Company Name:Common Stock: NovaGold Resources (NG)

Current Market Price: $11.19

Market Capitalization: $3.67 Billion

NovaGold Stock – Summary of the Company

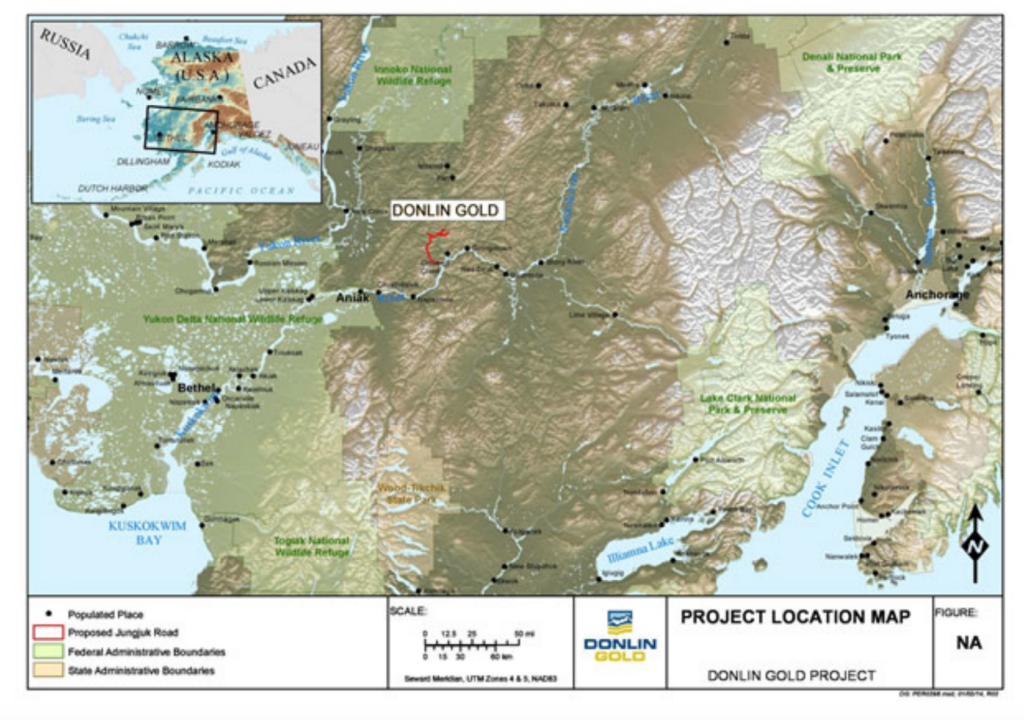

NovaGold is a gold mining company focused in the exploration and development of mining properties. The company is primarily focused on a single asset, the Dolin Gold project in Alaska. They have a 50% ownership of the property, the remaining 50% being held by gold mining giant Barrick Gold. NovaGold was founded in 1984 and is headquartered in Vancouver, Canada. The company has 12 full time employees and uses consultants as needed.

Due to the climate in Alaska, the Dolin Gold project should be considered seasonal as snow and harsh weather make work impossible during certain times of the year.

NovaGold – Revenue and Cost Analysis

the company’s only asset, The Dolin Gold project is still a development stage project and does not generate income. Based on the company’s most recent feasibility study the total capital cost estimate of the Dolin Gold project is $6.7 billion. They estimate the projects breakeven gold price to be $902 per ounce.

NovaGold had a net loss of $27 million in 2019. This is in line with its annual losses since 2015. In 2018, it had an accounting loss of $112 million. However, a large part of this loss was due to a discontinued operation charge from the sale of the Galore Creek property. Excluding this charge, 2018’s loss was similar to 2019, and prior years.

General and Administrative expenses were very high in 2019, totaling $16.3 million, with $12 million being spent on salaries, benefits, and share based compensation. This is an extremely high number for a company with 12 full time employees.

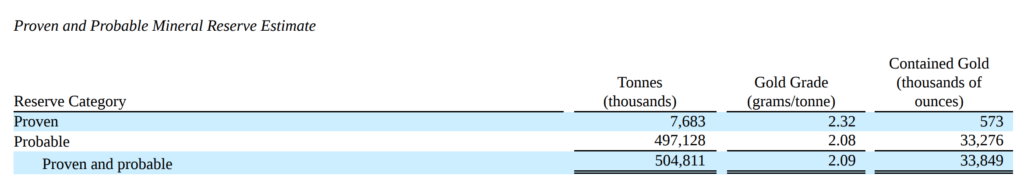

Gold Reserves

The Dolin Gold property has 573,000 ounces of “proven” reserves. However, it has an astounding 32.3 million ounces of probable reserves.

