Common Stock: McEwen Mining (MUX)

Current Market Price: $.96

Market Capitalization: $386 million

McEwen Mining – Summary of the Company

McEwen Mining in a mining and exploration company focused on the development and operation of mines which produce both precious and base metals. The company owns properties in The United States, Canada, Mexico, and Argentina. MUX was founded in 1979. The company’s headquarters are in Toronto, Canada, however they are incorporated in Colorado. The company currently has around 450 employees.

Revenue and Cost Analysis

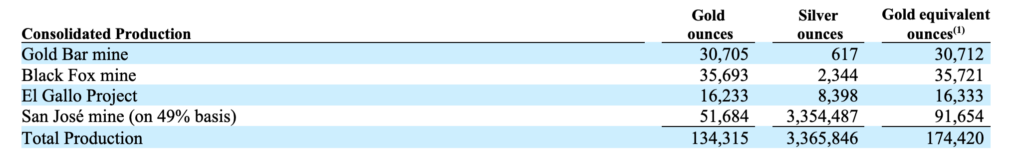

In 2019 McEwen mining produced 134,315 ounces of gold and over 3.3 million ounces of silver. Revenue in 2019 was $117 million, down from $128 million in 2018, but still substantially higher than 2017 sales of $67 million.

The company has consistently run an operating loss. In 2019, the company had an operating loss of $63 million, significantly worse than 2018’s operating loss of $47 million. These losses are mostly due to high exploration expenses which totaled $37 million and $36 million in 2019 and 2018 respectively.

Balance Sheet Analysis

The company has sufficient liquidity for the near term. Current assets were $92 million at year end 2019, including $46 million in cash. Current liabilities were $48.7 million and total liabilities were $131 million at the end of 2019.

However, this liquidity came at a cost to common stock holders. In addition to issuing new debt in 2018, MUX raised a total $75 million through two public offerings in 2019. The offerings included a common share with a warrant attached.

The company had total assets of $631 million at the end of 2019.

MUX Stock – Debt Analysis

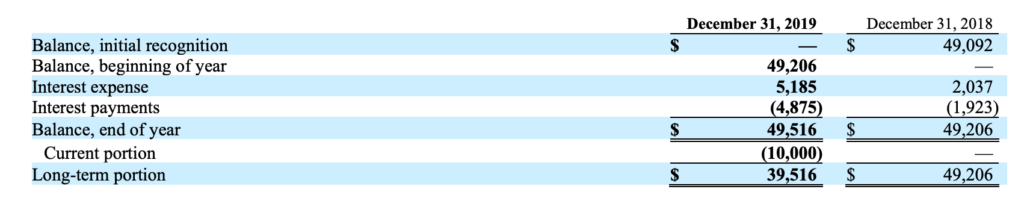

In 2018, the company issued $50 million in new debt at a 9.75% annual interest rate. Interest and principal payments begin in August of 2020.

This debt has restrictive covenants that will have a significant impact on common stock investors. The covenants impact the company’s ability to:

- Borrow additional funds;

- Pay dividends or distributions on capital stock;

- Repurchase, redeem, or retire capital stock;

- Make certain loans and investments;

- Sell assets;

- Enter into certain transactions with affiliates;

- Create or assume certain liens on assets;

- Make certain acquisitions;

- Engage in certain other corporate activities.

MUX Stock – Share Dynamics and Capital Structure

At year end 2019 MUX had 361 million common shares outstanding. MUX has significant dilutive instruments outstanding such as warrants and stock based compensation. In 2019 alone McEwen Mining issued over 29 million new warrants. Fully diluted shares outstanding is over 394 million.

MUX has a dilutive capital structure and existing common stock holders are highly likely to be further diluted in the future. Investors should carefully consider their place in the capital structure before investing in MUX stock.

MUX Stock – Dividends

MUX stock paid a very small dividend of less than 1 cent per share in 2019. Debt covenants may restrict MUX from paying future dividends.

Management – Skin in the game

There has not been any relevant insider buying or selling recently. It is worth noting that a significant portion of the shares, around 23%, are owned by company insiders. Most of these shares are owned by the company’s founder Rob McEwen.

MUX Stock – 3 Metrics to Consider

Price to Book Ratio

Current price of common stock/ Book value per share

$.96/$1.27=.75

Based on my estimate of fully diluted shares outstanding, MUX has a book value per share of $1.27. At current the market price this implies a price to book ratio of .75. A price to book ratio of .75 means MUX stock is trading at a significant discount to the book value of its assets.

Debt to Equity Ratio

Total Liabilities/Total Shareholder Equity

$131 million/$499 million = .26

A debt to equity ratio of .26 means the company has low liability levels relative to its equity capital. This means McEwen mining is financed mostly from equity and is not overly reliant on debt financing.

Working Capital Ratio

Current Assets/Current Liabilities

$92 million/$48.7 million = 1.88

A working capital ratio of 1.88 means the company has sufficient short term liquidity.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

MUX Stock – Summary and Conclusions

McEwen mining is in an interesting position. The company has a strong asset portfolio, including some producing mines. They have a history of successful operations and delivering returns to shareholders. But the company is currently running an operating loss, and has had to impair its balance sheet to continue to finance the operations.

In order to fully realize the value of their assets, meaning bringing exploration stage projects into production, the company will certainty need to raise more capital, further impairing its balance sheet, at the expense of existing common stock holders.

However, if MUX can continue to raise capital and a few of these exploration stage projects turn out to be winners, investors could potentially reap adequate returns, despite further dilution. Given that MUX stock currently trades at a significant discount to the book value of its assets, MUX may merit a very small allocation within a well-diversified portfolio of gold stocks, for highly risk tolerant investors.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.