Common Stock: Alio Gold (NYSE:ALO)

Current Market Price: $.88

Market Capitalization: $75.6 million

Alio Gold Stock – Summary of the Company

Alio Gold is a gold mining company focused on the exploration, development, and operation of gold properties in North America. Their major property is the Florida Canyon Mine in Nevada, but they also own development stage projects in Mexico. Alio was founded in 2005 and is headquartered in Vancouver Canada. They have around 300 employees and contractors.

Revenue and Cost Analysis

In 2019, the Company sold 80,530 gold ounces at an average realized gold price of $1,333 per ounce, compared to sales of 82,598 gold ounces at an average realized gold price of $1,280 per ounce during 2018. This represents a decrease of 3% in gold ounces sold and an increase of 4% in realized gold price over 2018.

Total metal revenues from mining operations in 2019 were $111.5 million compared to $104.5 million during 2018, due to lower gold ounces sold in 2018. All the company’s production is from the Florida Canyon Mine.

Despite increasing revenue, the company’s net loss increased significantly. In 2019, they had a net loss of $136 million, compared to a net loss of $14 million in 2018. However, a large portion of this net loss was due to a one-time impairment charge of $124 million.

Alio Gold – Royalty and Streaming Agreements

The Florida Canyon mine is subject to 3 royalties, a 2.5% and 3.25% net smelter royalty. And a 10% “royalty area” for the deposit.

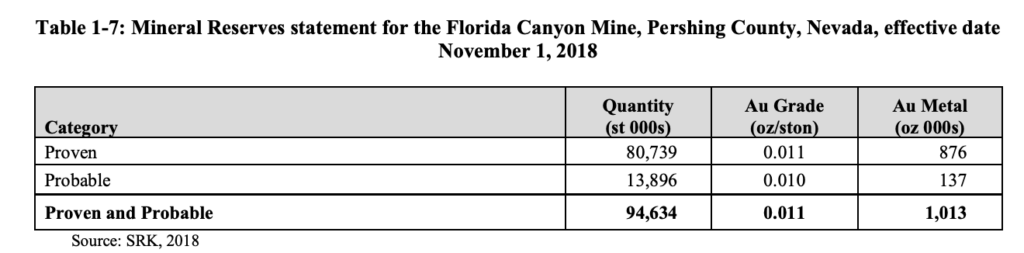

Alio Gold – Reserves

The Florida Canyon Mine has “proven and probable” reserves of 1,013,000 ounces of gold.

Balance Sheet Analysis

Alio has a strong balance sheet with sufficient liquidity to meet their near-term obligations. Debt and liability levels appear manageable.

At the end of 2019 the company had $90.1 million in current assets, including $16.5 million in cash and $62.9 million in inventory. Current liabilities were $41.5 million, made up mostly of accounts payable and lease liabilities.

Alio has a strong long term asset base of mineral properties and equipment. At the end of 2019 total assets were $251.2 million compared to total liabilities of $132.6 million

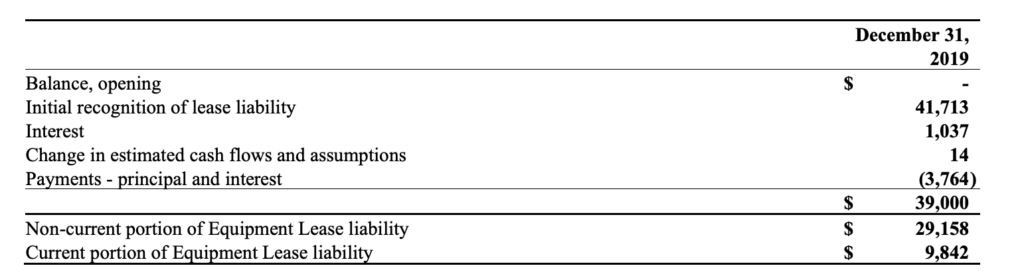

Alio Gold – Debt Analysis

The company has an outstanding lease liability totaling $39 million. They also have $15 million loan outstanding. The Loan Facility has a maturity date of October 31, 2022, with eight equal quarterly repayments of the principal balance commencing on January 31, 2021, requiring monthly interest payments based on an interest rate of 8% plus the greater of three-month London Inter-bank Offered Rate (“LIBOR”) or 2%.

Alio Gold Stock – Share Dynamics and Capital Structure

As of March 2020 Alio had 86 million common shares outstanding. They also have options and warrants outstanding. Fully Diluted shares outstanding is around 92.2 million shares.

Although Alio does have some senior debt and dilutive instrument in their capital structure, both appear reasonable. I believe the company’s capital structure is acceptable for common shareholders.

Alio Gold Stock – Dividends

The company does not pay a dividend and plans to retain its future earnings; therefore, they are unlikely to start paying dividends for the foreseeable future.

Management – Skin in the game

There has not been any relevant insider trading of Alio stock recently.

Alio Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$132.6 million/$118.6 million = 1.1

A debt to equity ratio of 1.1 means the company uses nearly equal parts debt and equity in its capital structure, with slightly more debt. Alio should not be overly reliant on any one form of financing in the future.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.88/$1.29 = .68

Based on my estimate of fully diluted shares outstanding, Alio has a book value per share of $1.29. At the current market price this implies a price to book ratio of .68. A price to book ratio of .68 means Alio stock currently trades at a significant discount to the value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$90.1 million/$41.5 million = 2.2

A working capital ratio of 2.2 implies sufficient liquidity in the short term. Alio should not have a problem meeting its near-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Alio Gold Stock – Summary and Conclusions

Alio has a proven and producing mine in a strong jurisdiction. They also have several exploration stage projects in the riskier jurisdiction of Mexico. The company has a strong liquidity position and debt levels appear to me manageable.

Although they do have some dilutive instruments outstanding, the capital structure appears acceptable for common stock holders.

Operating results have been inconsistent, with the company running a net loss for the past 2 years. Significant royalty obligations related to the Florida Canyon property are also concerning. However, Alio appears well positioned to benefit from a rising gold price.

Given that Alio stock currently trades at a significant discount to the book value of its assets, Alio may merit an allocation, as this discount provides a margin of safety to protect investors from the risks associated with a single asset stock with poor operating results. I would consider investing in Alio stock within a well-diversified gold stock portfolio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.