Common Stock: AntarChile

Current Market Price: $8,921.30 (CLP) $12.05 (USD)

Market Capitalization: $4 Trillion (CLP) $5.5 Billion (USD)

*All values in this article are expressed United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

AntarChile Stock – Summary of the Company

AntarChile is an industrial holding company with assets in the forestry, fuel, fishing, and energy sectors. Their largest holding is a 60.82% stake in Empresas Copec, which is a forestry and energy company that owns several gas station chains globally. Empresas Copec accounts for around 98% of the AntarChile’s assets. AntarChile has a commercial presence in 80 countries, and production in 16.

The company was founded in 1989 and is headquartered in Santiago, Chile. They employ over 37,000 people worldwide.

Revenue and Cost Analysis

AntarChile had total revenue of $23.7 billion in 2019, a slight decrease from $24 billion in 2018. Their COGS was $20.4 billion, representing a gross margin of 13.7%, a deterioration compared to 17.3% in 2018.

The company was profitable in each of the last two years. In 2019 AntarChile had net income of $249.6 million, representing a profit margin of 1%, a significant deterioration compared to 4.8% in 2018. This decrease in net income can be attributed in large part of $243 million in impairment charges, as well as decreased gross margins.

Balance Sheet Analysis

AntarChile has a decent, but leveraged balance sheet. They have a sound base of long term assets and sufficient liquidity in the near term. However they have significant liabilities outstanding, including debt.

It is also worth noting the company uses derivatives to hedge currency and commodity price exposure. Investors should analyze this derivative book in detail before investing.

AntarChile – Debt Analysis

As of year-end 2019 the company has $9.4 billion in total debt outstanding, $972 million of which is classified as current.

AntarChile Stock – Share Dynamics and Capital Structure

As of year-end 2019 AntarChile had 456.4 million common shares outstanding. The company’s 12 largest shareholders own a combined 86.88% of the company.

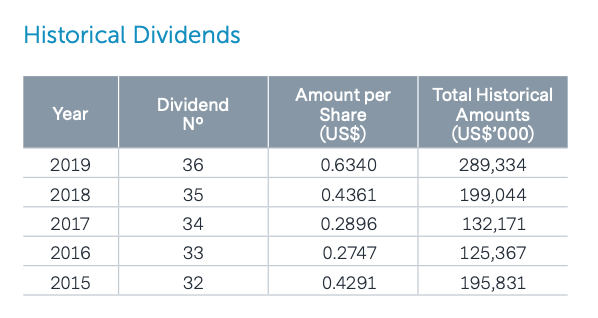

AntarChile – Dividends

In 2019 the company paid a dividend of $0.63 cents per share, an increase from $0.43 cents per share in 2018. At the current market price this implies a dividend yield of 5.2%.

AntarChile Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$14.2 billion / $11.4 billion = 1.2

A debt to equity ratio of 1.2 indicates that AntarChile uses a mix of debt and equity in its capital structure, but is slightly leveraged, relying more heavily on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$7.1 billion / $3.2 billion = 2.2

A working capital ratio of 2.2 indicates a sound liquidity position. AntarChile should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$12.05 / $24.87 = .48

AntarChile has a book value per share of $24.87. At the current market price this implies a price to book ratio of .48, meaning the company’s stock currently trades at a significant discount to the book value of the company.

AntarChile Stock – Summary and Conclusions

AntarChile is an impressive company. They own stakes in a diversified portfolio of companies in the forestry, energy, and fishing industries. These companies are present in 80 countries. AntarChile is in decent financial health, with sufficient liquidity and a profit. However results deteriorated significantly in 2019, and although the company has a long history of dividends, they decided to reduced their dividend payout ratio in 2020 and moving forward.

I will need to see the company’s full 2020 financials before drawing any conclusions. AntarChile is interesting as a long term investment prospect, but in the near term had significant impairment write offs in 2019, and 2020 was certainly a difficult year as well.

Investors can compare AntarChile stock to Colombian conglomerate Grupo Orbis.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.