Common Stock: Teranga Gold Corporation (TSX:TGZ, OTC:TGCDF)

Current Market Price: $8.14

Market Capitalization: $1.36 billion

Teranga Gold Stock – Summary of the Company

Teranga Gold Corporation is a gold mining company focused on the acquisition, exploration, development, and operation of gold mining properties in West Africa. Their keystone property if the Sabodala mine in Sengal. In 2019, they acquired the Massawa mine from Barrick Gold, increasing the size and scope of the Sabodala project. They also brought their 2nd producing mine into production in 2019, the Wahgnion mine in Burkina Faso. They have several other exploration and development stage projects in West Africa.

The company was founded in 2010 and is headquartered in Toronto Canada.

Revenue and Cost Analysis

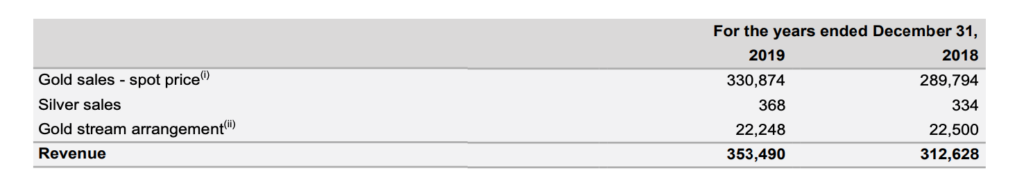

The company produced 288,768 ounces of gold in 2019, an 18% increase of 2018 production of 245,230 ounces. Total revenue was $353.5 million in 2019, increasing from $312.6 million in 2018.

Almost all of the company’s revenue is from gold sales, with a small amount of silver accounting for the remainder of sales.

Teranga Gold – Royalty and Streaming Agreements

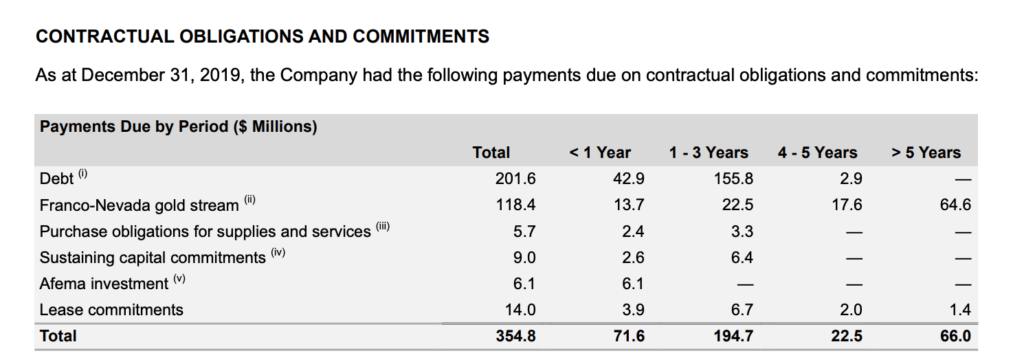

The company has a large gold stream liability related to a streaming agreement with Franco Nevada. They also have a significant royalty expense.

Teranga Gold – Reserves

The company has over 3.7 million ounces of gold reserves as of year-end 2019.

Balance Sheet Analysis

Teranga does not have a strong balance sheet and liquidity is constrained in the short term. At the end of 2019 current assets totaled $236.5 million compared to $304.1 million in current liabilities.

Most of the company’s assets are long term assets such as property and equipment. At the end of 2019 Teranga had total assets of $939.2 million compared to total liabilities of $596.9 million.

Teranga Gold – Debt Analysis

Teranga has significant debt on its balance sheet. Total debt was $201.6 million at the end of 2019, most of which is due within 3 years. They also have relevant lease obligations.

Teranga Gold Stock – Share Dynamics and Capital Structure

As of year-end 2019 Teranga had 107.6 million common shares outstanding. They also have dilutive instruments such as options outstanding. Fully diluted shares outstanding is around 116.1 million shares.

Investors need to carefully consider their place in the capital structure given the company’s high debt level and dilutive instruments outstanding.

Teranga Gold Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

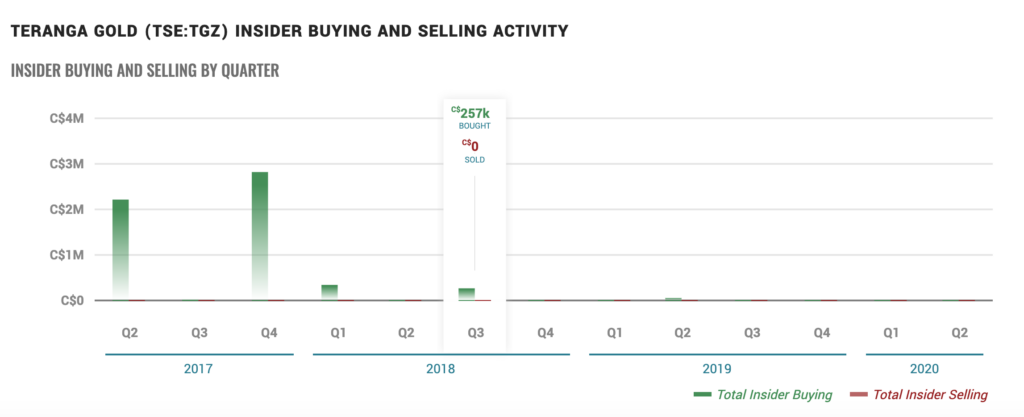

There has been no insider trading of Teranga stock over the past 12 months. However in 2017 and 2018 insiders were net buyers of Teranga common stock.

Teranga Gold – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$596.9 million/$578.9 million = 1.03

A debt to equity ration of 1.03 implies the company is financed with equal parts debt and equity, meaning they are not likely to be overly reliant on debt financing in the future.

Price to Book Ratio

Current Share Price/Book Value per Share.

$8.14/$4.98=1.63

Based on my estimate of fully diluted shares outstanding, Teranga has a book value per share of $4.98. At the current market price this implies a price to book ratio of 1.6. A price to book ratio of 1.6 means Teranga common stock currently trades at a premium to the book value of the company’s assets.

Working Capital Ratio

Current Assets/Current Liabilities

$236.5 million/ $304.1 =.77

A working capital ratio of .77 implies short term liquidity constraints, meaning Teranga may have problems meeting its near-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Teranga Gold Stock – Summary and Conclusions

Terenga has two quality mines with a low production cost. They have large reserves and should continue to produce for the foreseeable future.

However, the company is in poor financial health. Debt levels are high and they have significant streaming obligations. Furthermore, they have a significant amount of dilutive instruments outstanding.

Givens Terengas poor financial health, high jurisdictional risk, and the weak position of common shareholders in the capital structure, I would not invest in Teranga common stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.