Common Stock: Equinox Gold (NYSE:EQX)

Current Market Price: $11.16 USD

Market Capitalization: $2.65 billion USD

Equinox Gold Stock – Summary of the Company

Equinox Gold is a gold exploration and mining company focused on the acquisition, exploration, development, and operation of gold properties. They currently have two mines in production and one under construction. In December 2019, the company announced a merger with Leagold Mines, which will bring the combined company’s total operating mines to six. The company has properties throughout The Americas. Equinox Gold was founded in 2007 and is headquartered in Vancouver, Canada.

Revenue and Cost Analysis

In 2019, Equinox produced 194,941 ounces of gold. Their total revenue was $281.7 million and they had an all in sustainable mining cost of $931 per ounces. This represents a net loss $20.3 million for the year. Revenue increased significantly year over year. 2018 revenue was $30 million, however the company had a significant net loss in 2018 also, totaling $66 million.

The company continues to actively explore its properties. In 2019 exploration expenses were $8.8 million, down from $12.2 million in 2018.

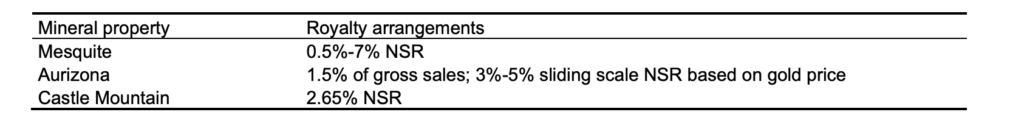

Equinox Gold – Royalty and Streaming Agreements

Several of the company’s properties are subject to net smelter royalty’s.

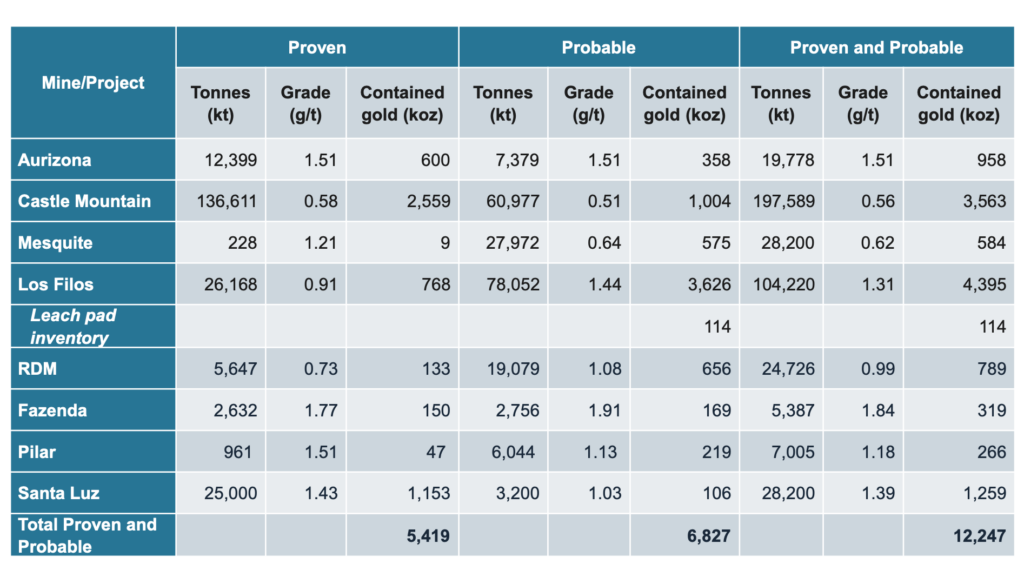

Equinox Gold – Mineral Resources

The company has “proven and probable” reserves totaling 12.2 million ounces of gold.

Balance Sheet Analysis

Equinox has an Ok balance sheet. The company has a strong and diversified asset base, with sufficient liquidity. Debt levels are high, but given the company’s production potential, debt appears reasonable.

