Common Stock: Stara (STTR3)

Current Market Price: N/A

Market Capitalization: N/A

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

***Stara shares are currently listed on the Brazilian stock exchange, but 100% of the shares are owned by 3 institutional investors. Therefore Stara stock does not currently have a market price.

Stara Stock – Summary of the Company

Stara is a Brazilian agriculture equipment manufacturer. They sell a wide range of products for example cultivators, spreaders, and sprayers, among others. The company sells their products throughout Brazil and exports to around 35 countries. Stara was founded in 1960 and is headquartered in the state if Rio Grande do Sul, Brazil. They currently employ around 2,500 people.

Revenue and Cost Analysis

Stara had revenue of R$ 1 billion in 2019, a significant increase from R$ 845.3 million in 2018. Their COGS was R$ 673.2 million in 2019, representing a gross margin of 34%, equal to their gross margin in 2018.

The company was profitable in each of the past two years. In 2019 Stara had net income of R$ 127.4 million, representing a profit margin of 12.5%, an increase from 10.5% in 2018.

Balance Sheet Analysis

Stara has a sound balance sheet. They have a solid base of assets, a strong liquidity position, and reasonable liability levels.

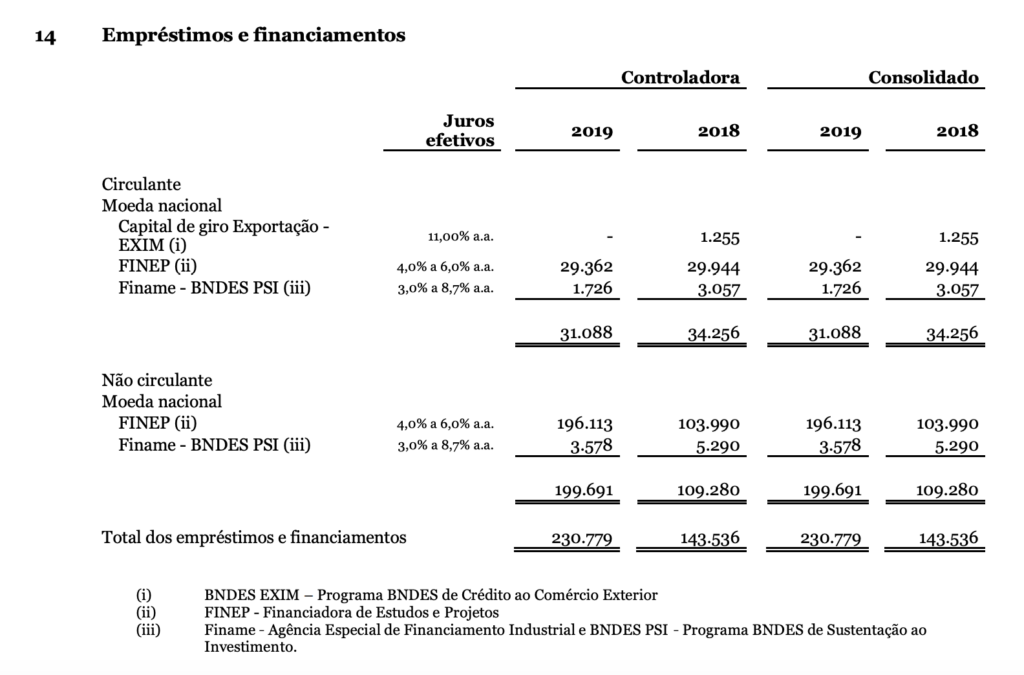

Stara – Debt Analysis

As of year-end 2019 Stara has R$ 230.8 million in total debt outstanding, R$ 31 million of which is classified as current.

Stara Stock – Share Dynamics and Capital Structure

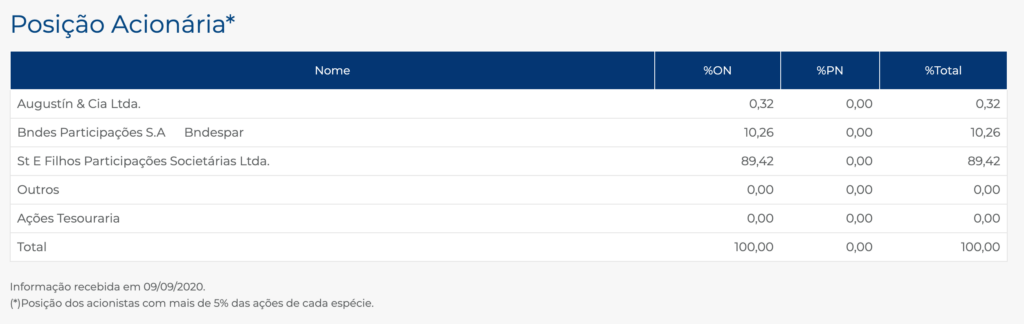

As of year-end 2019 Stara has 297.5 million common shares outstanding. Three institutional investors own 100% of the company and it does not appear any shares are currently available to the public.

Stara Stock – Dividends

Based on 2019’s results Stara paid total dividends of R$ 0.114 cents per share.

Stara Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 378.9 million / R$ 532.4 million = .71

A debt to equity ratio of .71 indicates that Stara uses a mix of debt and equity in its capital structure, but relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 644.7 million / R$ 172 million = 3.8

A working capital ratio of 3.8 indicates a strong liquidity position. Stara should not have a problem meeting its near term obligations.

Brazilian Agriculture Market – Economic Factors and Competitive Landscape

Brazil is an agricultural powerhouse, it ranks 5th in the world in terms of arable land. Agriculture is a large and important industry for the Brazilian economy. Brazil is the world’s largest producer of oranges, sugarcane, and coffee. They also compete globally in the production of soy, meat, and corn. Brazils’ diverse geography allows it to produce a wide variety of crops.

Global agricultural is a highly competitive market subject to large swings in global commodity prices. Brazilian agricultural companies will have to compete fiercely on a global stage for exports. However, given the scale of the industry in Brazil, I believe it is reasonable to assume that there are many well run, investable agriculture companies in Brazil.

Stara Stock – Summary and Conclusions

Stara is a solid company. They are healthy financially and export to over 35 countries. However there are no share currently available to trade, so it is not worth going into too much detail. I will leave Stara stock on my watch list, and revisit the company if their share structure changes. Investors looking for similar exposure can consider Kepler Weber stock.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.