Common Stock: Canarc Resources (TSX: CCM, OTC: CRCUF)

Current Market Price: $.05

Market Capitalization: $12.1 million

Canarc Resources – Summary of the Company

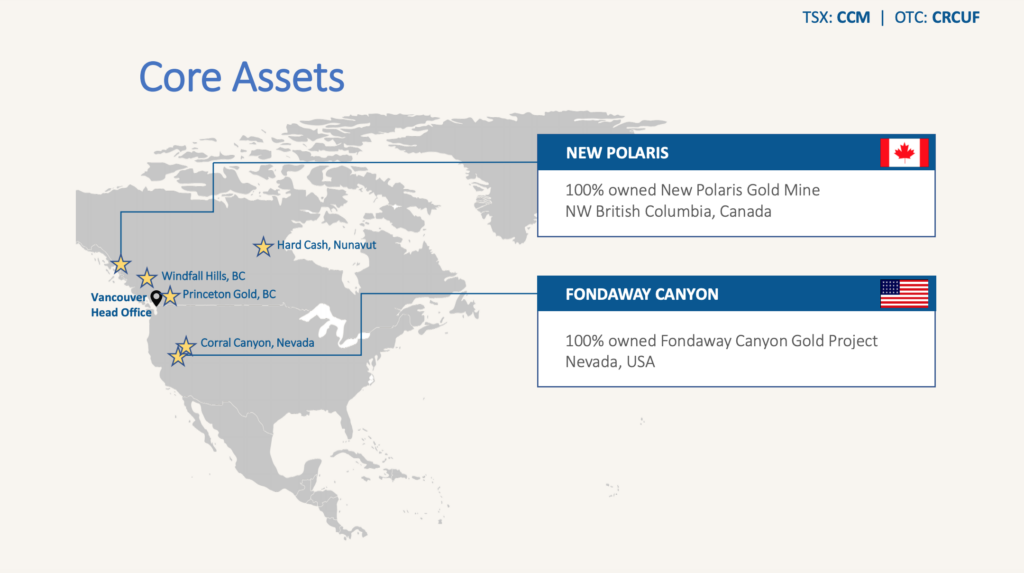

Canarc Resources is a precious metals company focused on the acquisition, exploration, and development of precious metals properties. They have several exploration stage projects in The United States and Canada. Canarc was founded in 1987 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Canarc does not currently have any producing properties, therefore they do not have any revenue and consistently have a net loss.

In 2019, they had a net loss of $1 million, a slight improvement from a net loss of $1.1 million in 2018.

Most of the company’s expenses are related to compensation, including share based payments, and general administrative expenses.

Canarc Resources – Royalty and Streaming Agreements

Several of the company’s exploration stage properties have royalty agreements attached. Canarc carries a significant deferred royalty liability on its balance sheet,

Balance Sheet Analysis

Canarc has a strong balance sheet with low liability levels and sufficient liquidity. At the end of 2019, current assets totaled $2.1 million, including $1.9 million in cash. Current liabilities were only $231 thousand.

Most of the company’s assets are long term assets which are interests in mineral properties. At the end of 2019 total assets were $18.3 million compared to $393 thousand in total labilities.

Canarc Resources – Debt Analysis

Carnac does not have any debt outstanding. However, they do have a small lease liability.

Canarc Resources Stock – Share Dynamics and Capital Structure

As of March 2020, Canarc had 242.6 million shares outstanding. They also have 17.7 million compensation related options and 1.5 million warrants outstanding. Fully diluted shares outstanding is around 261.9 million

Although the company has no debt, its capital structure is dilutive and investors should consider the effect of this dilution before investing.

Canarc Resources Stock – Dividends

The company does not currently pay a dividend and is unlikely to do so in the short to medium term.

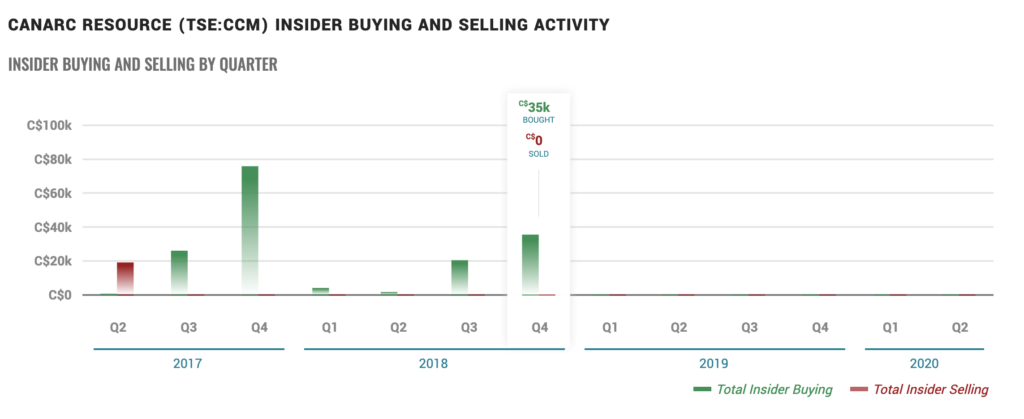

Management – Skin in the game

There has not been any insider trading of Canarc Resources stock over the past 12 months. However, in 2017 and 2018, insiders were net buyers of Canarc Resources stock.

Canarc Resources Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$393 thousand/ $17.9 million = .02

A debt to equity ratio of .02 means Canarc has almost no debt in its capital structure and is funded almost entirely with equity capital.

Price to Book Ratio

Current Share Price/Book Value per Share.

$.05/$.068=.73

Based on my estimate of fully diluted shares outstanding Canarc has a book value per share of $.068. At the current market price this implies a price to book ratio of .73. A price to book ratio of .73 means Canarc common stock currently trades at a discount to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$2.1 million/$231 thousand = 9.1

A working capital ratio of 9.1 indicates strong short term liquidity, meaning it is likely Carnac will be able to meet its near-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Canarc Resources – Summary and Conclusions

Canarc has several promising exploration stage projects in secure jurisdictions. Should any of these projects play out to their full potential, the company may have significant upside.

However, investors need to consider that much of this upside may have already been captured. The company has sold significant royalties on most of its properties and in some cases profit sharing agreements. In addition, the company’s capital structure is dilutive, with a significant amount of warrants and compensation based options and outstanding. Given the current stage of their projects, they will likely need additional equity financing, further diluting existing shareholders.

Despite the risks associated with large royalties and dilution, Canarc currently trades at a significant discount to the book value of its assets. This discount may provide a significant margin of safety for investors, making an allocation to Canarc equity worthwhile within a well-diversified portfolio of gold stocks. However even with this margin of safety, Canarc is still a high-risk investment with a high probability of losing capital. It is only suitable for highly risk tolerant investors.