Common Stock: Azevedo & Travassos (AZEV3)

Current Market Price: R$ 10.08

Market Capitalization: R$ 54.4 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Azevedo & Travassos Stock – Summary of the Company

Azevedo e Travassos is a Brazilian company that provides engineering and infrastructure services. Its activities include electromechanical assembly, heavy and civil construction, drilling and completion of wells, oil exploration and production, and development of real estate properties. The company was founded in 1922 and is headquartered in Sao Paulo Brazil.

Revenue and Cost Analysis

Azevedo e Travassos financial situation has been consistently deteriorating for the past several years. Total revenue in 2019 was R$ 1.7 million, down from R$ 64 million in 2017. The company had a net loss of R$R$35.7 million in 2019.

Balance Sheet Analysis

The company is in a dire financial position. Liabilities are extremely high and the company is likely insolvent.

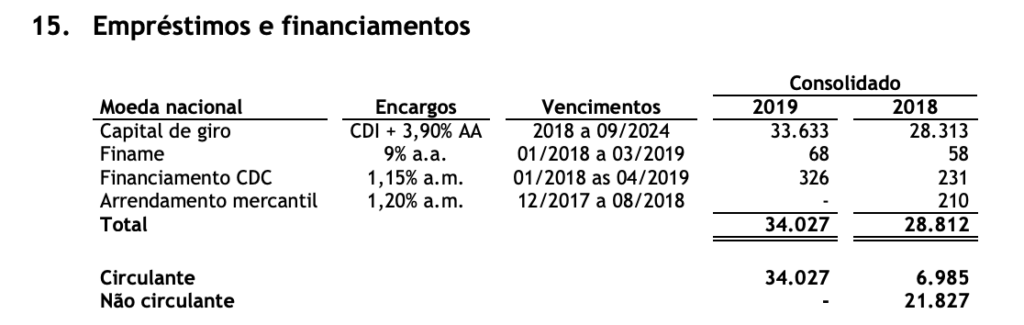

Azevedo & Travassos – Debt Analysis

As of year-end 2019 the company had R$ 34 million in debt outstanding, all due in 2020.

Azevedo & Travassos Stock – Share Dynamics and Capital Structure

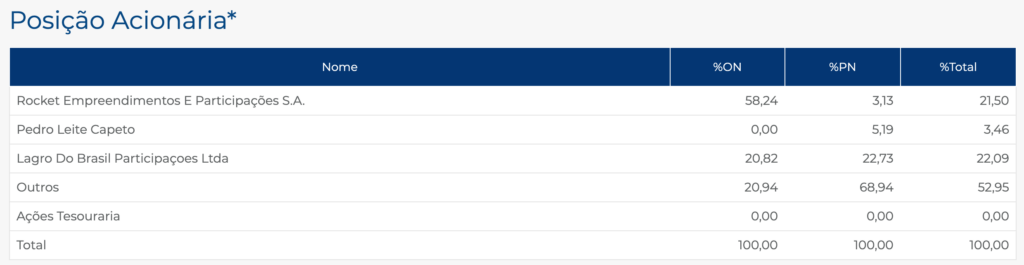

The company has 1.8 million common shares outstanding and 3.6 million preferred shares outstanding. Total shares outstanding is 5.4 million.

The majority of the company’s outstanding shares are held by two financial holding companies.

Azevedo & Travassos Stock – Dividends

The company does not pay a dividend.

Azevedo & Travassos Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$301.6 million/ – R$246 million = -1.2

A debt to equity ratio of negative 1.2 indicates that Azevedo & Travassos has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 21.2 million/ R$ 218.3 million = .09

A working capital ratio of .09 indicates a dire liquidity position, Azevedo & Travassos is likely insolvent.

Brazilian Engineering and Infrastructure Market – Economic Factors and Competitive Landscape

The Brazilian engineering and infrastructure market got destroyed during the country’s financial crisis in 2016/2017. Many companies never recovered and the industry is still struggling.

Azevedo & Travassos Stock – Summary and Conclusions

Azevedo & Travassos is in extremely poor financial health. The company never recovered from Brazils 2016/2017 financial crisis. In 2019, they declared their intent to declare bankruptcy. Given the company’s high debt and liability levels, common stock investors face the likelihood of a total loss of capital. Azevedo & Travassos stock is not investable at any price.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.