Preferred Stock: Brinquedos Estrela (ESTR4)

Current Market Price: R$ 28.63

Market Capitalization: R$ 23.1 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Brinquedos Estrela Stock – Summary of the Company

Brinquedos Estrela is a Brazilian toy manufacturing company. They offer a wide range of products including dolls, games, toy cars, and stuffed animals, among others. The company has three manufacturing facilities, the largest being at their headquarter in the state of Sao Paulo. Estrela was founded in 1937.

Revenue and Cost Analysis

Estrela has had declining revenue for the past several years. Total revenue in 2019 was R$ 143.9 million, down from R$ 189 million in 2017 and R$ 174.3 million in 2018. The company has not been profitable in any of the past three years, with net losses of R$ 40.8 million in 2019, R$ 28.5 million in 2018, and R$ 43.5 million in 2017.

Balance Sheet Analysis

Estrela has a weak balance sheet. The company has very poor liquidity, with current liabilities being more than double all of the company’s assets.

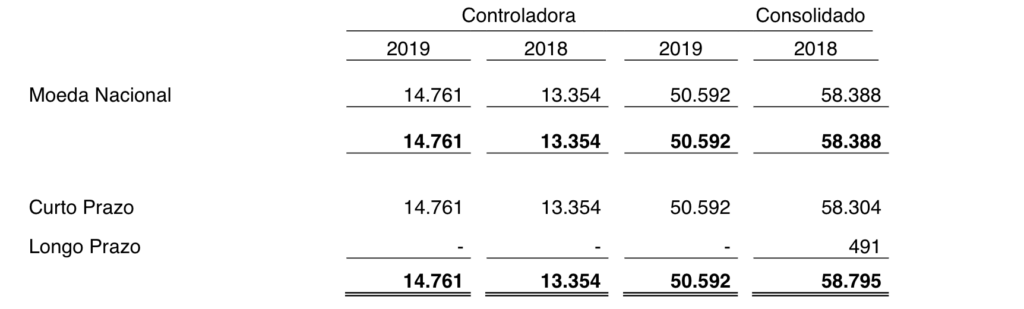

Brinquedos Estrela – Debt Analysis

As of year-end 2019 the company has R$ 50.5 million in total debt outstanding, all of which is classified as current and all of which is denominated in Brazilian Reals.

Brinquedos Estrela Stock – Share Dynamics and Capital Structure

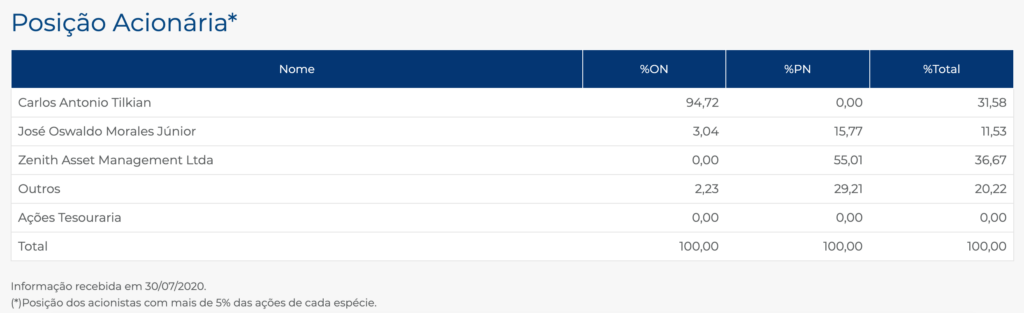

As of year-end 2019 the company has 269 thousand common shares outstanding and 539 thousand preferred share outstanding. Total shares outstanding is around 808 thousand shares. The company’s shares are tightly held by several individuals and one institutional investors. Around 20% of the company’s outstanding stock is held by investors with a stake less than 5%.

Brinquedos Estrela Stock – Dividends

The company did not pay a dividend in 2019.

Brinquedos Estrela Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 684.5 million / -R$ 478.5 million – -1.43

A debt to equity ratio of negative 1.43 indicates that Estrela has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 86.1 million / R$ 550.2 million = .15

A working capital ratio of .15 indicates a very weak liquidity position. Estrela may have problems meeting its near term obligations.

Brinquedos Estrela Stock – Summary and Conclusions

Estrela is a fun company with a long history in Brazil. The company offers a wide range of toy products, some of which are very well known. However the business is in poor health. Revenues have been declining and the company consistently runs a net loss. Their balance sheet is weak and liquidity if very concerning.

Brinquedos Estrela is in a competitive market, and given its financial position and recent operating history, I don’t think the company is well positioned to compete with companies like amazon moving forward. I will not be investing in Estrela stock. If I were going to allocate to a Brazilian manufacturing company, I would prefer to allocate to a company in a more stable and less competitive industry, such as Josapar.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.