Common Stock: Lojas Marisa (AMAR3)

Current Market Price: R$ 7.08

Market Capitalization: R$ 1.8 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Lojas Marisa Stock – Summary of the Company

Lojas Marisa is a Brazilian retailer that sells clothing and accessories, mostly focused on products for women. They have over 300 stores throughout Brazil. In addition to product sales, they also have revenue from their lending business which offers credit cards and personal loans to customers. Lojas Marisa was founded in 1948 and is headquartered in Sao Paulo Brazil.

Revenue and Cost Analysis

Lojas Marisa had revenue of R$2.9 billion in 2019, a slight increase from R$ 2.8 billion in 2018. The majority of this revenue came from product sales, with a small but relevant amount coming from their credit card and personal loan business.

In 2019 the company had COGS of R$1.3 billion, representing a gross margin of 46%, on par with their gross margin of 45% in 2018. The company had a net loss of R$ 112.3 million in 2019, a significant deterioration compared to a profit of R$ 28.3 million in 2018. This deterioration is due to increased depreciation expense and significantly lower financial income.

Balance Sheet Analysis

Lojas Marisa has a leveraged balance sheet. They have sufficient liquidity in the short term, but have a high level of liabilities, including debt.

Lojas Marisa – Debt Analysis

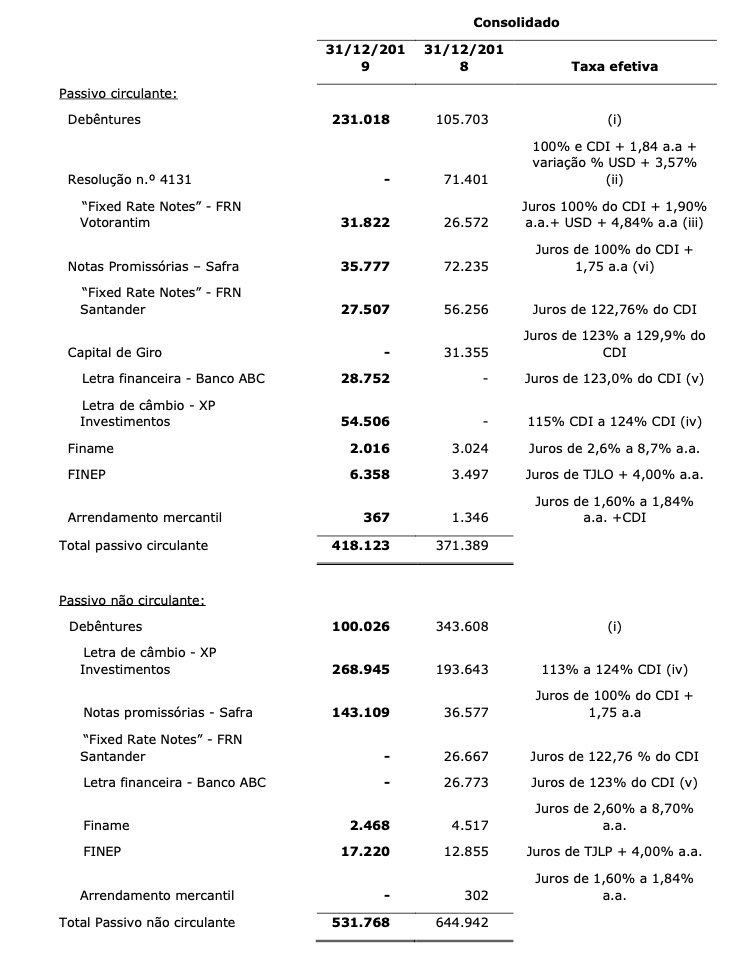

As of year-end 2019 Lojas Marisa has R$ 949.9 million in total debt outstanding, R$ 418.1 million of which is classified as current.

