Company Name: Common Stock: Liberty Gold (LGDTF)

Current Market Price: $.91

Market Capitalization: $221.7 million

Liberty Gold Stock – Summary of the Company

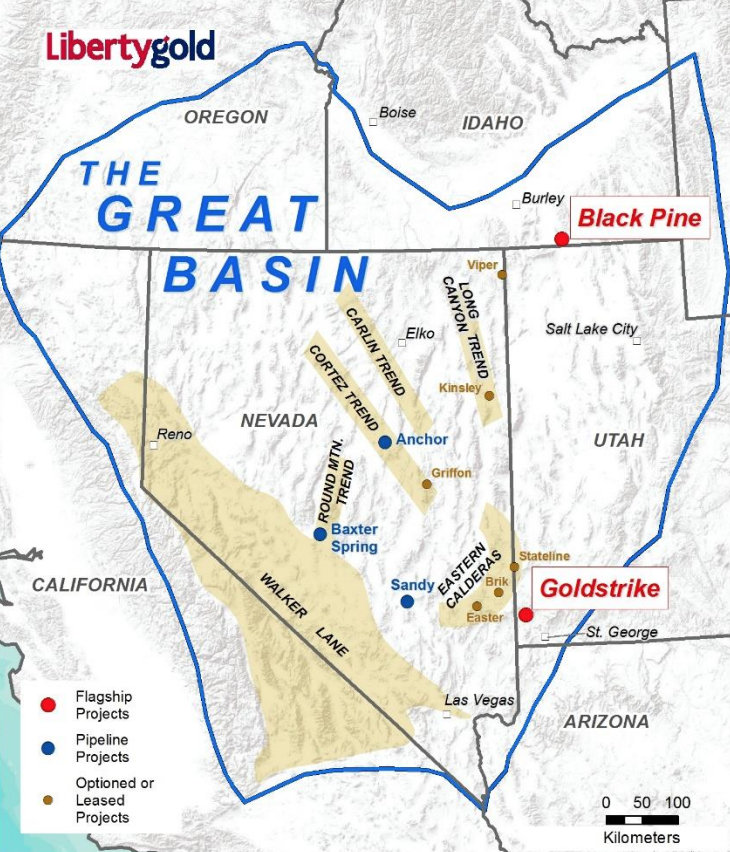

Liberty Gold is a gold mining company headquartered in Vancouver, Canada. The company is focused of the exploration and development of gold mining properties, primarily in The United States and Turkey. Currently the company has 2 properties that could be considered “material”, the Blackpine property in Idaho and the Goldstrike property in Utah. Liberty Gold owns 100% of both these properties. The company also owns interests through subsidiaries and joint ventures in other early stage properties.

Revenue and Cost Analysis

Liberty Gold does not have any mines which are currently producing meaning the company does not have any revenue. The company had an operating loss of $11.6 million in 2019, roughly equal to a loss of $11 million in 2018.

The two largest expenses were exploration and evaluation related expenses followed by wages and compensation. General administrative and office expenses were also relevant.

Liberty Gold Stock – Royalty and Streaming Agreements

Liberty Gold will receive a 1% net smelter royalty related to its sale of the Kinley Mountain project in December 2019. However, the purchaser has the option to buy back .5% of this royalty.

The company sold a 15% net profit interest (“NPI”) to Ely Gold royalties in December 2019 for cash and warrants on the common shares of Ely Gold.

Liberty Gold will receive a 1% net smelters royalty related to the sale of the Griffon project in Nevada.

The company sold a .5% net smelter royalty on its Blackpine property.

Balance Sheet Analysis

Liberty Gold has a simple, but strong balance sheet. The company has a cash balance of $14.3 million at year end 2019. This is a significant increase from $7.7 million at the end of 2018. This increase is due mostly to the sale of assets.

Liability levels are low and liquidity is strong. The company should be able to meet its current obligations without seeking additional funding. Their largest liability is a deferred tax payment of $1.6 million arising from foreign exchange differences.

Debt Analysis

Liberty Gold has no debt. They do have a small lease obligation but this appears very manageable given current liquidity levels.

Liberty Gold Stock – Dividends

The company has never paid a dividend and states in its public filings that it has no plan to pay a dividend at this time.

Liberty Gold Stock – Share Dynamics and Capital Structure

Liberty Gold has a highly dilutive capital structure. The number of common shares outstanding at year end 2019 was 243.6 million. However, the company has large amounts of options, restricted share units, and warrants outstanding. I estimate the fully diluted number of common shares outstanding to be over 304 million shares.

Ownership

Van Eck owns in excess of 10% of the Common shares of the Corporation. Van Eck directly holds approximately 12% of the Corporation’s issued and outstanding Common Shares

Management – Skin in the game

Management and directors own a significant portion of the common shares outstanding, approximately 6% to 7%. This is generally thought of as a good signal to common share holders as it aligns the interests of management and shareholders.

Another good signal for common shareholders is that insiders have been net buyers over the past 12-18 months.

Liberty Gold Stock – 3 Metrics to Consider

Price to Book Ratio

Price of common stock/Book Value per share

$.91/.11=8

Based on my estimate of diluted shares outstanding, Liberty Gold has a book value per share of $.11. This implies a price to book ratio of 8. A price to book ratio of 8 means the company is currently trading at a very high premium relative to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$16.9 million/$5.4 million = 3.1

A working capital ratio of 3.1 indicates strong short term liquidity. This means the company is likely to be able to meet its near-term obligations without issue.

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

$7.4 million/$26.1 million=.28

A debt to equity ratio of .28 indicates that the company is primarily funded by equity and is not heavily reliant on debt to fund itself.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Liberty Gold Stock – Summary and Conclusions

Liberty Gold has 100% ownership of 2 promising properties, both of which have produced gold in the past. The company has a strong balance sheet with what appears to be sufficient liquidity to fund itself until these properties are developed.

However, Liberty gold has a highly dilutive capital structure. Should these properties prove to be winners, then existing common shareholders are likely to be heavily diluted, limiting their upside. Additionally, the company has sold royalties on some of its properties, further limiting the upside for common shareholders.

Investors should carefully consider the capital structure of Liberty Gold when evaluating the common shares. A new and profitable gold mine does not necessarily mean returns for shareholders.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.