Common Stock: Orezone Gold (TSXV: ORE)

Current Market Price: $.50 USD

Market Capitalization: $123.3 million USD

Orezone Gold Stock – Summary of the Company

Orezone Gold is a gold exploitation company focused of the development of their flagship asset, the Bombore gold project, in Burkina Faso. In 2019, the company updated its feasibility study and is currently in the process of financing and developing the mine. Orezone was spun out from IAMGOLD in 2008 and is headquartered in Vancouver, Canada.

Revenue and Cost Analysis

The Bombore property is not currently producing and therefore Orezone does not have any revenue. The company consistently runs a net loss and is likely to do so for at least 1-2 more years, until the mine s brought into operation.

In 2019 Orezone had a net loss of $22.4 million, a significant increase for 2018’s net loss of $15.7 million. The company’s largest expenses were exploration and evaluation expenses in both years. These expenses totaled $17.3 million and $ 11 million in 2019 and 2018 respectively.

Orezone Gold – Royalty and Streaming Agreements

The Burkina Faso government owns a 10% equity interest in the company. The government is also entitled to a sliding scale net smelter royalty ranging from 3% to 5%.

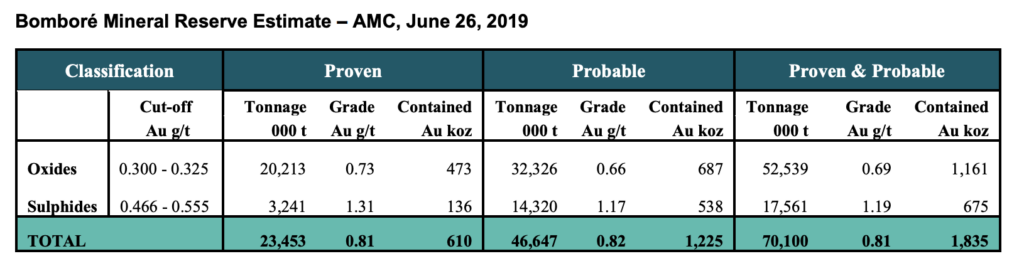

Orezone Gold – Mineral Resources

The Bombore property has “Proven and Probable” mineral resources totaling 1.8 million ounces of gold.

Balance Sheet Analysis

Orezone has a solid balance sheet with sufficient liquidity and low liability levels.

Orezone Gold – Debt Analysis

As of year-end 2019 the company does not have any debt outstanding.

Orezone Gold Stock – Share Dynamics and Capital Structure

As of March 2020, the company had 251 million common shares outstanding. In addition, they had 16.3 million options and 18.8 million warrants outstanding. Fully diluted shares outstanding is around 286.1 million shares.

Orezone has a dilutive capital structure. Investors should carefully consider their place in the capital structure and the effects of dilution before investing.

Orezone Gold Stock – Dividends

The company does not currently pay a dividend and is unlikely to do so in the near term.

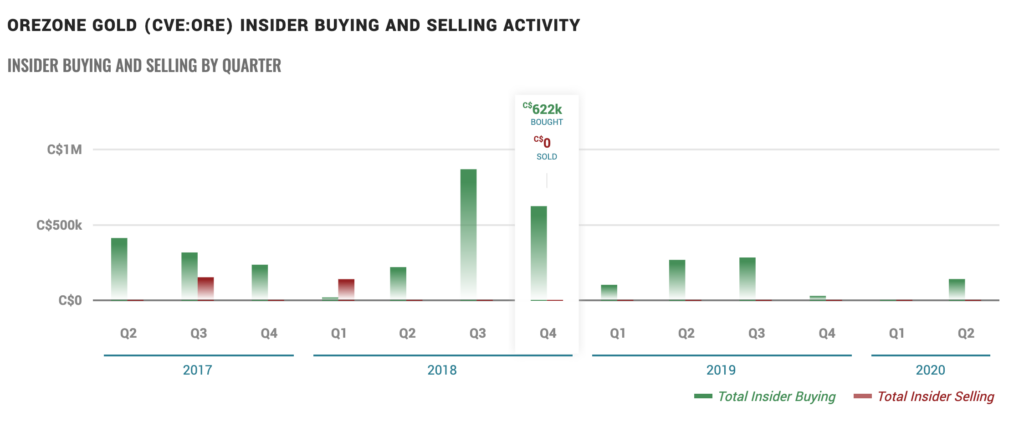

Management – Skin in the game

Insiders at Orezone Gold have been net buyers of the stock in the recent past. This is generally viewed as a bullish signal for the stock.

Orezone Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$3.9 million/$12.8 million = .3

A debt to equity ratio of .3 indicates that the company uses some debt in its capital structure, but relies mostly on equity financing to fund itself.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.50/$.05 = 10

Based on fully diluted shares outstanding Orezone has a book value per share of $.05. At the current market price, this implies a price to book ratio of 10, meaning the company currently trades at a significant premium to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$13.2 million/$3.6 million = 3.6

A working capital ratio of 3.6 indicates sufficient liquidity. Orezone should not have a problem meeting its short-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Orezone Gold Stock – Summary and Conclusions

The company owns a strong asset which they have explored aggressively. Everything appears to be in place to advance to the development stage of the project. Orezone appears to be in good financial health with competent management.

The major risks associated with the company are asset concentration (single asset company) in a risky jurisdiction. Financing and dilution are also a risk, as the company will need a significant financing package to develop the mine, and their capital structure is already dilutive.

I am on the fence as to whether Orezone is a worthy investment or not. I am also considering other projects at a similar stage of development, such as Orla Mining (OLA). For now, I will wait. I will continue to monitor the company’s progress and reevaluate in the near future.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.