Common Stock: Tecnoglass (NASDAQ:TGLS)

Current Market Price: $ 7.00 USD

Market Capitalization: $ 322.8 million USD

*All values in this article are expressed in United States Dollars (USD) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Tecnoglass Stock – Summary of the Company

Tecnoglass is a leading vertically-integrated manufacturer, supplier and installer of architectural glass, windows, and associated aluminum products for the global commercial and residential construction industries. They have a 2.7 million square foot manufacturing complex in Colombia. Their main market is the United States, where they are the 2nd largest glass fabricator. The US accounts for around 80% of the company’s revenue. They also sell their products throughout the Caribbean and Latin America. They have over 1,000 customers and employee over 5,500 people. Tecnoglass was founded in 1984 and is headquartered in Barranquilla, Colombia. The company

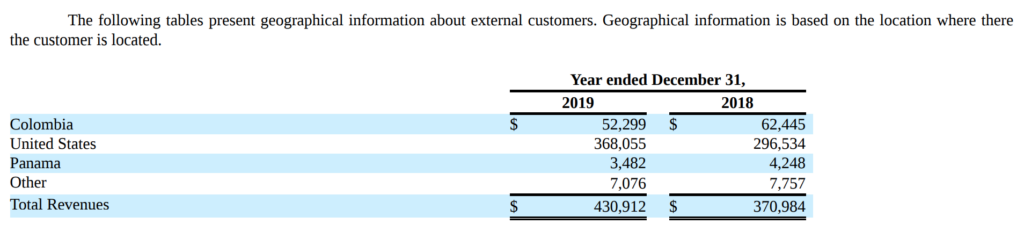

Revenue and Cost Analysis

Tecnoglass had total revenue of $431 million in 2019, a significant increase from $371 million in 2018. Their COGS was $295.1 million in 2019, representing a gross margin of 31.5%, a slight decrease compared to 32.4% the previous year.

The company was profitable in each of the last two years. In 2019 Tecnoglass had net income of $24.3 million, a significant increase compared to $8.5 million in 2018. Their profit margin also improved significantly year over year, going from 2.3% in 2018 to 5.6% in 2019.

Tecnoglass has somewhat concentrated revenues. The company’s 100 largest customers represent 83% of total sales.

Balance Sheet Analysis

Tecnoglass has a decent balance sheet. They have a solid base of long term assets and a sound liquidity position in the near term. However the company is leveraged and has a significant amount of debt outstanding.

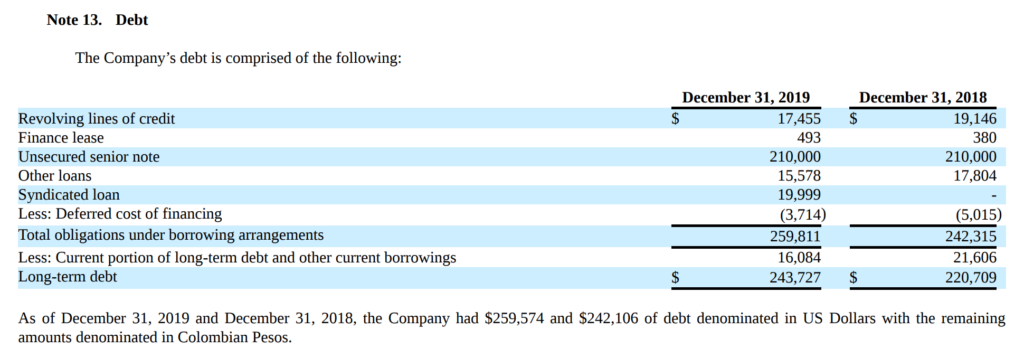

Tecnoglass – Debt Analysis

As of year-end 2019 the company has $ 259.8 million in total debt outstanding, $ 16 million of which is classified as current. Almost all of the company’s debt is denominated in US Dollars.

