Common Stock: Biosev (BSEV3)

Current Market Price: R$4.94

Market Capitalization: R$ 4.9 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Biosev Stock – Summary of the Company

Biosev is an agricultural products company that produces on its own lands as well as purchases raw material from third parties. They are focused on the production, processing, and sale of agricultural products, mainly sugar cane and its derivative products. Their three main product lines are sugar, ethanol, and energy. Biosev was founded in 2012 and is headquartered in Sao Paulo, Brazil.

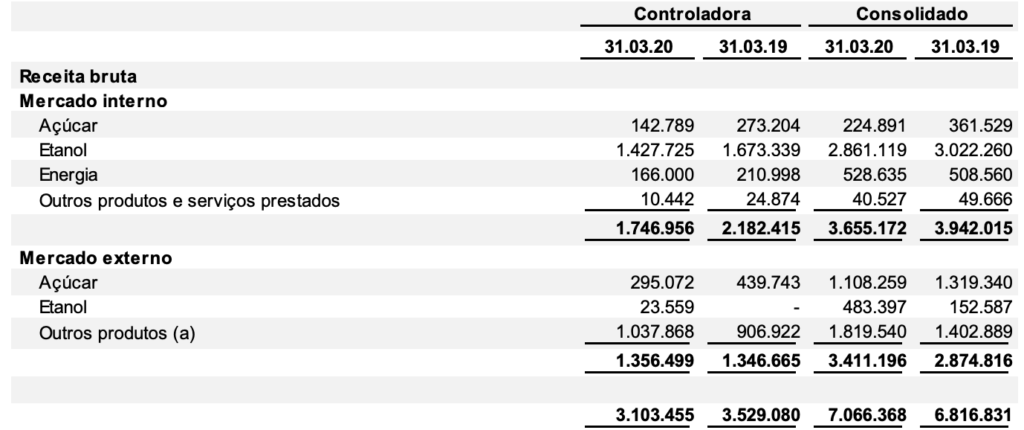

Revenue and Cost Analysis

Biosev had total revenue of R$ 6.5 billion in the fiscal year ending March 2020, this represents a slight increase from R$ 6.2 billion in the previous year. Sales were split roughly 50/50 between the domestic market and the export market.

The company’s COGS for the fiscal year ending March 2020 were R$ 5.8 billion, representing a gross margin of 11.5%. Biosev had a net loss in each of the previous two years. In the fiscal year 2020, they had a net loss of R$ 1.5 billion and a loss of R$1.2 billion in the previous period.

Balance Sheet Analysis

Biosev has a weak balance sheet. Their liquidity position is very poor. Current liabilities are high, including a significant debt liability and its current assets are mostly inventory. The company will likely need to raise capital in the medium term to continue as a going concern.

It is also worth noting that Biosev has significant hedging instruments on its balance sheet, mainly interest rate swaps.

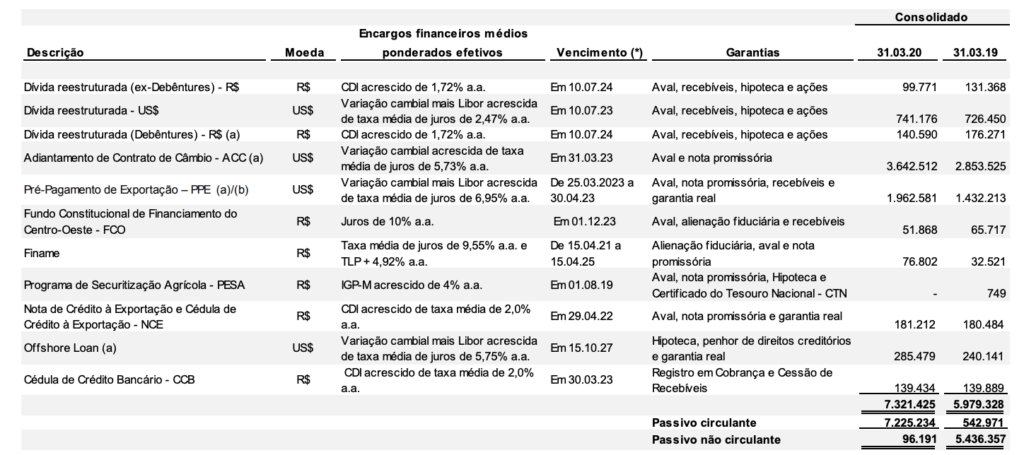

Biosev – Debt Analysis

As of the fiscal year end March 2020, Biosev has R$ 7.3 billion in total debt outstanding, almost all of which is due in the current period. Over half of the company’s debt is denominated in US Dollars (USD), therefore the company’s financial results are suffering badly from the negative effects of this carry trade, due to a rapidly depreciating Brazilian Real.

Biosev Stock – Share Dynamics and Capital Structure

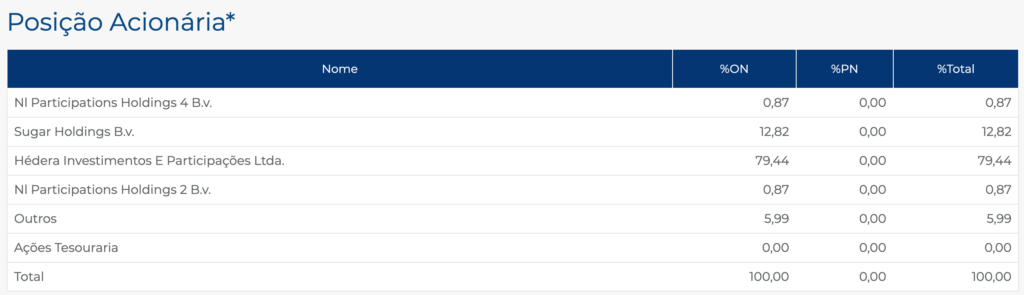

The company has 1 billion common shares outstanding, which are mostly held by institutional investors.

Biosev Stock – Dividends

The company does not currently pay a dividend.

Management – Skin in the game

Biosev is part of the Louis Dreyfus group. The majority of its outstanding shares are held by a few institutional investors, so there is little relevant insider activity for investors to consider.

Biosev Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 14.4 billion/ R$ 1 billion = -14.4

A debt to equity ratio of negative 14.4 indicates that Biosev has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Interest Coverage Ratio

EBIT/ Interest Expense

R$ 364.5 million/ R$ 615 million = -.6

An interest coverage ratio of negative .6 indicates a very weak debt and liquidity position. The company’s interest payments exceed the company’s operating results. This is a sign of a heavily indebted company that is in distress.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 5.6 billion/ R$ 12 billion = .46

A working capital ratio of .46 indicates a weak liquidity position. Biosev may have problems meeting its near-term obligations. Investors should pay close attention to the company’s liquidity position.

Biosev Stock – Summary and Conclusions

Biosev is in a very poor financial position. Their liquidity is extremely low and they have needed to increase already high debt levels to meet current obligations. Even worse, a large portion of this debt is denominated in USD, so their financials are suffering due to a depreciating Brazilian Real. The company operates on very low gross margins, and it is difficult to envision a scenario where the company returns to profitability any time soon.

I would likely not be comfortable investing in an ethanol company under any circumstances, as I do not have a strong understanding of the market. But based solely on Biosev’s financials, I can discard the company’s stock as uninvestable.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.