Common Stock: Harte Gold Corp. (TSX: HRT)

Current Market Price: $.195 CAD

Market Capitalization: $162.2 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Harte Gold Stock – Summary of the Company

Harte Gold is a precious metals exploration company focused on gold properties in Canada. Their principal property is the Sugar Zone Mine located in Ontario Canada, which is currently producing. Harte Gold was founded in 1982 and is headquartered in Toronto Canada.

Revenue and Cost Analysis

In 2019 Harte Gold had revenue from gold and silver sales totaling $49.7 million. Harte has consistently run a net operating loss and in 2019 had an operating loss of $14 million and a comprehensive loss of $61.5 million.

Harte Gold – Royalty and Streaming Agreements

Some of the claims on the Sugar Zone property are subject to net smelters royalty’s ranging from 1.5% to 3%.

Harte Gold – Mineral Resources

Harte Gold has measured and indicated resources totaling 1.1 million ounces of gold.

Balance Sheet Analysis

Harte Gold has a weak balance sheet. They have significant short and long term liability’s in addition to a constrained liquidity position.

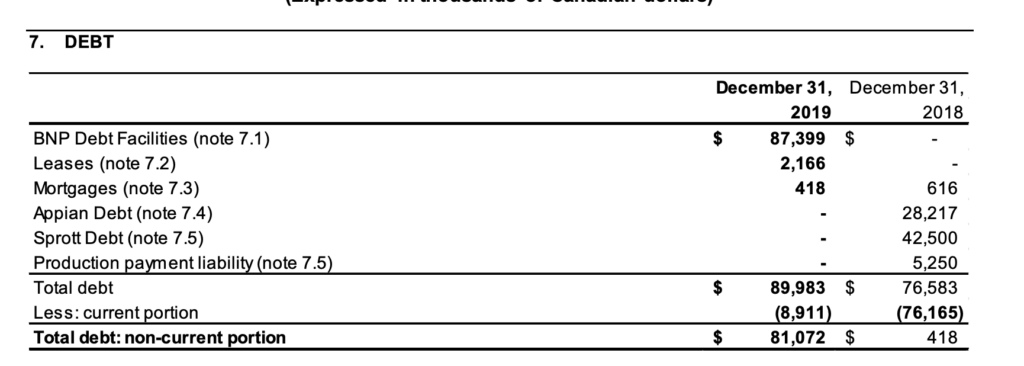

Harte Gold Stock – Debt Analysis

As of year-end 2019, Harte Gold had $90 million in debt outstanding. Their credit facility is fully drawn and according to management they do not have access to additional credit. Furthermore, management has stated that it is likely to breach its debt covenants.

Harte Gold Stock – Share Dynamics and Capital Structure

Harte Gold has a highly dilutive capital structure. Fully diluted shares outstanding is around 945.6 million shares.

Investors should carefully consider the effects of dilution and their place in the capital structure before investing.

Harte Gold Stock – Dividends

The company does not currently pay a dividend.

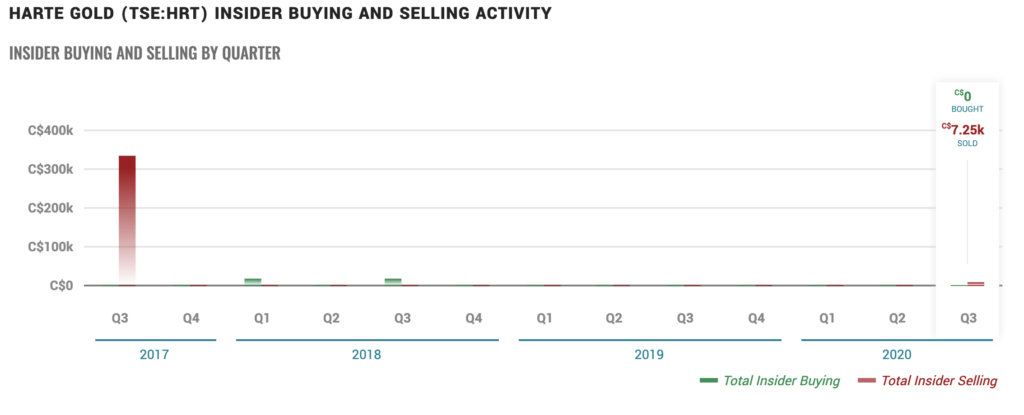

Management – Skin in the game

Insiders at Harte Gold have not made any relevant transactions in the company’s stock in the recent past, providing no signal to investors.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Harte Gold Stock – Summary and Conclusions

Harte Gold has a producing mine in a well-established gold region. They have a large land package with significant exploration potential.

However, the company is in poor financial health. They have significant debt outstanding, with covenants managements has stated are likely to be breached. Furthermore, the company’s capital structure is highly dilutive, so even if Harte is able to overcome its debt issues, upside for common shareholders is limited.

I am not willing to invest in Harte Gold common stock at this time, due to is poor financial position. I will continue to monitor the company, as they are a potential acquisition target for larger producers already operating in the region. But I will need to see significant improvements in the company’s financial health before I reconsider investing.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.