Common Stock: Jaguar Mining (TSX:JAG)

Current Market Price: $.66 USD

Market Capitalization: $477.5 million USD

**Note: All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

Jaguar Mining Stock – Summary of the Company

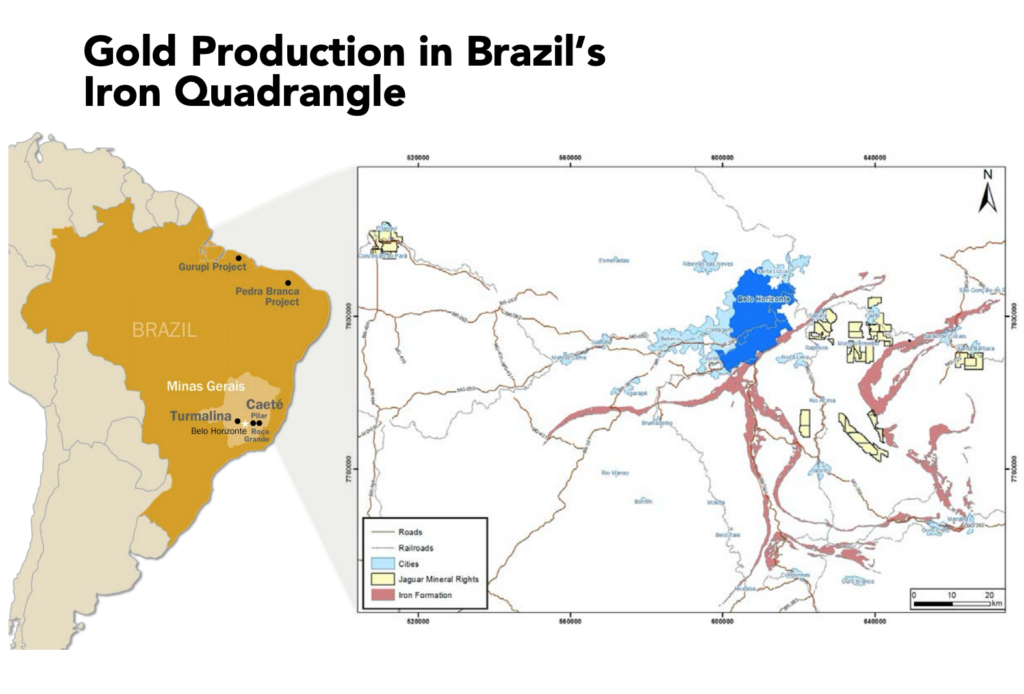

Jaguar Mining is a gold mining company focused on the development and operation of gold properties in Brazil. They own 3 major properties with a total of 64,000 hectares. The company’s principal assets are located in the state of Minas Gerais. Jaguar Mining was founded in 2002 and is headquartered in Toronto Canada. As of year-end 2019 they had 1,141 employees, all but 2 of which are in Brazil.

Revenue and Cost Analysis

In 2019 Jaguar produced a total of 74,082 ounces of gold, a slight decrease from 2018 production of 75,048 ounces. Total revenue in 2019 was $97.2 million, on which they earned a gross profit of $23.2 million and a small net loss of $148 thousand.

Jaguar Mining – Royalty and Streaming Agreements

The Turmalina property is subject to a 5% net revenue interest up to $10 million and 3% thereafter, to an unrelated third party. In addition, there is a 0.5% net revenue interest payable to the surface landowner.

Jaguar pays a royalty of .5% of revenue on the Pilar mine.

