Preferred Stock: Bombril S.A. (BOBR4)

Current Market Price: R$ 2.03

Market Capitalization: R$ 528.8 million

*All values in this article are expressed in Brazilian Reis (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Bombril Stock – Summary of the Company

Bombril S.A. manufactures and sells hygiene and cleaning products such as detergents, sponges and soaps. The company offers 264 products under 16 different brands. Bombril has 3 manufacturing operations in Brazil, located in the states of Sao Paulo, Minas Gerais, and Pernambuco.

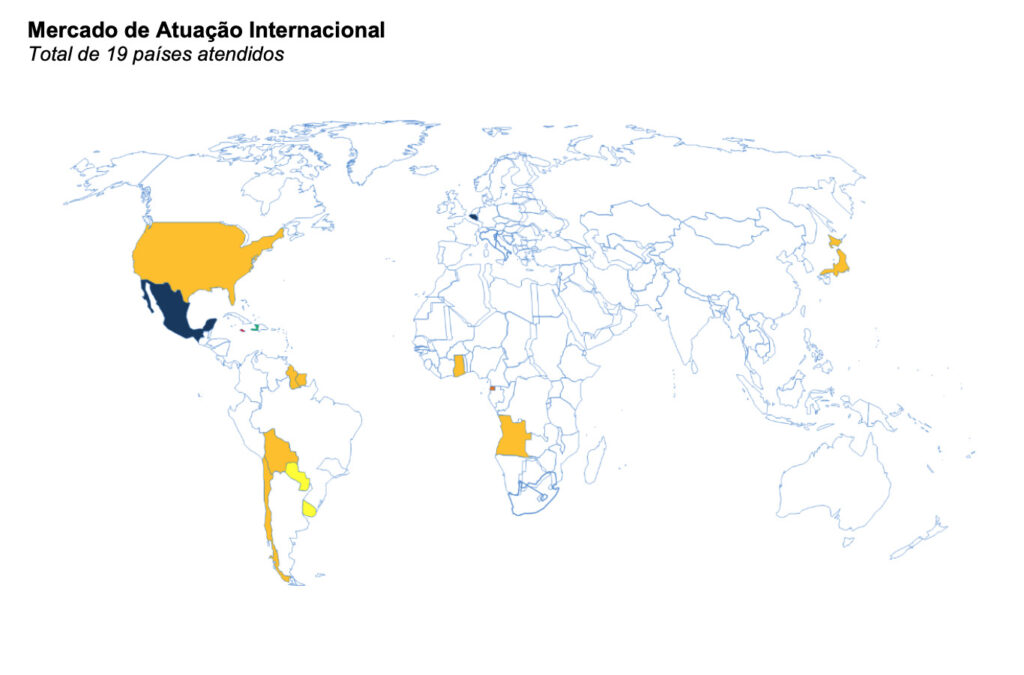

The company sells its products throughout all of Brazil, and in addition exports to 19 countries. Their largest export destinations are Mexico, Paraguay, and Bolivia.

The company was founded in 1948 and is headquartered in Sao Bernardo do Campo, in the State of Sao Paulo, Brazil. As of year-end 2019 the company had around 2,900 employees.

Revenue and Cost Analysis

In 2019 Bombril has gross sales of R$ 1 billion with a cost of goods sold of R$647 million, representing a gross margin of 39%. The company had a net loss of R$40.4 million in 2019. Debt expense weighed heavily on the company’s results.

Balance Sheet Analysis

Bombril’s balance sheet is weak. They have low liquidity and a heavy debt burden. If operating results do not improve, the company may face financial difficulties in the short to medium term.

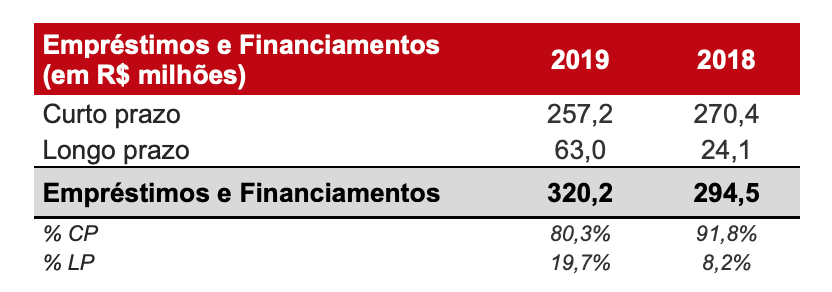

Bombril Stock – Debt Analysis

As of year-end 2019 Bombril had debt outstanding valued at R$ 320.2 million, an increase from R$ 294.5 million at year end 2018. Although bank debt increased year over year, the company paid down debt outstanding to suppliers, so in aggregate the company’s debt burden decreased slightly year over year.

