Common Stock: Coeur Mining (CDE)

Current Market Price: $4.21

Market Capitalization: $1 billion

Coeur Mining – Summary of the Company

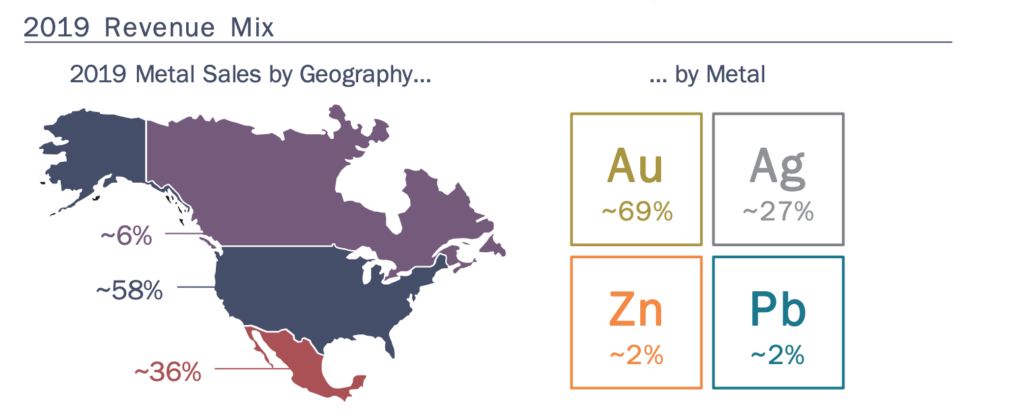

Coeur mining is a mining company focused on the exploration, development and operation of mining properties which produce primarily gold and silver. The company has producing mines in Canada, The United States, and Mexico, as well as exploration stage projects throughout North America. Coeur was founded in 1928 and is headquartered in Chicago, Illinois. They employ around 2,200 people.

Coeur Mining – Revenue and Cost Analysis

Coeur had total revenues of $711 million in 2019, a 13% increase of 2018 sales of $625.9 million, however this was roughly equal to 2017 sales of $709 million. Most of this revenue comes from gold sales followed by silver sales. They also sell small amounts of zinc and lead.

In 2019 Coeur produced 359,418 ounces of gold and 11.7 million ounces of silver.

The company has had a loss for the past two years. In 2019, the net loss was $346 million, unusually high due to a large write down of the Silvertip property in Canada. In 2018, the net loss was $49 million. The company has had negative free cash flow in both these years.

Royalty and Streaming Agreements

A portion of the Palmarejo property, the company’s largest property in terms of revenue, is subject to a gold stream agreement with a Franco-Nevada Corporation. This agreement requires Coeur to sell 50% of applicable gold production for the lesser of $800 or spot price per ounce.

Coeur pays a 3% royalty on gold production at its Wharf property in South Dakota. They also pay a 2.5% net smelters royalty at their Silvertip property in Canada.

Reserves

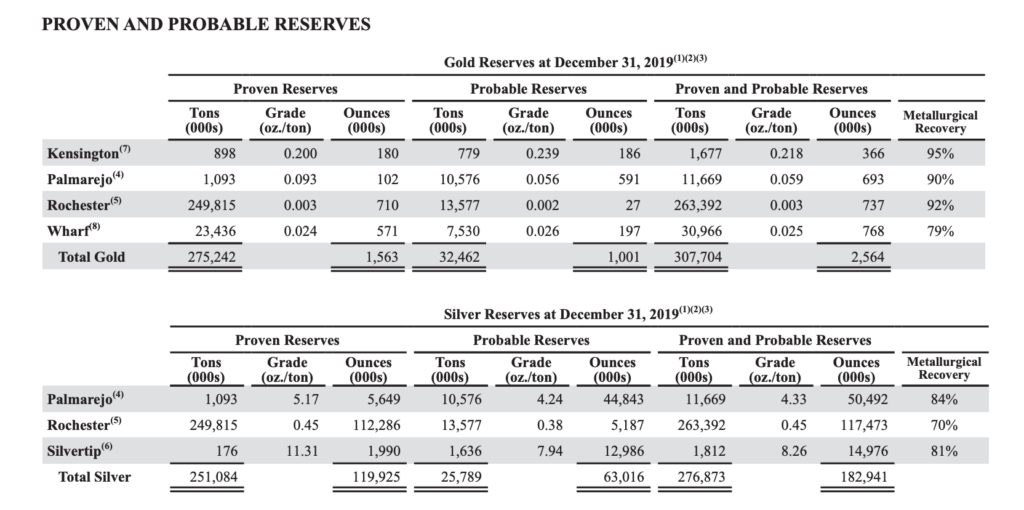

The company has “proven and probable” reserves of 2.5 million ounces of gold and 183 million ounces of silver.

Coeur Mining – Balance Sheet Analysis

Coeur has an OK balance sheet. Current assets total $210 million, $55 million of which is cash. Current liabilities total $190 million. Liquidity is sufficient to meet near term liabilities, including the interest on the debt.

They have a significant long term liability related to reclamation and mine closures. This liability has a balance sheet value of $344.7 million.

Debt Analysis

The company paid down a significant portion of its debt in 2019, reducing its total debt load to $295 million from $458 million. This debt is in the form of a senior note which is due in 2024.

They also have a finance lease obligation of $75.8 million and an operating lease obligation of $61 million.

