Common Stock: Caravajal Empaques

Current Market Price: $ 5,300 COP

Market Capitalization: $ 8.7 trillion COP

*All values in this article are expressed in Colombian Pesos (COP) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Caravajal Empaques Stock – Summary of the Company

Caravajal Empaques is a Colombian packaging manufacturer. In addition to their main packaging business, they have several other business lines such as education, furniture, and media, among others. The company is present in 14 countries throughout Latin America and employs over 19,000 people. Caravajal Empaques was founded in 1904 and is headquartered in Cali, Colombia.

Revenue and Cost Analysis

Caravajal had revenue of $ 3.4 trillion in 2019, a decrease compared to $ 3.5 trillion in 2018. Their COGS was $ 2.4 trillion in 2019, representing a gross margin of 28%, a slight improvement compared to 27% the previous year.

The company was profitable in both 2018 and 2019. In 2019 Caravajal had net income of $ 50 billion, representing a profit margin of 1.5%, a decrease compared to 2.5% in 2018.

Balance Sheet Analysis

Caravajal has a leveraged balance sheet. They have a solid base of long term assets, but their liquidity position is just sufficient and they have significant debt outstanding.

The company also has a defined benefit pension plan and a derivatives book, both of which should be analyzed in detail by investors before investing.

Caravajal Empaques – Debt Analysis

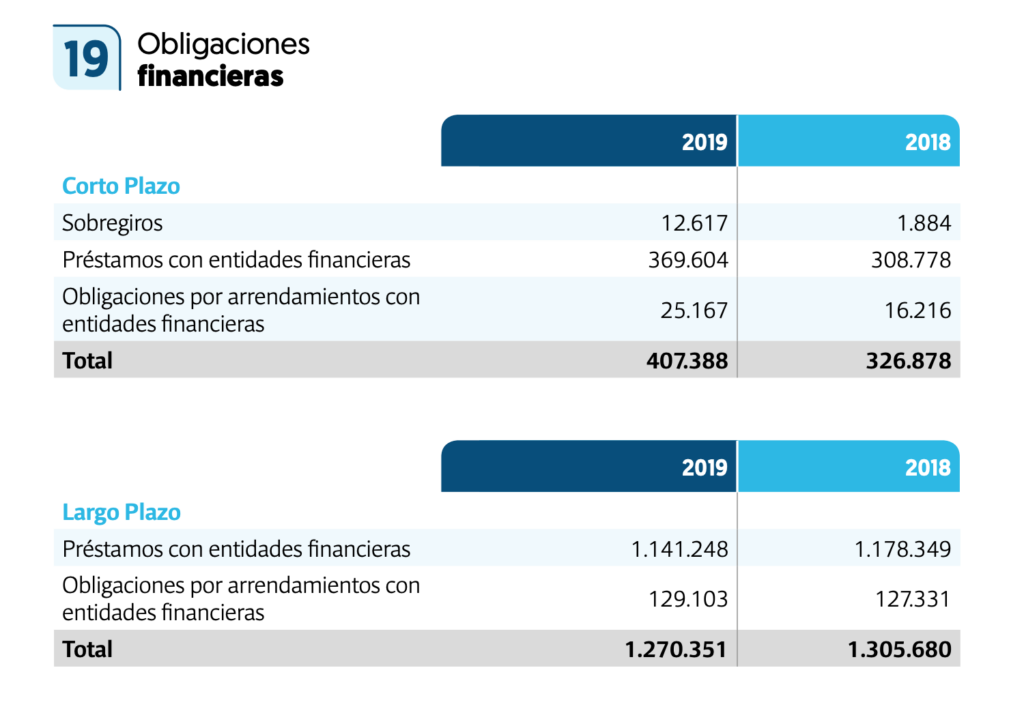

As of year-end 2019 the company has $ 1.7 trillion in total debt outstanding, $ 407 billion of which is classified as current.

Caravajal Empaques Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 1.6 billion common shares outstanding.

Caravajal Empaques Stock – Dividends

The company paid total dividends of $ 16.74 per common share in 2019. At the current market price this implies a dividend yield of 0.3%.

Caravajal Empaques Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 3 trillion / $ 560 billion = 2.9

A debt to equity ratio of 2.9 indicates that Caravajal is levered and uses a significant amount of debt in its capital structure.

Working Capital Ratio

Current Assets/Current Liabilities

$1.4 trillion / $1.4 trillion = 1

A working capital ratio of 1 indicates a sufficient, but not strong liquidity position. Investors should monitor the company’s liquidity position closely for signs of deterioration.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 5,300 / $ 342 = 15.5

Caravajal has a book value per share of $ 342. At the current market price this implies a price to book ratio of 15.5, meaning the company’s stock currently trades at a significant premium to the book value of the company.

Caravajal Empaques Stock – Summary and Conclusions

Caravajal is an impressive company. They have a long history of operations, a presence throughout Latin America, and diversified businesses. However the company’s financial position is not strong. Their margins are tight and their liquidity is just sufficient. Furthermore their balance sheet is leveraged, with significant debt outstanding.

Most importantly, the company’s focus is not clear to me. Am I investing in a packaging business, education business, or furniture business? Do to the company’s weak financial position and lack of focus on their core business, I am no willing to invest in Caravajal Empaques stock. Investors can compare the company to another Colombian packaging company, Compania de Empaques.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.