Company Name: Common Stock: Yamana Gold (AUY)

Current Marktet Price: $4.40

Current Market Capitalization $4.2 Billion

Summary of Yamana Gold

Yamana gold is a mining company headquartered in Toronto, Canada. They were founded in 1980 and currently have over 12,000 employees. The company mines and produces gold and silver. In addition to its producing properties, it owns development and exploration stage properties, as well as land positions. Yamana Gold operates throughout The Americas in Canada, Chile, Brazil, and Argentina.

Revenue and Sales Analysis

In 2019 Yamana Gold produced 900k ounces of gold and 10.6 million ounces of silver. In addition, they produced relevant amounts of copper, zinc, and molybdenum. The company expects to maintain similar production levels of gold and silver through 2021. In 2019 sales were $1.6 billion, declining for the 2nd consecutive year, down from $1.8 billion in 2017.

Although sales declined, in 2019 Yamana Gold had an operating profit of $474 million and net income of $225.6 million. This is compared to operating and net losses in both 2017 and 2018.

Although top line revenue decreased, margins improved. Overall the companies operating results have been inconsistent, but improving. They have a reasonable production cost of around $760 per GEO (Gold equivalent ounce) and expect to maintain these production levels for the foreseeable future.

Balance Sheet Analysis

Yamana Gold had $7.1 Billion in assets at year-end 2019, this is down from $8 billion at year end 2018. This difference is almost entirely attributable to the divesture of the companies ownership stake in the Chapada mine in Brazil. The majority of the company’s assets, $6.7 billion, are long term assets such as property, plant, and equipment. The company has $401 million in current assets, $158 million of which is held in cash and equivalents

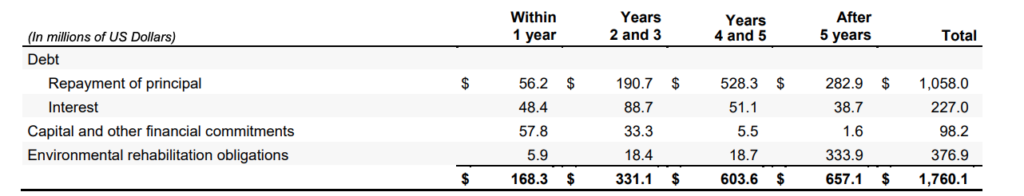

The company has $2.9 billion in total liabilities, of which $1 billion is debt. Total debt decreased to $1 billion from $1.8 billion. The proceeded from the Chapada sale were mostly used to pay down debt. The debt that was retired was retired ahead of schedule and the company is targeting a net leverage ratio of 1x by 2021. However, debt levels will balloon in 4-5 years, which could significantly impair returns to shareholders.

Overall Yamana gold has a healthy and improving balance sheet. Debt levels are manageable and liquidity is sufficient, but not great. Management has shown a willingness to improve the company’s financial position by paying down debt, while maintain dividend payments to shareholders. As long as the company can continue to improve its balance sheet, from both a liquidity and deb perspective, then the current levels of debt and the debt balloon in 4-5 years should be manageable, leaving the company well positioned in the future.

Moody’s Rating of Yamana Gold

In September 2019 Moody’s competled a periodic review of Yamana Gold, maintaining its Baa3

Ratings, making it just above investment grade status.

Yamana Gold Dividends

The company has consistently paid out dividends to its shareholders. It currently has a dividend yield of just over 1%.

Yamana Gold Stock Dynamics and Capital Structure

The company has around 950 million shares outstanding, which has remained stable over the past 3 years. Although the company does carry senior debt, they do not have a relevant amount of convertible issues (warrants, options, etc…) outstanding. From a common shareholder’s perspective, the capital structure appears acceptable.

Economic factors and competitive landscape.

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

3 Valuation metrics to consider

Price to Book

Yamana gold stock has a book value per share of $4.87, representing a price to book ratio of .85. This means the company is currently trading at a slight discount to the book value of its assets.

Dividend payout Ratio

Dividends Paid/Net Income

$23.7 million/$225.6 million= 10.5%

The company paid out 10.5% of net income to shareholders in 2019.

Cash Coverage Ratio

Cash/Current Liabilities

$158.8 million/$1.15 Billion=.137

Cash Coverage is low, indicating low short term liquidity.

Summary and Conclusions – Yamana Gold Investment Analysis

There is a lot to like about Yamana Gold at its current valuation. The company has a well-diversified asset portfolio, in terms of both revenue streams and geography. This reduces the risk of a catastrophic outcome for shareholders due to the impairment of any one asset.

Operating results have been inconsistent, but the shares are currently trading at a discount to book value, providing investors with a margin of safety that could compensate for the inconsistency of operation. However low levels of current liquidity are concerning and a debt balloon in 4-5 years could seriously impair margins.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draw draw attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.