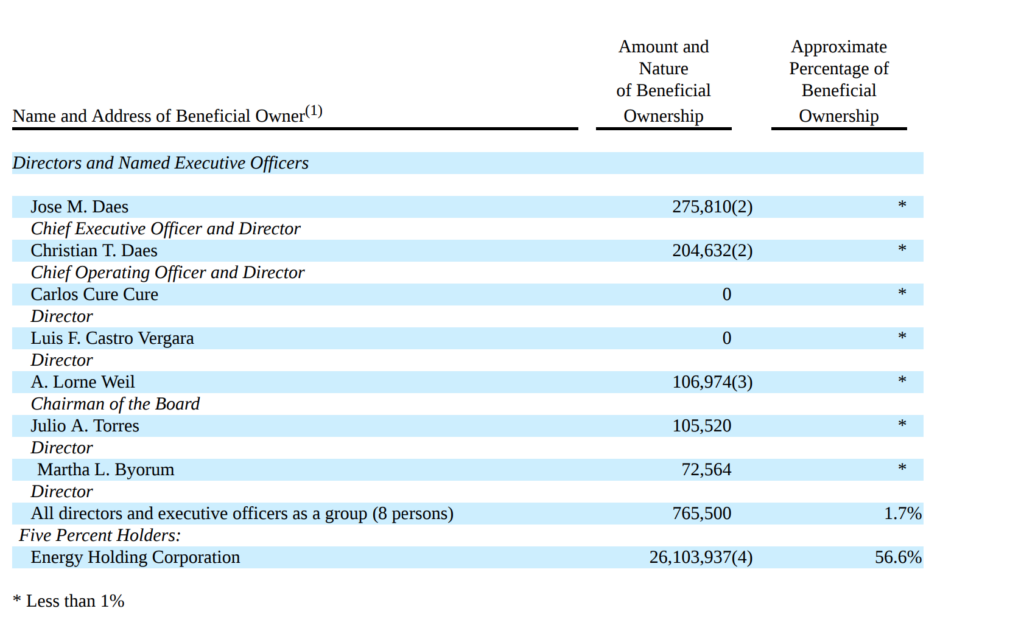

Tecnoglass Stock – Share Dynamics and Capital Structure

As of February 2020 the company has 46.1 million common shares outstanding. The company has 340 holders of record. The majority of the company’s shares, 56.6%, are owned by Energy Holding Corporation. All of the directors combined own 1.7%.

Tecnoglass Stock – Dividends

The company has paid a quarterly dividend since 2016. Based on 2019’s results Tecnoglass paid total annual dividends of $ 0.56 cents per share ($ 0.14 cents quarterly). At the current market price this implies a dividend yield of 8%.

Tecnoglass Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 382 million / $ 187 million = 2

A debt to equity ratio of 2 indicates that Tecnoglass is leveraged and uses a significant amount of debt in its capital structure.

Working Capital Ratio

Current Assets/Current Liabilities

$ 323 million / $ 129 million = 2.5

A working capital ratio of 2.5 indicates a sound liquidity position. Tecnoglass should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 7.00 / $ 4.05 = 1.7

Tecnoglass has a book value per share of $ 4.05. At the current market price this implies a price to book ratio of 1.7, meaning Tecnoglass stock currently trades at a premium to the book value of the company.

Tecnoglass Stock – Summary and Conclusions

Tecnoglass is a solid company. They are a market leader in both the United States and Colombia, with significant growth opportunities in both markets. The company is in a decent position financially, with a strong asset base and sufficient near term liquidity. However the company is leveraged. Debt levels may be a drag on performance moving forward, since the majority of the company’s debt matures in 2022.

I like the company a lot and I think it presents a unique investment opportunity. It has a high dividend and the potential to grow top line revenue significantly in the long term. I will wait to see how the company performed during the 2020 corona virus crisis and also how the company’s debt position has evolved before making my final investment decision.

Investors can compare Tecnoglass stock to other LATAM manufacturers such as the Brazilian company Schulz.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.