Common Stock: Bahema Educação (BAHI3)

Current Market Price: R$ 126.28

Market Capitalization: R$ 280.2 million

*All values in this article are expressed in Brazilian Reis (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Bahema Educação Stock – Summary of the Company

Bahema was originally founded in 1953 in Salvador Bahia. The company started out selling agricultural machinery, eventually becoming a caterpillar representative in Brazil. In the 1980’s the company began to invest its surplus cash into public equities, which eventually became the company’s principal asset. In 2008, the company distributed most of its assets to shareholders. In 2016, the company began to study the idea investing its remaining assets into elementary and high schools. In 2017, the company began investing in its first schools and Bahema Educação was born. The company is headquartered in Sao Paulo Brazil and continues to actively invest in new schools.

Bahema Educação currently owns interests in five schools, three of which it has a controlling interest. The company has around 6,000 students. Bahema takes a hands-off approach and does not look to replace management after investing. They will work with the schools to make operational improvements where possible.

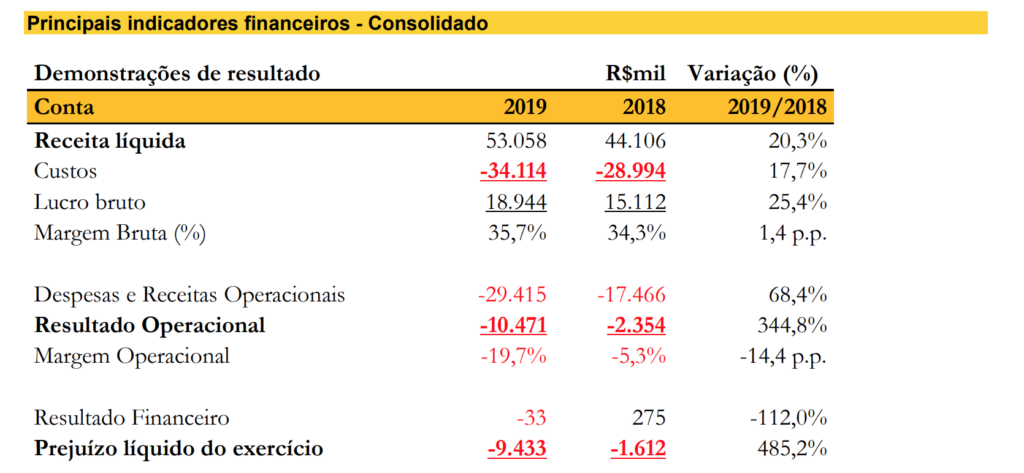

Revenue and Cost Analysis

Bahema had revenue of R$ 53 million in 2019, a significant increase from 2018 sales of R$ 44.1 million. However, the company had a net loss in both years. Bahema had a net loss of R$ 9.4 million and R$ 1.6 million in 2019 and 2018 respectively. The company’s largest operating expenses are compensation related.

Balance Sheet Analysis

Bahema has a decent balance sheet. Its liquidity position is sufficient in the near term and it has manageable liability levels in both the short and long term.