Moody’s Rating

Coeur’s debt is currently rated B3, which is below investment grade and considered speculative. In September 2019 Moody’s completed a periodic review of Coeur and stated:

Coeur’s B3 corporate family rating reflects its relatively high cost operations, project execution risks and exposure to volatile gold, silver, zinc and lead prices that have pressured credit metrics and have led to negative free cash flow generation. The rating also factors in the smaller scale of Coeur’s operations and relatively short mine life at certain underground assets.

CDE Stock – Share Dynamics and Capital Structure

As of February 2020, Coeur had 243,074,353 common shares outstanding and 1,373 shareholders of record. They have a small number of restricted shares (compensation) and options outstanding, making the fully diluted shares outstanding around 245.5 million.

Coeur does not have a significant amount of dilutive instrument outstanding. They do have a senior note due in 2024, but it appears they will be able to meet this obligation. Their capital structure is acceptable for common shareholders.

CDE Stock – Dividends

Coeur does not currently pay a dividend and has not historically paid a dividend to common stock holders.

Management – Skin in the game

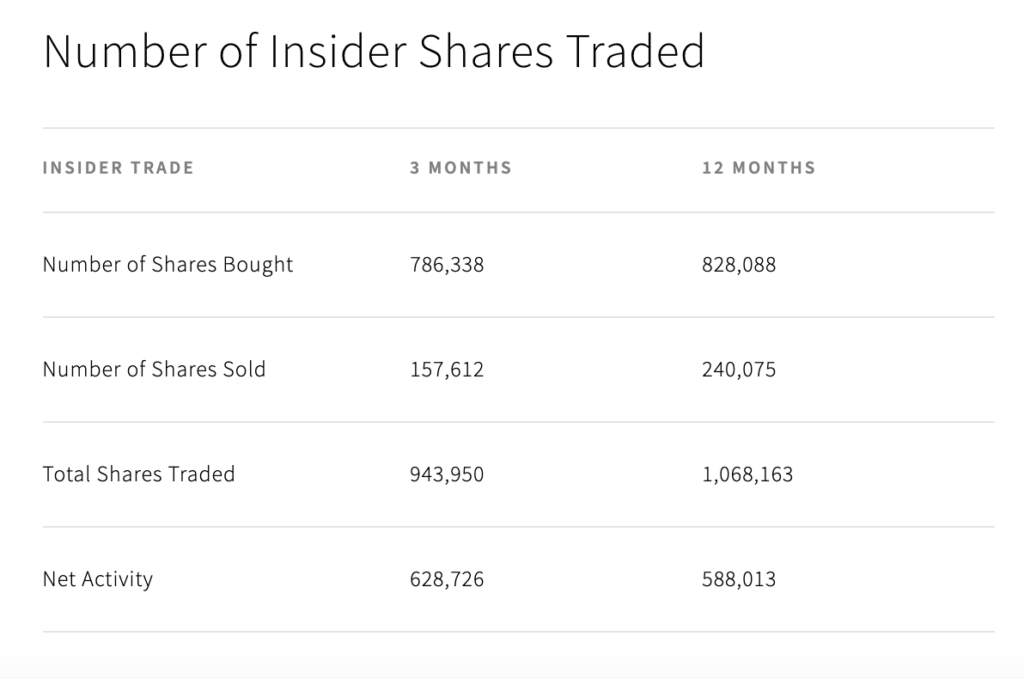

Over the last 12 months CDE insiders have been net buyers of the company’s stock. Insiders currently own between 1% and 2% of the shares outstanding.

Net insider buying is generally thought of as a bullish signal for the stock.

Coeur Mining – 3 Metrics to Consider

Price to Book Ratio

Price of common stock/Book Value per share

$4.21/$3.49 = 1.2

Based on my estimate of fully diluted shares outstanding, Coeur has a book value per share of $3.49. At the current market price this implies a price to book ratio of 1.2.

A price to book ratio of 1.2 means CDE shares trade at a small premium to the book value of the company’s assets. However, given Coeur’s history of asset write downs, the book value of its assets may be overstated.

Working Capital Ratio

Current Assets/Current Liabilities

$210 million/ $190 million = 1.1

A working capital ratio of 1.1 implies a sufficient, but not strong liquidity position. Coeur should be able to meet its short-term obligations.

Debt to Equity Ratio

Total Liabilities/ Total Shareholder Equity

$520.9 million/$667 million = .78

A debt to equity ratio of .78 implies that the company is funded by more equity than debt, meaning they are not overly reliant on debt financing.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

CDE Stock – Summary and Conclusions

Coeur mining has a diversified asset portfolio spread out across North America. They have been working to improve the financial health of the company and significantly reduced their debt levels in 2019. The company’s liquidity appears adequate in the near term.

However operating results have been inconsistent and the company has had a net loss and negative free cash flow for the past 2 years. They have also had several significant write downs in the recent past, so instead of bringing new mines into operation, they have been decreasing the value of the miners they have. Additionally, they have limited their upside significantly via royalty and streaming agreements.

At its current valuation CDE is by no means a bargain, it trades at a premium to the book value of its assets, a value that is likely overstated. The company does not pay a dividend and it is unclear if and when they will be able to improve their operating results. At its current price, I do not believe common stock investors can purchase CDE stock with a sufficient margin of safety to compensate for the risks involved.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.