Preferred Stock: Tekno (TKNO4)

Current Market Price: R$ 38.01

Market Capitalization: R$ 161.2 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Tekno Stock – Summary of the Company

Tekno is a Brazilian manufacturing company that produces and applies coatings for various types of metal products such as steel, tin, and aluminum (“coil coating”). The industries that most often use these pre painted products are civil construction, household appliances, automobiles, industrial refrigeration, electronics, packaging and food. The company’s production is entirely in Brazil and they have over 205,000 square meters of factory space. Tekno was founded in 1939 and is headquartered in Sao Paulo, Brazil.

Revenue and Cost Analysis

Tekno increased its sales significantly from 2018 to 2019. In 2018 the company had R$ 137.1 million in total sales which increased to R$ 149.3 million in 2019. They were also able to increase their gross margin from 13% in 2018 to 20% in 2019. Tekno was profitable in each of the last two years. It increased its net income from R$ 718 thousand in 2018, which represents a profit margin of less than 1% to R$ 9.4 million in 2019, representing a profit margin of 6.2%.

Balance Sheet Analysis

Tekno has a good balance sheet. They have a sound liquidity position with a solid base of long term assets. Liability levels are reasonable and debt is not excessive.

Tekno – Debt Analysis

Tekno has a small amount of debt outstanding. As of year-end 2019 the company has R$ 3.3 million in total debt outstanding, of which R$ 1.3 million is classified as current. In 2019 Tekno paid off all foreign currency denominated debt, so all of its remaining debt is denominated in Brazilian Reals.

Tekno Stock – Share Dynamics and Capital Structure

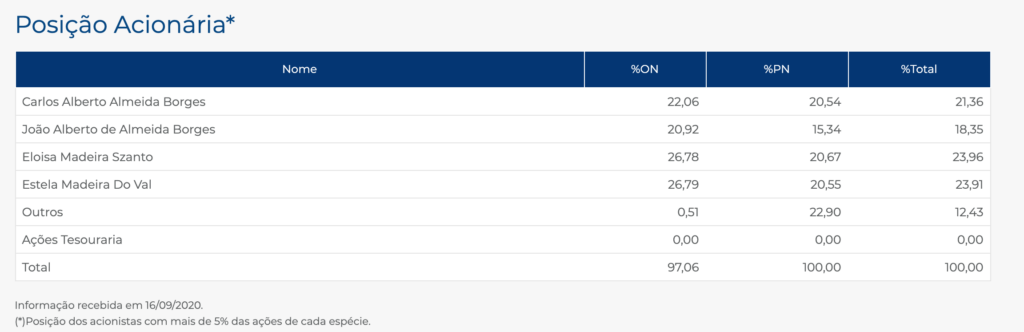

As of year-end 2019 Tekno has 1.6 million common shares outstanding and 1.3 million preferred shares outstanding. Total shares outstanding is around 2.9 million shares. Several individuals own the majority of the company and only around 12% of the company’s shares are owned by smaller investors.

Tekno Stock – Dividends

Based on 2019’s results, Tekno will pay a dividend of R$ .36 cents per share to preferred shareholders. At the current market price this implies a dividend yield of 0.9%.

Tekno Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 84 million / R$ 181.8 million = .46

A debt to equity ratio of .46 indicates that Tekno uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 117.6 million / R$ 37 million = 3.2

A working capital ratio of 3.2 indicates a sound liquidity position. Tekno should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 38.01/ R$ 49.13 = .77

Based on total shares outstanding Tekno has a book value per share of R$ 49.13. At the current market price this implies a price to book ratio of .77, meaning Tekno stock is currently trading at a discount to the book value of the company.

Tekno Stock – Summary and Conclusions

Tekno is a sound business that has been in operation since 1939. They are healthy financially, with growing sales, improving margins, a sound liquidity position, and low debt levels. The shares are tightly held and management pays a small dividend to preferred shareholders.

I don’t know very much about the coil coating business. So for now I am going to add Tekno to my watchlist and compare its 2020 financials to other Brazilian manufacturers such as Metalfrio and WEG. If their 2020 results look good, I will do a deeper dive into the coil coating business and consider an investment in Tekno stock based on its valuation at the time.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.