company focused on the acquisition and exploration of precious metals properties. They also hold equity investments in other precious metals companies. The company was founded in 2004 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Radius does not have any properties that are currently producing and therefore does not have any revenue. The company consistently runs a net loss and is likely to continue to do so for the foreseeable future.

In 2019 Radius had a net loss of $2.6 million, an increase from 2018’s net loss of $1.5 million. Their largest expenses in both years were exploration related. Exploration expenses were $753 thousand and $934 thousand in 2019 and 2018 respectively.

Radius Gold – Royalty and Streaming Agreements

The Bald Peak property in Nevada is subject to a 3% net smelter royalty. The Coyote property in Nevada is subject to a 2% to 3% net smelter royalty. The Palmillas and Planta Verde properties in Mexico are subject to a 1% net smelter royalty.

Balance Sheet Analysis

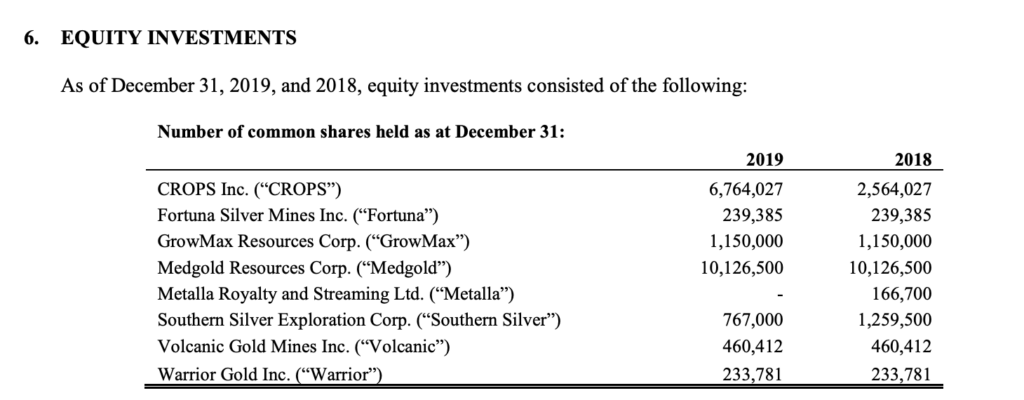

Radius has a sound balance sheet. They have a strong liquidity position and very low liability levels. They also own a portfolio of equity investments in other publically traded precious metals companies.

Radius Gold – Debt Analysis

As of year-end 2019 the company does not have any debt outstanding.

Radius Gold Stock – Share Dynamics and Capital Structure

As of July 2020, the company has 87 million common shares outstanding. In addition, they have 5.6 million options outstanding. Fully diluted shares outstanding is around 92.6 million shares.

Radius does not have an overly dilutive capital structure and appears acceptable for common shareholders.

Radius Gold Stock – Dividends

The company does not pay a dividend and is unlikely to do so for the foreseeable future.

Management – Skin in the game

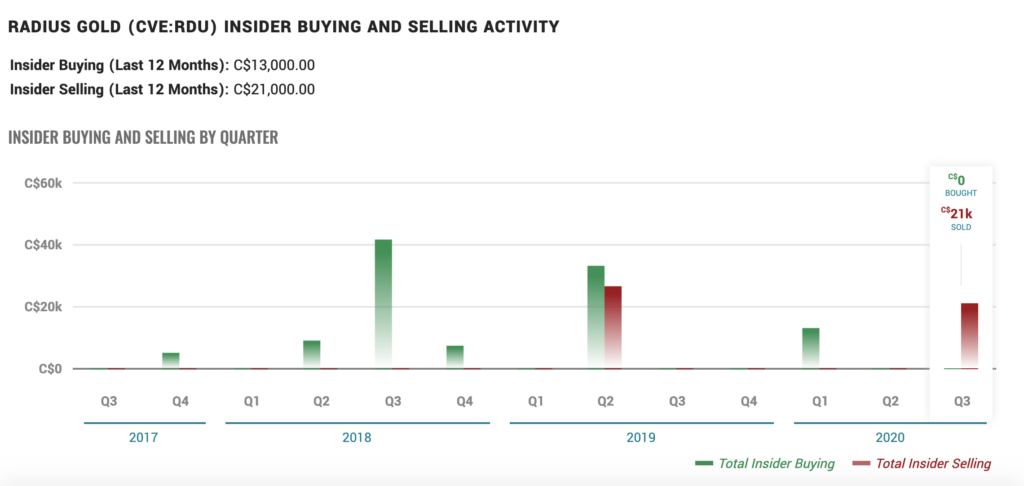

Insiders at Radius Gold have been net sellers of the company’s stock in the recent past, but the amounts are far too small to provide a signal to investors.

Radius Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$431 thousand/$3.8 million = .11

A debt to equity ratio of .11 indicates that Radius uses very little debt in its capital structure and relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$3.7 million/$155 thousand = 24

A working capital ratio of 24 indicates a strong liquidity position. Radius should not have a problem meeting its obligations in the near term.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.305/ $.04 = 7.2

Based on fully diluted shares outstanding Radius Gold has a book value per share of $.04. At the current market price this implies a price to book ratio of 7.2, meaning the company’s stock trades at a premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Radius Gold Stock – Summary and Conclusions

Radius is an interesting company. They own equity interests in several publically traded precious metals companies, including Fortuna Silver, which is a core position in my precious metals portfolio. In addition, they own or have options on several other exploration stage properties in the US, Mexico, and Peru, some of which are being actively explored.

The company is sound financially and the capital structure is acceptable for common shareholders. I am seriously considering an investment in Radius Gold stock, but before I allocate, I need to analyze the companies in their equity portfolio that I am not familiar with. But it appears there is a lot of optionality embedded in Radius Gold stock and it has the potential to become a significant position in my portfolio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

2 Comments

Comments are closed.