Common Stock: Torex Gold Resources (TSX:TXG, OTC:TORFX)

Current Market Price: $12.82

Market Capitalization: $1.1 billion

Torex Gold – Summary of the Company

Torex Gold Resources is a gold exploration and production company headquarter in Toronto, Canada. Their keystone property is the Morelos gold property located southwest of Mexico City. They own 100% of the property and have several different mines on the property, including exploration stage projects. The company was founded in 1980.

Revenue and Cost Analysis

Torex produced 454,811 ounces of gold in 2019, an annual record. Total revenue was $640.8 million, a significant increase over 2018 revenue of $442.9 million. Almost all revenue comes from gold sales, with a very small, non-relevant, portion attributable to silver and copper sales

The all in sustaining cost per ounce was $805 in 2019. The company had operating income of $160.9 million and net income of $71.2 million in 2019, compared to $108.2 million in operating income and $23.2 million in net income in 2018.

Torex Gold – Royalty and Streaming Agreements

The company pays a 2.5% royalty to the Mexican Geological Survey Agency related to certain mines. Total royalty expense was $19.2 million in 2019.

Balance Sheet Analysis

Torex Resources has a strong liquidity position, but high debt levels. At the end of 2019 current assets totaled $339 million, including $161.8 million in cash. Current liabilities totaled $242.6 million and total liabilities were $394.8 million.

Most of the company’s assets are long term assets like property and equipment. At the end of 2019 they had total assets of $1.2 billion.

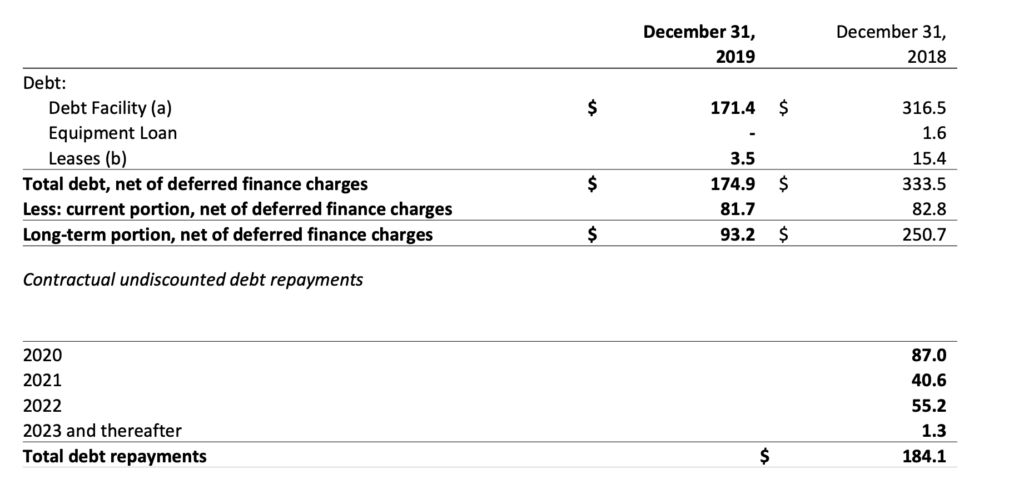

Torex Gold – Debt Analysis

The company has a significant amount of debt due in both the short and medium term. Total debt was $174.9 million at the end of 2019. This is a significant improvement over total debt of $333.5 million at the end of 2018. The debt carries an interest rate varying between LIBOR plus 3% to 5%.

Torex Gold Stock – Dividends

The company does not currently pay a dividend.

Torex Gold Stock – Share Dynamics and Capital Structure

At the end of 2019 Torex had 85.4 million common shares outstanding. They also had dilutive compensation based options outstanding totaling 1.25 million. Fully diluted common shares outstanding is 86.6 million.

Torex Resources has a non-dilutive capital structure, but high debt levels could negatively impact common shareholders. Investors should carefully consider the company’s ability to repay its debt and how it impacts their position in the capital structure.

Management – Skin in the game

Over the last 12-18 months’ insiders have been net sellers of Torex Gold Resources stock.

Torex Gold – 3 Metrics to Consider

Interest Coverage Ratio

EBIT/Interest Paid

$23.8 million/$19.6 million= 1.21

An Interest coverage ratio of 1.21 means the company generated enough income from its operating activities to meet its interest obligation. However, they do not have a wide margin for error and any adverse operating results could impact their ability to meet debt payments.

Price to Book Ratio

Current Share Price/Book Value per Share

$12.82/$9.63= 1.33

Based on fully diluted shares outstanding Torex Resources has a book value per share of $9.63. At the current market price this implies a price to book ratio of 1.33. A price to book ratio of 1.33 means Torex stock is trading at a small premium to the book value of its assets

Working Capital Ratio

Current Assets/Current Liabilities

$339 million/$242.6 million = 1.4

A working capital ratio of 1.4 implies the company has sufficient liquidity in the short term to meet its current obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Torex Gold – Summary and Conclusions

Torex Gold Resources has a strong keystone asset in Mexico. The property is currently producing profitably and has good future prospects. The company has a solid liquidity position, but relatively high amounts of debt. The capital structure is non-dilutive, so as long the company can continue decreasing its debt load, common shareholder will be in a good position.

The risks for common stock holders are obvious, the company is completely dependent on one property, in a risky jurisdiction. Torex stock currently trades at a fair price relative to the book value of its assets. Given that the company is currently operating at a profit and has significant future potential, Torex stock would be a sound addition to a diversified gold stock portfolio, if the investor is comfortable with the concentrated jurisdictional risk.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.