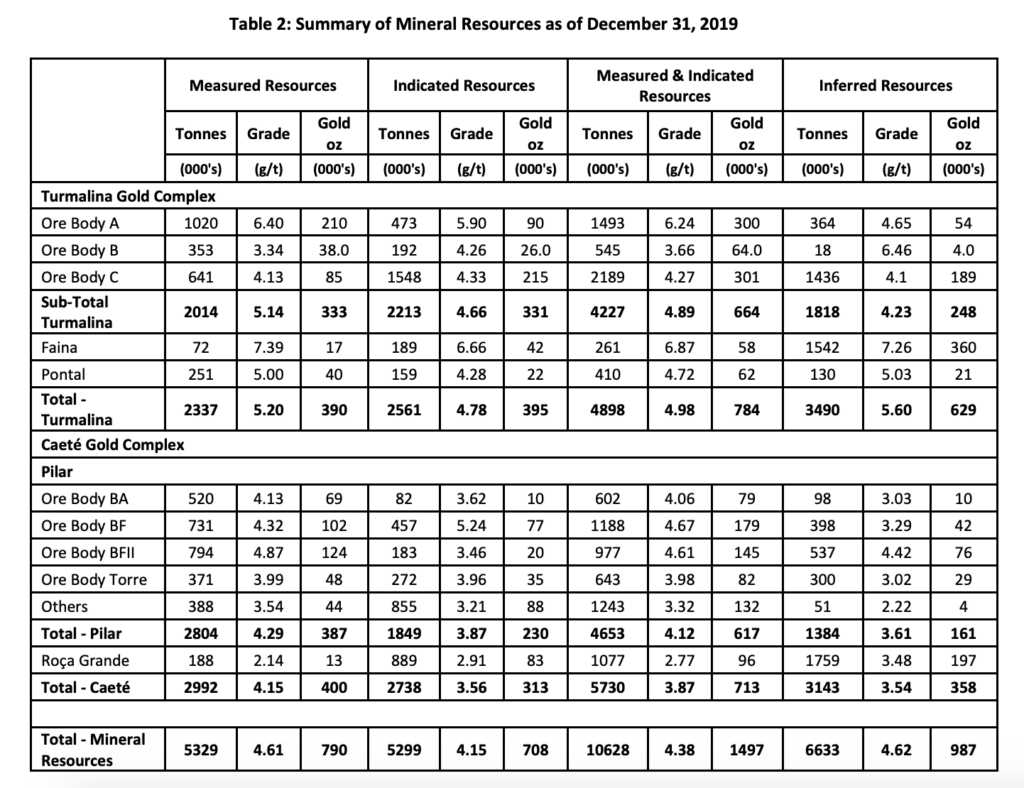

Jaguar Mining – Mineral Resources

Jaguar has Measured and Indicated Mineral resources of 10,628,000 t with an average grade of 4.38 g/t Au – containing 1,497,000 oz. of gold, and Inferred Mineral resources of 6,633,000 t with an average grade of 4.62 g/t Au – containing 987,000 oz. of gold.

Balance Sheet Analysis

Jaguar has a sound balance sheet with sufficient liquidity and reasonable liability levels. They have a large legal provision valued at $11.5 million related to labor disputes. However, this is normal for Brazilian companies and not overly concerning.

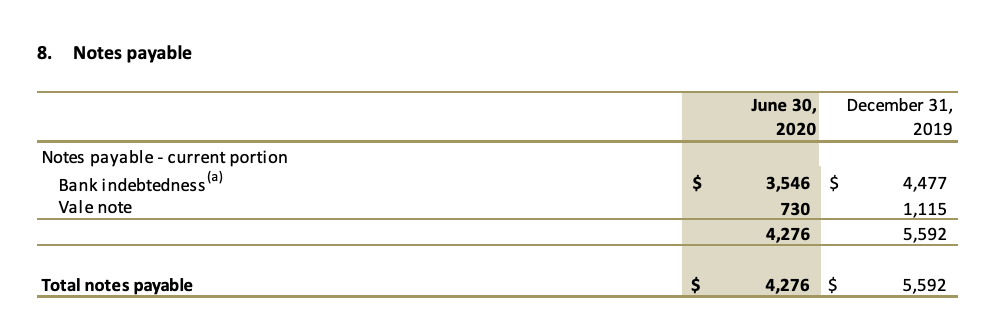

Jaguar Mining Stock – Debt Analysis

As of June 2020, Jaguar had total debt of $4.2 million. This debt is unsecured and carries an interest rate ranging from 5.7% to 8.7%.