Lojas Marisa Stock – Share Dynamics and Capital Structure

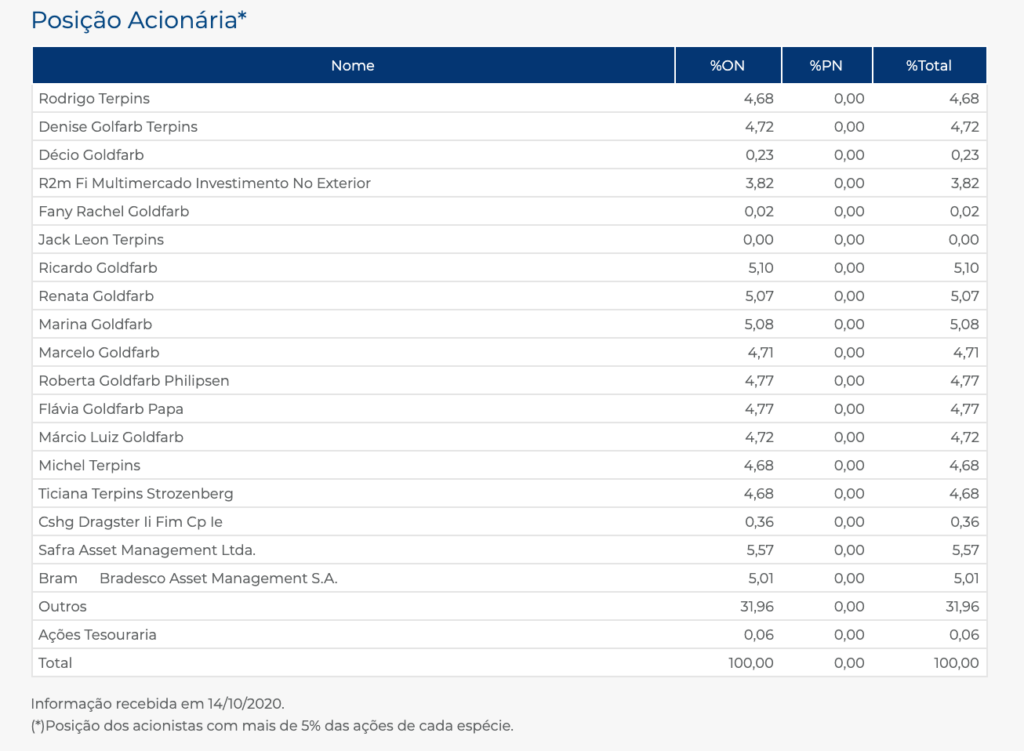

As of March 2020 Lojas Marisa has 261.6 million common shares outstanding. Insiders and several institutional investors own around 68% of the company, with the remaining 32% being held by investors with less than a 5% ownership position.

Lojas Marisa Stock – Dividends

The company did not pay a dividend based on 2019’s results.

Lojas Marisa Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 2.6 billion / R$ 1.4 billion = 1.8

A debt to equity ratio of 1.8 indicates that Lojas Marisa has a leveraged balance sheet and uses a significant amount of debt in its capital structure.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 2.4 billion / R$ 1.5 billion = 1.5

A working capital ratio of 1.5 indicates a sufficient but not strong liquidity position. Lojas Marisa should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 7.08 / R$ 5.43 = 1.3

Lojas Marisa has a book value per share of R$5.43. At the current market price this implies a price to book ratio of 1.3, meaning the company’s stock currently trades at a slight premium to the book value of the company.

Lojas Marisa Stock – Summary and Conclusions

Lojas Marisa is well known retailer in Brazil, present throughout the country. They are relatively large, with sales of R$ 2.9 billion in 2019. However sales have been stagnant for several years and the company lost money in 2019. The company’s financial position is likely to deteriorate further due to the coronavirus shut downs. They have a leveraged balance sheet and relevant debt obligations.

Although brick and mortar retail is still viable in Brazil, I would like to see the company growing their ecommerce business. In 2019 ecommerce sales accounted for 6% of total revenue, which is low in my opinion, especially considering that management states that they have had a virtual store since 1999.

I am not willing to invest in Lojas Maris stock due to their stagnant revenue, low ecommerce sales, debt, and the negative effects of the coronavirus shutdowns. If I had to invest in a Brazilian retail equity, I would prefer a company with a healthier financial position and a growing ecommerce business, such as Grupo Dimed.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.