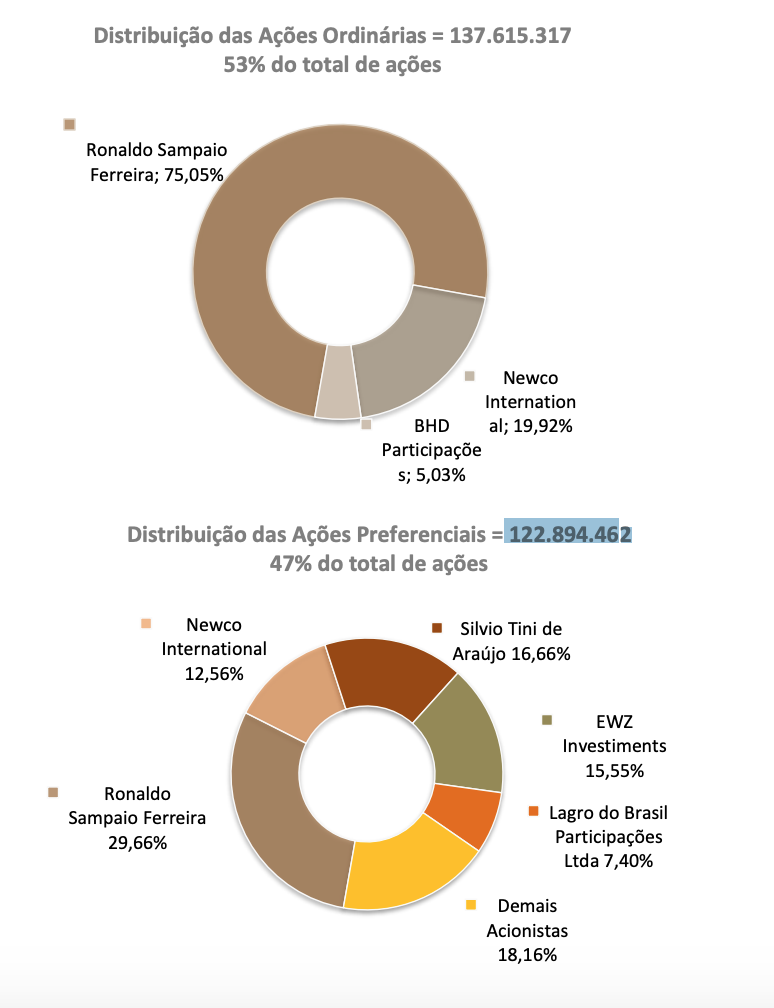

Bombril Stock – Share Dynamics and Capital Structure

Bombril has both common and preferred shares outstanding, however only the preferred shares trade publically. 75% of the common shares (not publically traded) are held by the Sampaio Ferreira family (founding family). The family also owns round 30% of the outstanding preferred shares.

As of year-end 2019 there were 137.6 million common shares and 122.9 million preferred shares outstanding.

Bombril Stock – Dividends

The company did not pay a dividend in 2019. When dividends are paid, preferred shareholders are guaranteed a dividend that is a minimum of 10% greater than ordinary shareholders. The company states its intent to pay out 25% of net income in dividends.

Management – Skin in the game

The founding family still owns a large portion of the company. I think it is fair to say that their interests are aligned with shareholders.

Bombril Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 646.8 million / R$ -285.1 million = -2.3

A debt to equity ratio of negative 2.3 indicates that Bombril has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 266 million/ $469 million = .56

A working capital ratio of .56 indicates a weak liquidity position. Bombril may have problems meeting its near-term liabilities. Investors should further investigate the company’s liquidity issues before investing.

Interest Coverage Ratio

EBIT/ Interest Expense

R$ 61.7 million/ R$ 91.2 million = .71

An interest coverage ratio of .71 indicates that the company has a high debt burden relative to their operating results. Bombril may have difficulties meeting its debt obligations.

Summary and Conclusions

Bombril has a solid product portfolio with several well established brands. They have distribution throughout Brazil and export, which is not very common among Brazilian manufacturers. The company’s shares are tightly held by the founding family.

However, Bombril is in poor financial health. Their liquidity position is weak and their debt burden is excessive. The company faces the real possibility of insolvency.

Although I am intrigued by the company’s product portfolio and distribution, the company’s financial position is too weak to merit further analysis. I will add Bombril to my watch list, and review their next annual report when it is available.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.