Common Stock: Raia Drogasil (RADL3)

Current Market Price: R$ 24.33

Market Capitalization: R$ 40.1 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Raia Drogasil Stock – Summary of the Company

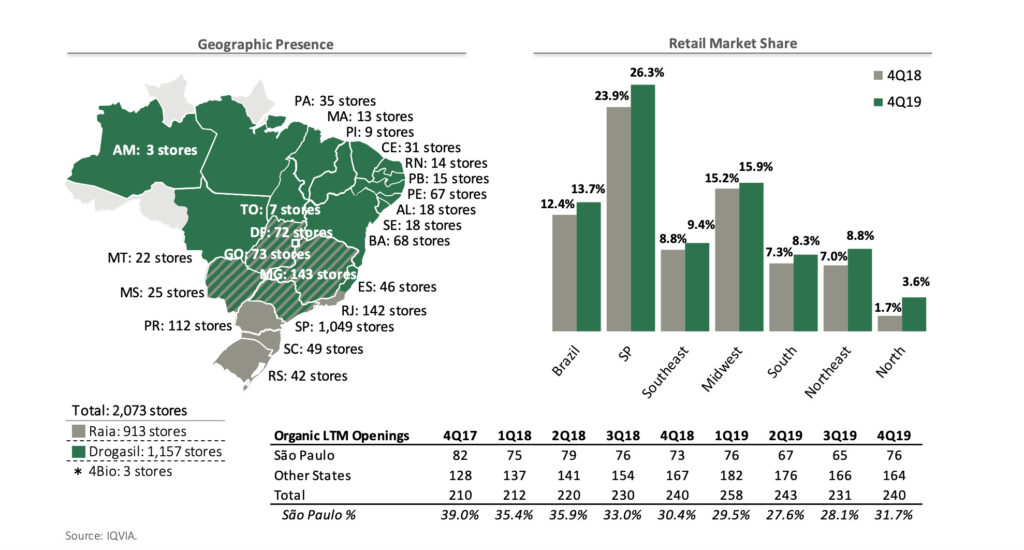

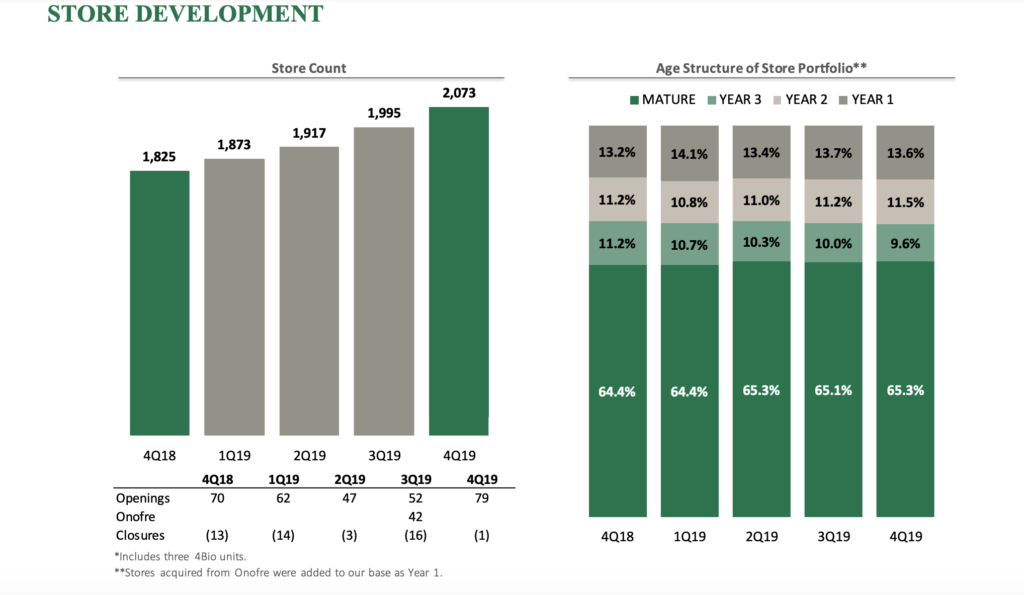

Raia Drogasil is one of the leading drugstore chains in Brazil. The company is present throughout Brazil, in 23 out of 27 states. As of year-end 2019 they have 2,073 total stores in operation, 240 of which were opened in 2019. In addition they have 11 distribution centers in 8 states. The company has 36 million active customers and their e-commerce app has 1.2 million downloads. The company’s history dates back as far as 1905, but Raia Drogasil as it is constituted today was formed by a merger in 2011. Raia Drogasil is headquartered in Sao Paulo Brazil and employs over 41,000 people.

Revenue and Cost Analysis

The company had net revenue of R$17.5 billion in 2019, a significant increase from R$ 14.8 billion in 2018. Their COGS was R$ 12.3 billion in 2019, representing a gross margin of 30%, equal to their gross margin in 2018.

Rai Drogasil was profitable in each of the last two years. In 2019 they had net income of R$ 788.7 million, representing a profit margin of 4.5%, an increase from 3.4% in 2018.

Balance Sheet Analysis

Raia Drogasil has a decent, but leveraged balance sheet. They have a solid base of tangible long term assets and sufficient liquidity in the near term. However they are leveraged, with significant debt and lease obligations.

