Common Stock: Dommo Energia (DMMO3)

Current Market Price: R$ 1.10

Market Capitalization: R$ 305 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Dommo Energia Stock – Summary of the Company

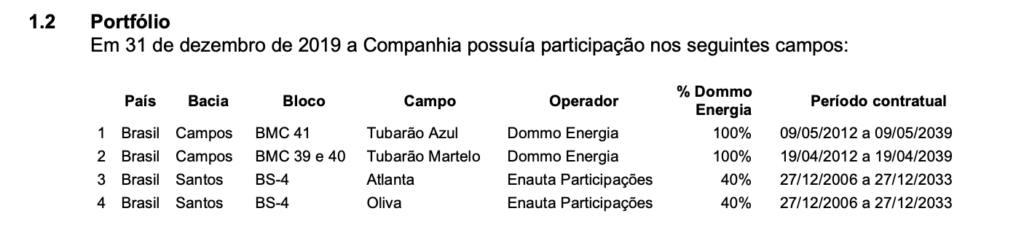

Dommo Energia is an oil and gas exploration and production company focused on the acquisition, exploration, development, and operation of offshore properties. They currently own blocs in two offshore regions, Bacia de Campos and Bacia de Santos. Some of the company’s properties have produced in the past and been decommissioned and some are currently producing. Dommo was founded in 2007 and is headquartered in Rio de Janeiro, Brazil.

It is worth noting that Dommo Energia was formerly named OGX and was run by disgraced Brazilian Billionaire Eike Batista, who was convicted of insider trading in the company’s stock.

Revenue and Cost Analysis

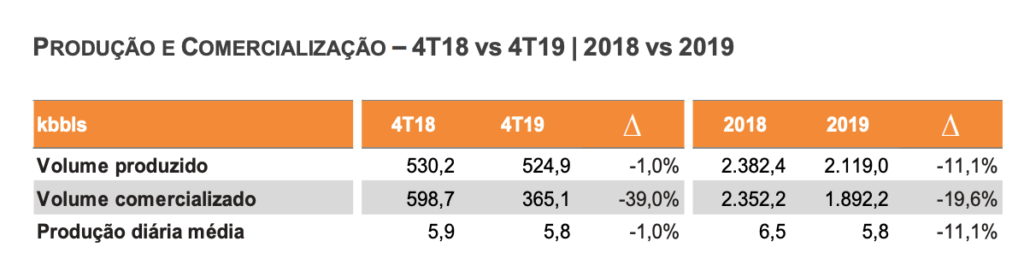

Dommo produced a total of 2.1 million barrels of oil in 2019, a decrease from 2.3 million barrels in 2018. Total revenue was R$ 438.1 million in 2019, a decrease from R$ 538.2 million in 2018. The company’s COGS were R$ 383.5 million in 2019, implying a gross margin of 12.5%. Dommo was not profitable in either of the past 2 years, with a net loss of R$ 126.5 million and R$ 671 million in 2019 and 2018 respectively.

Balance Sheet Analysis

Dommo has a weak balance sheet. They have a weak liquidity position and significantly more liabilities than assets. Furthermore, the company will need to make a significant CAPEX investment into its assets to realize their full value.

Dommo Energia – Debt Analysis

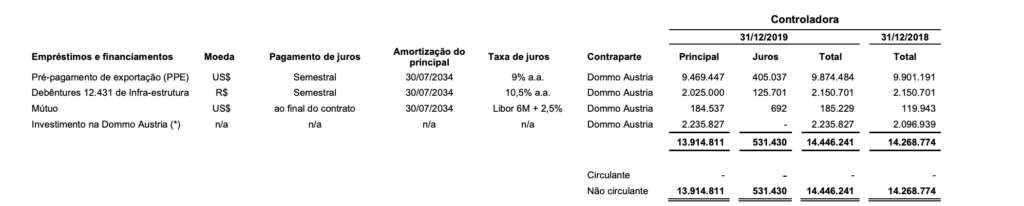

Dommo went through bankruptcy and restructuring in 2017. As of year-end 2019 they still have R$ 14.4 billion in debt outstanding. The debt is technically owed to a Dommo subsidiary, so it does not show up on the company’s consolidated balance sheet, but it is certainty an outstanding liability.

Dommo Energia Stock – Share Dynamics and Capital Structure

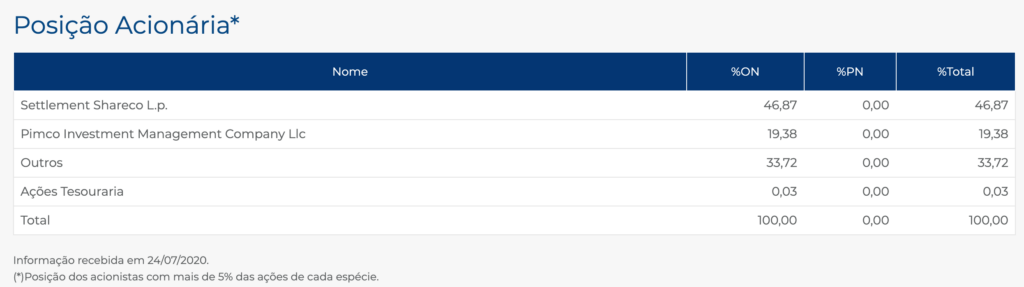

The company has 270 million shares outstanding as of year-end 2019. Two large institutions hold around 66% of the company, with the remaining 33% being held by smaller shareholders.

Dommo Energia Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

Past management has been convicted of fraudulent behavior associated with the company’s stock.

Dommo Energia Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 1.8 billion/ -R$482.4 million = -3.77

A debt to equity ratio of negative 3.77 indicates that Dommo has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Interest Coverage Ratio

EBIT/ Interest Expense

-R$ 86.5 million/ R$531.4 million = -.16

An interest coverage ratio of -.16 indicates an extremely poor liquidity position. Dommo does not earn enough from operation to pay the interest on its debt.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 220.8 million/ R$461.5 million = .48

A working capital ratio of .48 indicates a weak liquidity position. Dommo may have problems meeting its near-term obligations.

Dommo Energia Stock – Summary and Conclusions

Dommo is in a very weak financial position with an impaired asset base and excessive debt. Furthermore, the company has a history of fraudulent behavior associated with its management and stock. I wouldn’t touch Dommo Energia stock with a 40-foot pole.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.