Common Stock: Baumer (BALM3)

Current Market Price: R$ 15.70

Market Capitalization: R$ 153.8 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Baumer Stock – Summary of the Company

Baumer is a Brazilian company that develops, manufactures, and sells hospital, odontology, and health industry solutions and equipment. The company operates through the following segments: Orthopedics, Hospital, Genius, and Castanho.

The Orthopedics segment manufactures and sells orthopedic implants and instruments. The Hospital segment manufactures and markets equipment for the hospital, pharmaceutical, chemical, cosmetic, and food industries. The Genius segment works with biomaterials. The Castanho segment provides equipment for hospitals, industrials, and hotel laundry.

Baumer was founded in 1952 and is headquartered in Sao Paulo Brazil.

Revenue and Cost Analysis

Baumer has been increasing its total sales for the past several years. Total revenue in 2017 was R$ 109.7 million, which increased to R$149.3 million in 2019. COGS were R$ 72 million in 2019, representing a gross margin of 52%, a decrease from gross margins of 58% and 56% in 2017 and 2018 respectively.

Although its COGS have been increasing, Baumer has been improving profitability while growing its top line sales, implying improving operational efficiencies (lower cost of operation). In 2019 Baumer had net income of R$ 4.1 million, compared to R$ 462 thousand and R$ 2.7 million in 2017 and 2018 respectively. This implies profit margins have increased from less than 1% in 2017 to 3% in 2019.

Balance Sheet Analysis

Baumer has a sound balance sheet. Liquidity is sufficient in the short term. They have a solid asset base and liability levels are reasonable.

Baumer – Debt Analysis

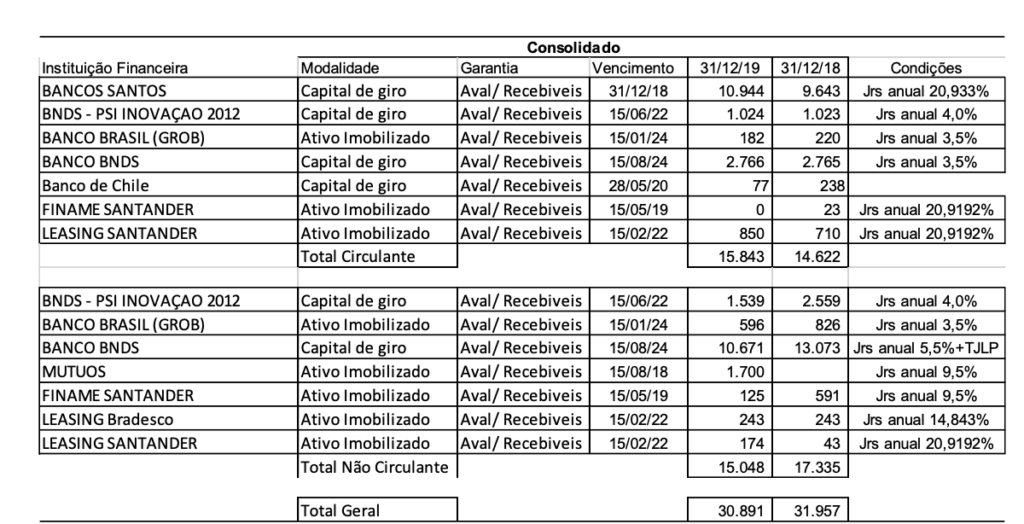

As of year-end 2019 Baumer has R$ 30.8 million in debt outstanding, about half of which is current and the other half long term.

Baumer Stock – Share Dynamics and Capital Structure

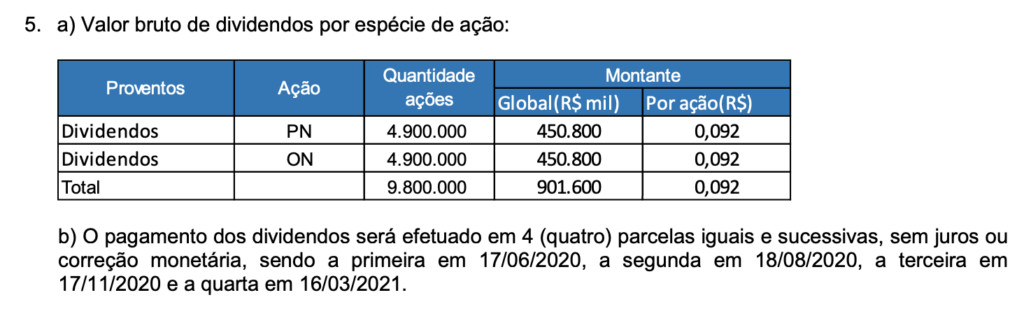

As of year-end 2019 Baumer had 4.9 million common shares outstanding and 4.9 million preferred shares outstanding. They also hold around 15 thousand shares in their treasury. Total shares outstanding is around 9.8 million shares.

Baumer Stock – Dividends

Baumer’s last approved dividend was for R$ .092 per share for both common and preferred shares. Payment will be made in 4 installments, the last being in March 2021. This corresponds to a payout ratio of 16% of 2019 net income.

Management – Skin in the game

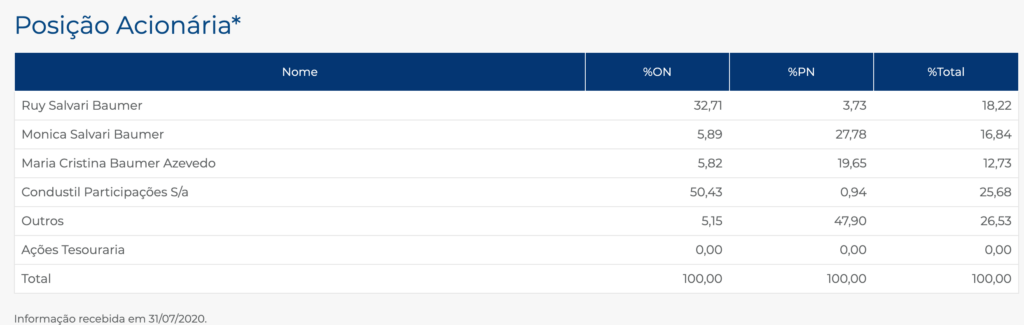

The Majority of the company’s shares are held by members of the Baumer family, some of whom also serve on the company’s board.

Baumer Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 82.4 million / R$ 108.1 million = .76

A debt to equity ratio of .76 indicates the Baumer uses a mix of both debt and equity in its capital structure but uses slightly more equity than debt.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 111.8 million / R$ 59.3 million = 1.9

A working capital ratio of 1.9 indicates a sufficient but not strong liquidity position. Baumer should not have a problem meeting its near-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 15.70/ R$ 11.03 = 1.4

Based on total shares outstanding (common + preferred) Baumer has a book value per share of R$ 11.03. At the current market price this implies a price to book ratio of 1.4, meaning the company’s common stock trades at a slight premium to the book value of the company.

Baumer Stock – Summary and Conclusions

Baumer is a solid company. Over the past several years they have been able to improve both total sales and net income. They are in a good financial position and poised to continue to grow. They do have some debt outstanding, but this appears manageable.

The company appears to be fairly valued, meaning it does not have an adequate margin of safety for me to invest at this time. I would reconsider should their stock price drop significantly, but given how tightly held the shares are, I’m not holding my breath. I am eager to see the company’s 2020 results and how the coronavirus effected their business. Until then I will leave Baumer stock on my watch list, but likely won’t take a position.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.