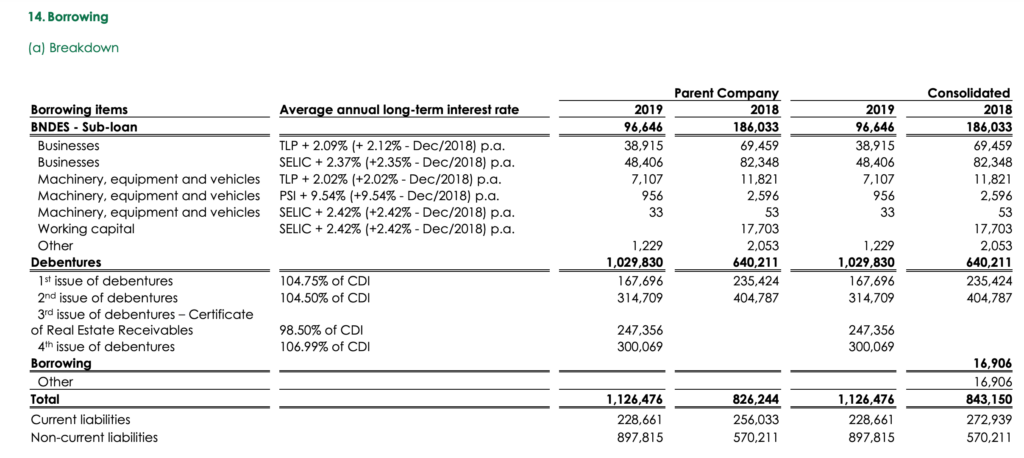

Raia Drogasil – Debt Analysis

As of year-end 2019 Raia Drogasil has R$ 1.1 billion in total debt outstanding, R$ 228.7 million of which is classified as current.

Raia Drogasil Stock – Share Dynamics and Capital Structure

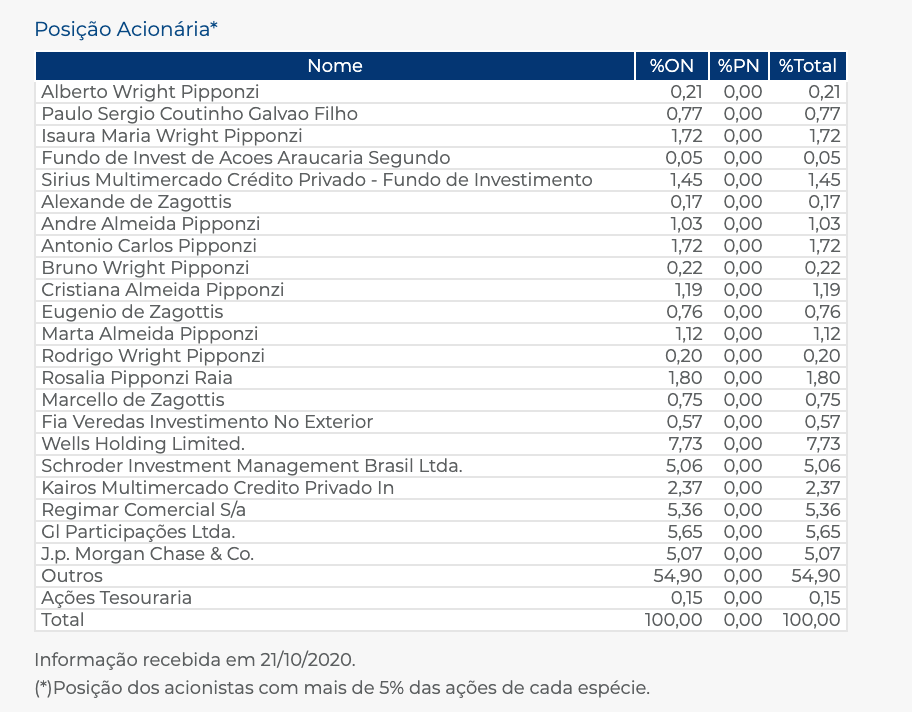

In late 2020 Raia Drogasil underwent a stock split, increasing total common shares outstanding to 1.65 billion shares. Insiders and institutional investors own around 45% of the shares, with the remaining 55% being held by smaller shareholders with a position smaller than 5%.

Raia Drogasil Stock – Dividends

Based on 2019’s results Raia Drogasil paid total dividends of R$ 0.128 cents per share (adjusted for a 5-1 stock split). At the current market price this implies a dividend yield of 0.5%.

Raia Drogasil Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 8.2 billion / R$ 4.1 billion = 2

A debt to equity ratio of 2 indicates that Raia Drogasil is leveraged and relies mostly on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 5.8 billion / R$ 4.1 billion = 1.4

A working capital ratio of 1.4 indicates a sufficient, but not strong liquidity position. Raia Drogasil should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 24.33 / R$ 2.46 = 9.8

Raia Drogasil has a book value per share of R$ 2.46. At the current market price this implies a price to book ratio of 9.8, meaning Raia Drogasil stock currently trades at a significant premium to the book value of the company.

Raia Drogasil Stock – Summary and Conclusions

Raia Drogasil is one of the leading drugstores in Brazil. They are growing at a rapid rate, increasing their stores by over 10% in 2019. They have 36 million active customers and serve 88% of Brazil’s “Class A” economic group. Their e-commerce business is relevant, but still relatively small. Despite their large footprint and scale, the Brazilian drugstore market is still highly fragmented. Raia Drogasil does not have more than a 26% market share in any one region, with most regions being under 10%. This implies significant opportunities for consolidation.

The company is in a decent position financially with sufficient near term liquidity and profits in each of the last two years. However they are leveraged and have significant debt and lease obligations outstanding. They did return capital to shareholders in 2019 via a dividend.

Raia Drogasil is an impressive company. I am interested in the Brazilian drugstore and pharmacy market as a place to possibly invest long term. However at Raia Drogasil’s current valuation I don’t feel the need to rush to make an allocation. I also like Grupo Dimed, and would like to study some of the other drugstore chains before picking my horse for this race. At this point I will wait for Raia Drogasil’s 2020 financials before making any investment decision.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.