Common Stock: Wigton Windfarm

Current Market Price: $0.55 JMD

Market Capitalization: $6 Billion JMD ($39.3 Million USD)

*All values in this article are expressed in Jamaican Dollars (JMD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Wigton Windfarm Stock – Summary of the Company

Wigton Windfarms is a Jamaican renewable energy company focused on building and operating wind farms in Jamaica. The company currently operates three windfarms which are all located in Rose Hill, Manchester, Jamaica. The company’s total installed capacity is 62.7 Mega Watts. Wigton supplies its energy to Jamaica Public Service Company which by extension supplies it to Jamaica’s national grid.

Wigton Windfarm was founded in 2000 and is headquartered in Kingston, Jamaica.

Revenue and Cost Analysis

For the fiscal year end March 2021, Wigton had total revenues of $2.6 billion, an increase from $2.4 billion in the previous year. Their COGS was $789 million in 2021, representing a gross margin of 70%, a slight increase compared to 68% the previous year.

Wigton has been profitable every year dating back to 2017. For the most recent year ending March 2021 the company had net income of $793 million, representing a profit margin of 30.5%, an increase compared to 27.4% in the previous year.

Balance Sheet Analysis

Wigton has a strong balance sheet. They have a solid base of long term assets, a very strong near term liquidity position, and reasonable liability levels.

The company’s windfarms have a 20 year useful life. Their first plant, built in 2004, will be full depreciated in 2024.

It is also worth noting the company has a defined benefit pension obligation that investors should analyze in detail.

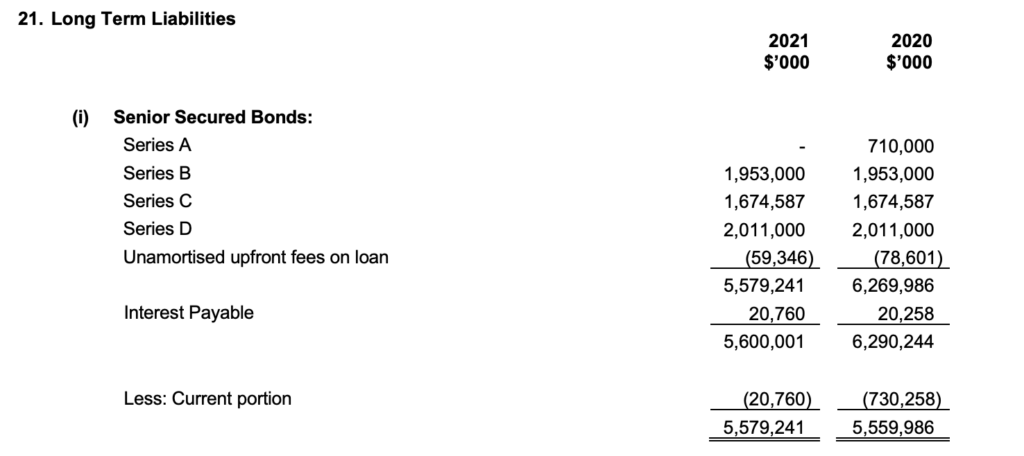

Debt Analysis

As of the fiscal year end March 2021, Wigton has $5.6 billion in total debt outstanding, almost all of which is classified as long term. Interest on their debt ranges from 6.65% to 8.4%.

The company paid down a significant portion of its debt obligations during 2020/2021, reducing its total obligations by $690 million.

Wigton Windfarm Stock – Share Dynamics and Capital Structure

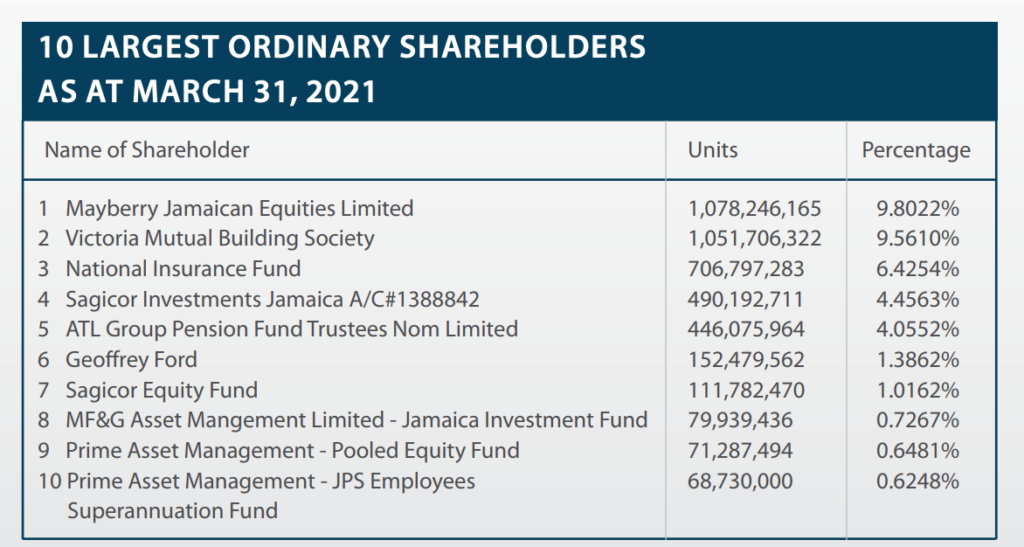

As of the fiscal year end March 2021 Wigton has 11 billion common shares outstanding.

The company’s 10 largest shareholders own around 38% of the company’s outstanding shares.

Dividends

The company did not pay a dividend for the fiscal year 2021.

Wigton Windfarm Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$6.6 billion / $4.2 billion = 1.6

A debt to equity ratio of 1.6 indicates that Wigton uses a mix of debt and equity in its capital structure, but is leveraged, and relies more of debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$3.7 billion / $117 million = 32

A working capital ratio of 32 indicates an extremely strong liquidity position. The company should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$0.55 / $0.38 = 1.4

Wigton has a book value per share of $0.38. At the current market price this implies a price to book ratio of 1.4, meaning the company’s stock currently trades at a slight premium to the book value of the company.

Wigton Windfarm Stock – Summary and Conclusions

Wigton Windfarm is an interesting case study for wind energy. They are the largest Windfarm in Jamaica, with 3 large plants. The company is financially healthy with stable revenues and consistent profits. Most concerning are the company’s debt levels and plant that will ends its useful life in 2024.

This is the first public wind farm I have ever looked at, so further research is required before I can draw any conclusions. But my first impression is that Wigton is a decent business trading at a reasonable valuation. I will need to clarify what will happen to the company’s plant when its useful life ends, and how this will affect their debt levels.

Investors can also look at other Jamaican companies, such as paint manufacturer Berger Paints.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.