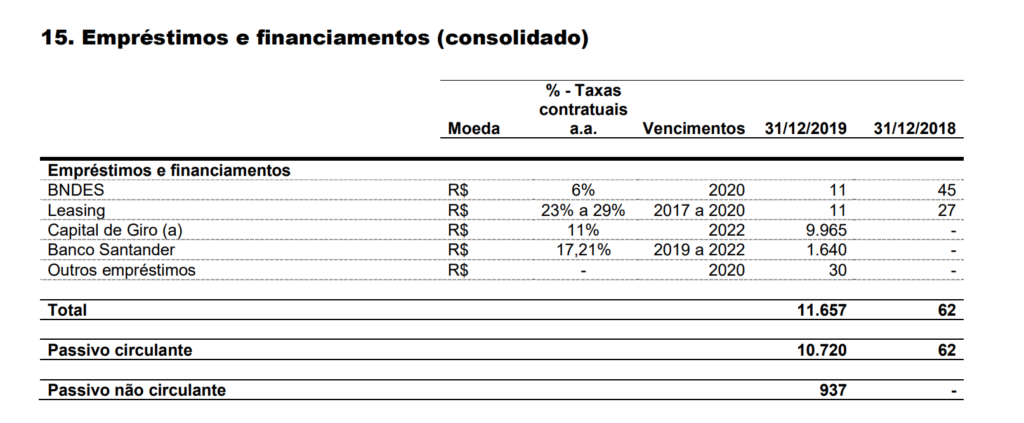

Bahema Educação – Debt Analysis

As of year-end 2019, Bahema had R$ 11.6 million in debt outstanding, almost all of which is due on the short term.

Bahema Educação Stock – Share Dynamics and Capital Structure

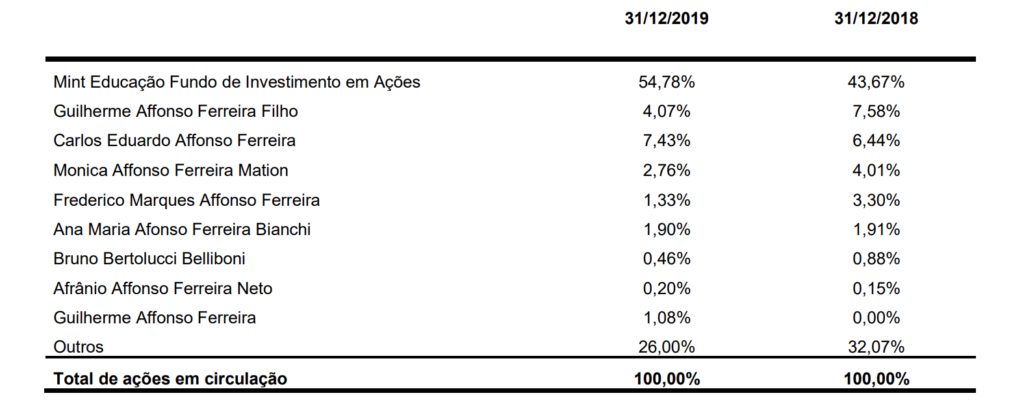

As of year-end 2019 Bahema had 2.2 million share outstanding. This represents a significant increase from year end 2018 when the company had around 1.2 million shares outstanding. This increase is due to the company’s raising capital in 2019 via share issuance.

Bahema Educação Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

Management owns a significant portion of the outstanding shares, so I believe it is fair to assume their interests are aligned with shareholders.

Bahema Educação Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 66 million/ R$ 121.7 million = .54

A debt to equity ratio of .54 indicates that Bahema uses mix of debt and equity in its capital structure but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 52.7 million/R$ 33.6 million = 1.6

A working capital ratio of 1.6 indicates a sufficient liquidity position. Bahema should not have problems meeting its obligations in the near term.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 126/R$ 56 = 2.2

Bahema has a book value per share of R$ 56. Based on the current market price this implies a price to book ratio of 2.2, meaning the company’s stock trades at a slight premium to the book value of the company.

Brazilian Private Education Market – Economic Factors and Competitive Landscape

The Brazilian private education market has significant potential in the long term. Public education in Brazil is notoriously poor and the market is ripe for private market solutions. Brazil is demographically favorable for the primary education market and a rising middle class is likely to seek alternatives to public schools for their children. Effectively run private education companies in the right markets have the potential to build strong and sustainable long term businesses.

Bahema Educação Stock – Summary and Conclusions

Bahema is a very young company in a market that interests me. The markets it has already invested in, (Sao Paulo, Rio de Janeiro, and Minas Gerais) all have significant growth potential for private education companies and Bahema is positioning itself to capture some of these growing markets.

However, the company is not in a strong financial position and has yet to show it is capable of managing its investments profitably. That is not to say it can’t, but given the extreme changes that are likely coming to education due to the coronavirus pandemic, I am not willing to invest in Bahema stock yet. I will wait for the company’s 2020 annual report and reconsider my investment decision after seeing how these changes have affected the company.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.