Common Stock: Telson Mining (TSXV: TSN)

Current Market Price: $0.285 CAD

Market Capitalization: $52 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

Telson Mining Stock – Summary of the Company

Telson mining is a mining and exploration company focused on base and precious metals properties in Mexico. They have one property in production, the Campo Morado mine, and another property that is being developed. Telson mining was founded in 1986 and is headquartered in Vancouver Canada.

Revenue and Cost Analysis

Telson had sales in $31 million in 2019, a decrease from $34 million in 2018. The company’s revenue is 100% from production at the Campo Machado mine, which produces gold, silver, lead, and zinc. The company earned $2.4 million from mining operations in 2019, but after general and administrative expenses Telson had a net loss. In 2019 Telson had a net loss of $29.3 million, a significant increase from a loss of $6.2 million in 2018. However this large increase is attributable to a one time impairment charge of $21.7 million in 2019.

Telson Mining – Royalty and Streaming Agreements

The Campo Morado property comprises seven mineral concessions located in Guerrero state, Mexico. The Campo Morado project is subject to a royalty between 2% and 3% of the net value of liquidation over the minerals extracted during the term of existence of the mining concession to the Servicio Geológico Mexicano (“SGM”).

As part of the Campo Morado acquisition, the seller retained the right to receive a variable purchase price on future zinc production on the first 10 million tonnes of ore processed by the Company at the Campo Morado mine when the price of zinc is at or above US$2,100 per tonne. This was accounted for as contingent consideration. Telson shall pay Nyrstar the greater of either:

a) US$20 per tonne of zinc sold if the zinc price received is over US$2,100 per tonne; or

b) a percentage that ranges between 0.5% and 4.25% of the net smelter revenues received from zinc when the price of zinc ranges between US$1,200 and US$2,500 from the Campo Morado mine.

A portion of the Tahuehueto mineral property is also subject to a 1.6% net smelter return royalty

Telson Mining – Mineral Resources

Telson has 1.39 million contained ounces of Gold and 74.4 million oz Silver in NI 43-101 compliant Measured and Indicated Resources for both projects plus very significant base metals.

Balance Sheet Analysis

Telson Mining has a weak balance sheet. They have very poor liquidity and a high level of liabilities relative to assets.

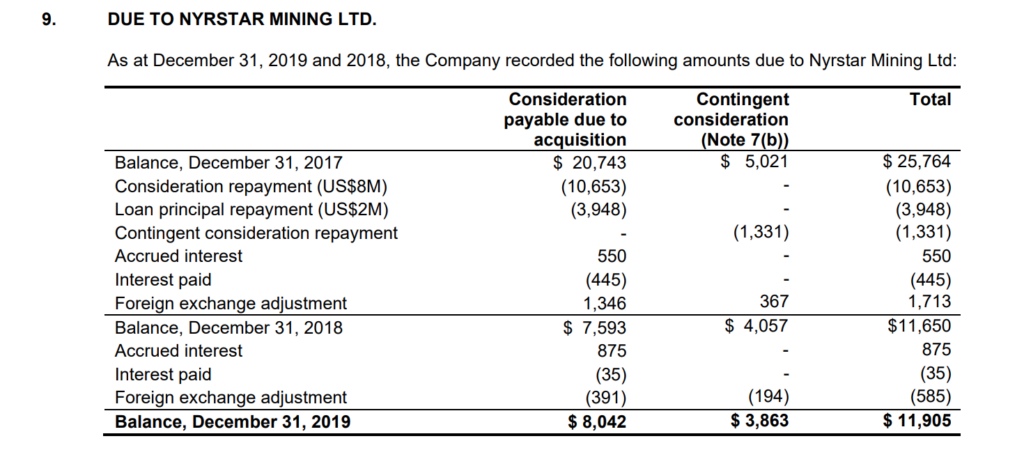

Telson Mining – Debt Analysis

As of year-end 2019 the company has $11.9 million in debt outstanding related to the acquisition of the Campo Morado property. The company also has several other loan facilities outstanding, valued at $3.9 million, $4.5 million ,and $16.5 million. Total debt outstanding is around $36.8 million.