NovaGold – Balance Sheet Analysis

The company has a simple, strong, and highly liquid balance sheet. They have $150 million in current assets comprised of cash and term deposits. These current assets are more than enough to meet operating expenses and short term liabilities for the foreseeable future.

However, the promissory note discussed below and its structure are likely to have a large impact on returns to common shareholders. Given the state of the Dolin Gold project, the company has stated it will need additional financing in the future.

The company does not have any significant off balance sheet obligations.

Debt Analysis

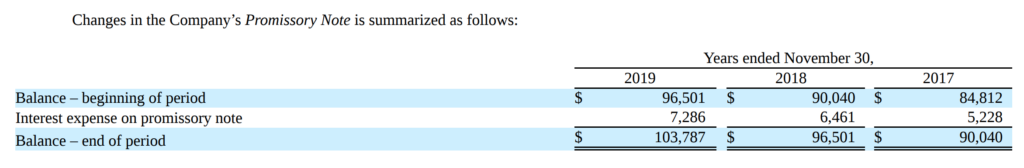

The Company has a promissory note payable to Barrick of $103,787, comprised of $51,576 in principal, and $52,211 in accrued interest at U.S. prime plus 2%. The promissory note resulted from the agreement that led to the formation of Donlin Gold LLC, where the Company agreed to reimburse Barrick for a portion of their expenditures incurred from April 1, 2006 to November 30, 2007. The promissory note and accrued interest are payable from 85% of the Company’s share of revenue from future mine production or from any net proceeds resulting from a reduction of the Company’s interest in Donlin Gold LLC. The carrying value of the promissory note approximates fair value.

NovaGold Stock – Share Dynamics and Capital Structure

NovaGold stock had 328.3 million common shares outstanding at year end 2019. They also have options and shared based compensation outstanding, bringing the fully diluted shares outstanding to about 343.7 million shares.

The company has a dilutive capital structure and management has been very generous with share based compensation, which totaled $6.1 million in 2019, which is over $500,000 per full time employee.

Investors should think carefully about their place in the capital structure. Management has stated “We expect to continue to raise capital through additional equity and/or debt financings, through the exercise of stock options, and otherwise.” Current shareholders are likely to be diluted in the future. How and when this dilution happens will have a large impact on investment returns.

Dividends

NovaGold stock does not pay a dividend and will not be able to pay one for the foreseeable future.

NovaGold Stock – Ownership

Electrum Strategic Resources L.P and its affiliate GRAT Holdings LLC hold in the aggregate 25.76% of the outstanding common shares as of January 15, 2020.

Management – Skin in the game

Over the last 12 months insiders have sold millions of shares. Insider selling coupled with extremely high levels of share based compensation should be worrisome for common shareholders.

NovaGold Stock – 3 Metrics to Consider

Working Capital Ratio

Current Assets/Current Liabilities

$150 million/ $3.3 million = 73.5

A working capital ratio of 73.5 is extremely high, implying very high liquidity. The company should not have issues meeting its short-term liabilities for the foreseeable future

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

$107.8 million/$138 million=.78

A debt to equity ratio of .78 implies the company is mostly funded by equity and not overly dependent on debt financing.

Price to Book Ratio

Price of common stock/Book Value per share

$11.19/$.40=27.8

Based on my estimate of fully diluted shares outstanding, NovaGold has a book value per share of $.40. At the current market price this implies a price to book ratio of 27.8. A price to book of 27.8 is extremely high and means NovaGold stock is currently trading at a very high premium relative to the book value of its asserts.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

NovaGold Stock – Summary and Conclusions

Management has painted an extremely optimistic picture of the company. The first line of the 2019 annual report reads “At some point your bound to run out of superlatives”. While selling this dream to the public, insiders have been dumping millions of shares on the open market and enriching themselves with high levels of compensation.

NovaGold owns 50% of one property in Alaska, that has yet to produce any tangible results. They have a significant debt to their partner, Barrick Gold, that continues to accrue interest. This debt will be paid out of NovaGold’s share of future production, significantly limiting returns to shareholders if/when the mine produces.

NovaGold stock currently trades at stratospheric levels given the state of the project and the structure of the company. The Dolin Gold project may well turn out to be the as good as management says. Common shareholder might even make money. But these are big maybes for a company that has yet to produce any tangible results and borrowed against future production. What I am sure of is that NovaGold insiders already got rich without producing an ounce of gold. And those aren’t the type of people I want to be in business with.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.