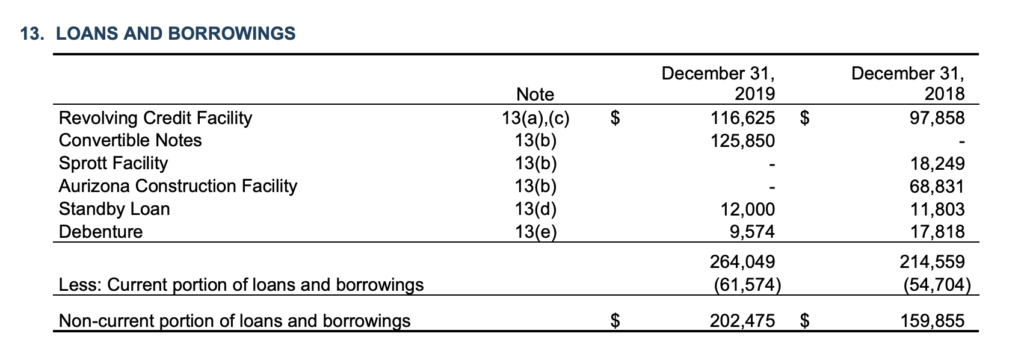

Equinox Gold – Debt Analysis

On April 11, 2019, Equinox Gold announced that it had completed the issuance of $130 million of convertible notes (the “Notes”) to Mubadala, as previously announced on February 25, 2019. The Notes have a 5-year term, bear interest at a fixed rate of 5% per year and are convertible at the holder’s option into common shares of the Company at a fixed US$ conversion price of $5.25 per share. The Company paid $2.0 million in transaction fees to Mubadala on issuance of the Notes.

As of year-end 2019, total debt outstanding was $264 million.

Equinox Gold Stock – Share Dynamics and Capital Structure

As of March 2020, the company had 114.8 million common shares outstanding. They also have options, warrants, and restricted share units outstanding. Fully diluted shares outstanding is around 143 million shares.

Equinox has both debt and dilutive instruments in its capital structure. Investors should carefully consider their place in the capital structure before investing.

Equinox Gold Stock – Dividends

The company does not currently pay a dividend.

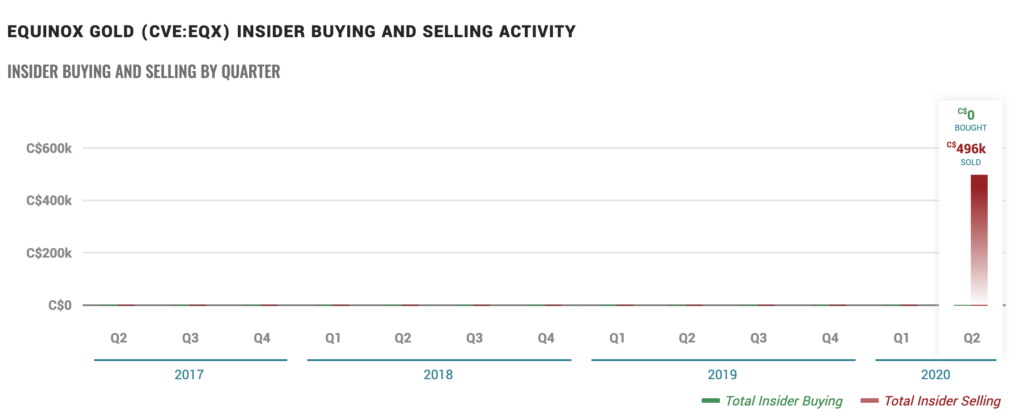

Management – Skin in the game

One insider at Equinox Gold has sold a significant amount of stock in 2020. However, insider ownership remains high. Overall this provides no signal to investors, bullish or bearish.

Equinox Gold Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$436 million/$403 million = 1.08

A debt to equity ratio of 1.08 indicates that the company uses nearly equal parts debt and equity in its capital structure, with slightly more debt.

Price to Book Ratio

Current Share Price/Book Value per Share.

$11.16/$2.83 =3.9

Based on fully diluted shares outstanding, Equinox has a book value per share of $2.83. At the current market price, this implies a price to book ratio of 3.9, meaning the company’s stock trades at a premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Equinox Gold Stock – Summary and Conclusions

Equinox has a strong and diversified asset portfolio. They have a solid based of producing properties as well as promising exploration stage projects. Jurisdictional risk is significantly diversified so that problems in any one jurisdiction should not have too negative an impact.

Most concerning are the potential dilution and debt levels. However, given the current production and potential for increased future producing, these appear reasonable.

Equinox has a proven management team and a solid asset base, with the potential for significant growth. I believe most gold stock portfolios would benefit from an allocation to Equinox Gold stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.