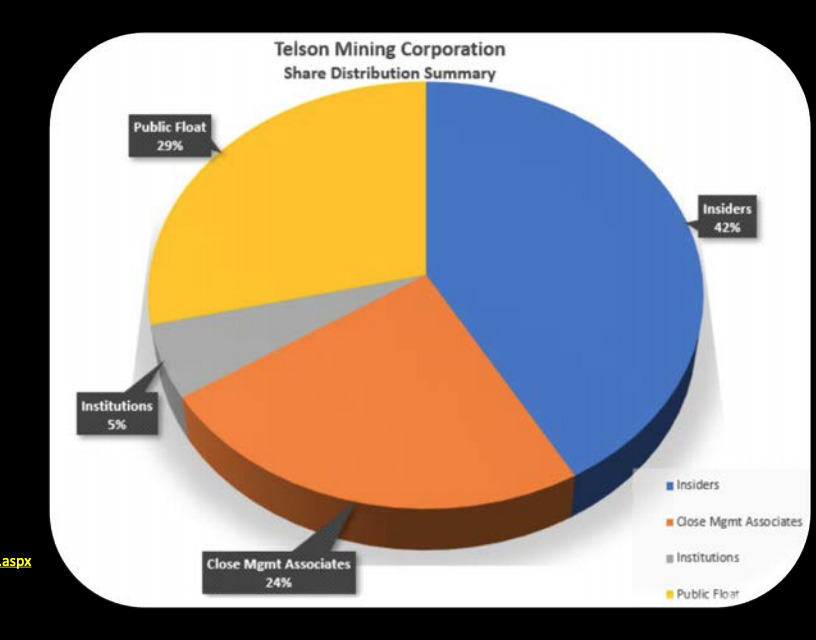

Telson Mining Stock – Share Dynamics and Capital Structure

As of October 2020 Telson has 182.7 million common shares outstanding. In addition they have 9 million options and 17.9 million warrants outstanding. Fully diluted shares outstanding is around 209.5 million shares.

Telson Mining has a dilutive capital structure. Investors should consider the effects of dilution before investing.

Telson Mining Stock – Dividends

The company does not currently pay a dividend. Management has stated they plan to retain future earnings for the foreseeable future.

Management – Skin in the game

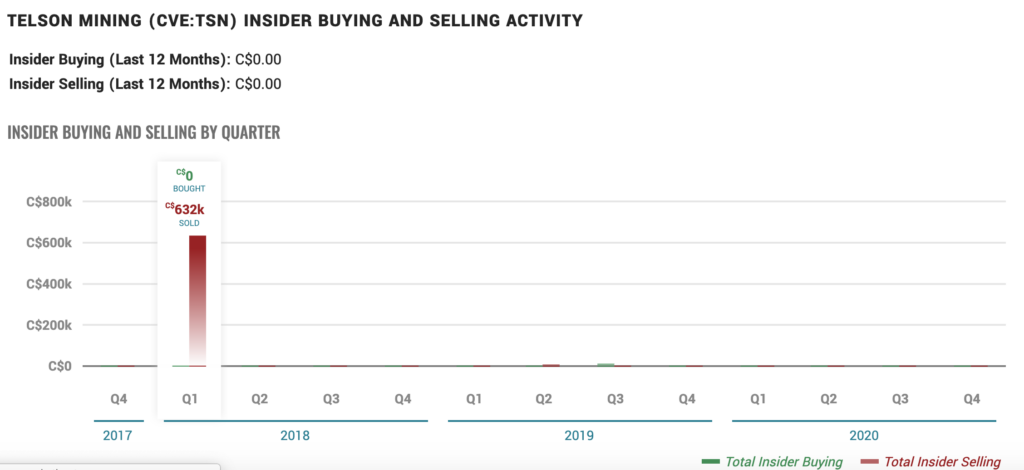

Insiders at Telson Mining have not made any relevant transactions in the company’s stock since 2018, providing investors with no signal.

Telson Mining Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$75.3 million / -$24.1 million = -3.1

A debt to equity ratio of negative 3.1 indicates that Telson Mining has accumulated losses and has significantly more liabilities than shareholder equity. The company faces the possibility of insolvency and investors should carefully analyze the company’s liabilities before investing.

Working Capital Ratio

Current Assets/Current Liabilities

$12.9 million / $ 69.1 million = .19

A working capital ratio of .19 indicates a very weak liquidity position. Telson may have problems meeting its obligations in the near term.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Telson Mining Stock – Summary and Conclusions

Telson Mining presents a difficult decision for potential investors. On the positive side the company recently brought their first mine into production and their second mine is in development. The company has significant mineral resources with the potential to add more via exploration. Furthermore the company appears undervalued based on conservative NPV assumptions for their projects.

The negatives are that the company is in a very poor financial position, which has likely deteriorated further due to the coronavirus crisis. They have very poor liquidity and significant amounts of debt. Their capital structure is dilutive and investors are likely to be further diluted in the future.

Due to the company’s very weak financial position I am not willing to invest at this time, however I will add the company to the top of my watchlist. If their development project continues to advance and I see signs that their financials are improving, I will reconsider. For now I would prefer to allocate to other Mexican development companies, such as Minera Alamos.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.