Jaguar Mining Stock – Share Dynamics and Capital Structure

As of June 30, 2020, Jaguar had 724 million common shares outstanding. They also have warrants and options outstanding. Fully diluted shares outstanding is around 740 million shares.

Eric Sprott owns 48.9% of the company’s outstanding shares and Sprott Asset Management owns an additional 13.3% of the company.

Jaguar Mining Stock – Dividends

Jaguar did not pay any dividends in 2017, 2018 or 2019. Furthermore, management has stated that they are unlikely to pay dividends for the foreseeable future.

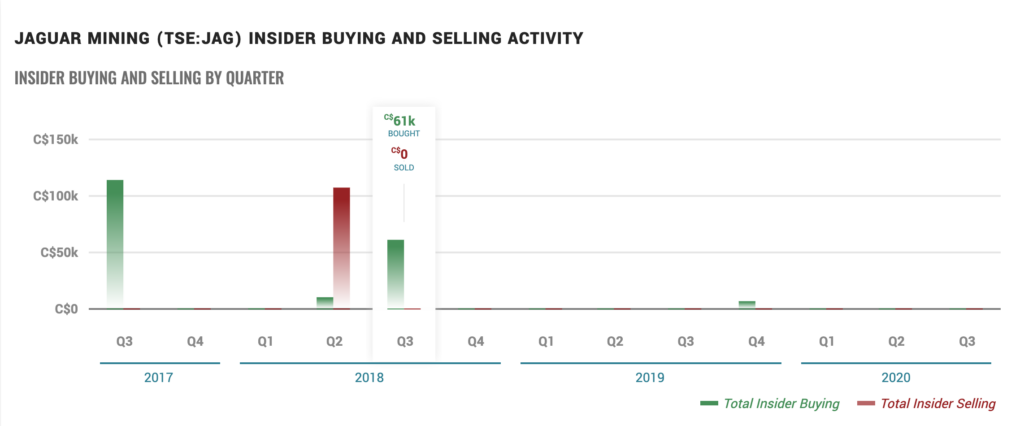

Management – Skin in the game

Insiders at Jaguar Mining have not made any relevant transactions in the recent past, providing no signal for investors.

Jaguar Mining Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$72.3 million/ $128.5 million = .56

A debt to equity ratio of .56 indicates that Jaguar relies on both debt and equity to fund itself, but uses more equity than debt.

Working Capital Ratio

Current Assets/Current Liabilities

$30.5 million/$40 million = 1.3

A working capital ratio of 1.3 indicates sufficient short term liquidity. Jaguar should not have problems meeting its obligations in the near term.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.66/$.17 = 3.8

Based on fully diluted shares outstanding Jaguar has a book value per share of $.17. At the current market price this implies a price to book ratio of 3.8, meaning Jaguar stock currently trades at a premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Jaguar Mining Stock – Summary and Conclusions

Jaguar Mining owns a solid portfolio of assets in Brazil’s most well established and secure mining district. They currently have relevant production and significant untapped exploration potential. The company is healthy financially with sufficient liquidity and manageable liability levels. Jaguar is well positioned to benefit from not only a rising gold price, but also a weakening local currency in the Brazilian Real (BRL).

Having lived and worked in Brazil for nearly a decade, I view the jurisdictional risk to investors as low. Litigation expenses and tax increases are always a risk in Brazil, and may be a temporary drag on net income, but I expect a declining local currency and rising gold price to more than offset this.

Debt levels are low and there is little potential dilution, making the capital structure attractive for common stock holders. I am going to take an initial position in Jaguar Mining stock, and continue to build position.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.