Common Stock: SSR Mining (SSRM)

Current Market Price: $18.07

Market Capitalization: $2.2 Billion

SSR Mining – Summary of the Company

SSR Mining is a precious metals company focused on the exploration, development, acquisition, and operation of properties throughout the Americas. They currently have 3 producing mines in Canada, The United States, and Argentina, as well as various exploration stage properties. The company was founded in 1946 and is headquartered in Vancouver, Canada. They currently have over 1,400 full time employees and over 400 contractors.

SSR Mining – Revenue and Cost Analysis

In 2019 SSR had total revenue of $606.9 million, a significant increase over 2018 sales of $420 million. Net income in 2019 was $55 million, representing a profit margin of 9%. Cash flows from operating activities were $134 million in 2019, a significant increase from $59 million in 2018. These increases were due in large part to the company selling higher amounts (ounces) of both gold and silver.

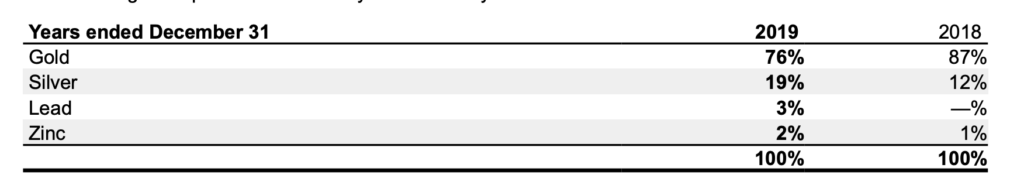

Most of SSR’s revenue comes from the sale of gold and silver. They also sell small amounts of zinc and lead. In 2019 silver represented a significantly larger portion of the company’s revenue compared to 2018.

SSR Mining – Balance Sheet Analysis

SSR has a strong balance sheet with, good and improving liquidity. At year end 2019, they had current assets of $899 million, including $503 million of cash. The company’s cash position improved significantly, increasing by $84 million compared with year end 2018.

Most of the company’s assets are long term assets such as property and equipment. At year end 2019 SSR had total assets of $1.75 billion.

Debt Analysis

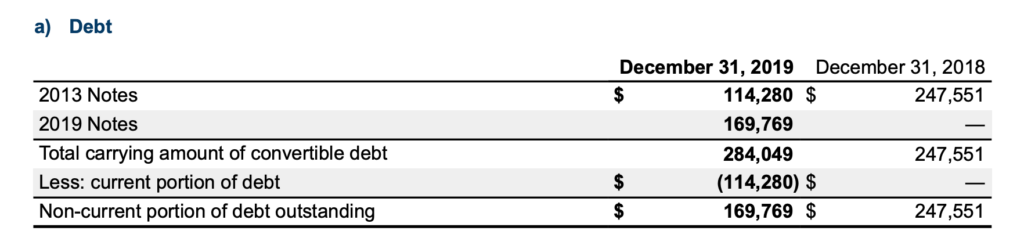

In 2019 SSR issued $230 million in convertible debt due in 2039. Each $1000 in principal is convertible into 54 common shares at a price of $18.48 per common share.

Overall the company has manageable debt levels, especially given its strong liquidity position. However, the debt is convertible and this conversion could represent significant dilution of common shareholders.

SSRM Stock – Share Dynamics and Capital Structure

As of February 2020, SSR had 123.2 million shares of common stock outstanding. In addition, the company has options and share based compensation outstanding. Not including the potential dilution from convertible notes outstanding, diluted shares outstanding is around 126 million shares.

SSR has a dilutive capital structure. It has significant amounts of convertible senior debt. The 2019 convertible issue alone, if fully converted, could represent the issuance of over 12 million new common shares. Investors should carefully consider their position in the capital structure and the implications of dilution before investing SSRM stock.

SSRM Stock – Dividend

SSRM stock does not currently pay a dividend.

Management – Skin in the game

Over the past 12-18 months’ insiders at SSR mining have been net sellers of the common stock. Additionally, they own a very small portion of the shares outstanding, less than 1%

Insider selling and low insider ownership is generally thought of as a bearish signal for the stock as it indicates a lack of alignment of interests with common shareholders.

SSRM Stock – 3 Metrics to Consider

Working Capital Ratio

Total Current Assets/Total Current Liabilities

$899 million/$234 million = 3.84

A working capital ratio of 3.84 indicates a strong short term liquidity position. The company’s cash position alone is sufficient to meet all short-term obligations. SSR should not have issues paying its bills in the near term.

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

$616 million/$1.1 billion=.54

A debt to equity ratio of .54 implies that the company is financed mostly with equity capital and not overly reliant on debt financing.

Interest Coverage Ratio

Interest Expense/ Net Operating Income

$30 million/$122 million = 4.1

An interest coverage ratio of 4.1 means the company is generating sufficient income from operations to meet their debt obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

SSR Mining – Summary and Conclusions

SSR mining has a diversified asset base and a strong balance sheet. The company’s strong liquidity position has it well positioned to capitalize of future opportunities. They appear to be efficiently running operations and are able generate free cash flow.

My biggest concern with SSRM stock is the capital structure and the potential dilution from convertible debt. If SSR performs well in the future, then these conversion options are certain to be exercised, limiting the upside for existing shareholders.

Although SSR mining is a well-run company with attractive assets, I don’t believe the capital structure is ideal for common shareholders. At its current price, SSRM stock does not have a sufficient margin of safety to compensate for the high risk of dilution.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.