Common Stock: Klabin (KLBN3)

Current Market Price: R$ 4.74

Market Capitalization: R$ 25.5 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Klabin Stock – Summary of the Company

Klabin is Brazil’s largest producer and exporter of packaging paper. Their operations are fully integrated and they operate the following business units; Forestry, which owns 557,000 hectares of land, of which 299,000 are planted with pine and eucalyptus, the remainder being native forest; Pulp, Paper, and Packaging. They have 25 production facilities, 24 in Brazil and 1 in Argentina. The company employees around 23,000 people. Klabin was founded in 1889 and is headquartered in Sao Paulo Brazil.

Revenue and Cost Analysis

Klabin had revenue of R$ 10.3 billion in 2019, an increase from R$ 10 billion in 2018. Their COGS was R$ 7.2 billion in 2019, representing a gross margin of 33% (after an adjustment for the value of biological assets), this was a significant decrease from their gross margin of 43% in 2018.

The company was profitable in each of the last 2 years. In 2019 Klabin had net income of R$ 714.6 million, representing a profit margin of 7%, a significant increase from 1.9% in 2018.

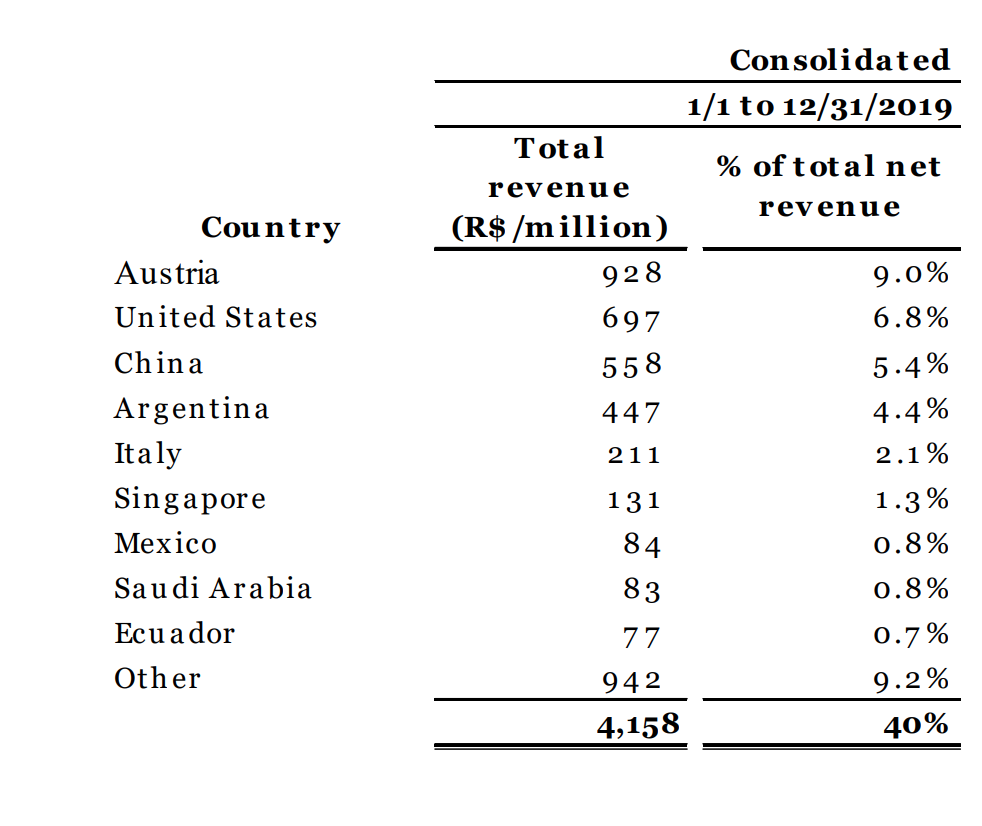

Around 60% of the company’s net revenue is derived domestically, with the remaining 40% coming from exports.

Balance Sheet Analysis

Klabin has a decent, but leveraged balance sheet. They have a strong liquidity position in the short to medium term, as their debt does not begin to mature until 20204. They also have a solid base of assets. However in the long term their high levels of debt are concerning.

In 2019 the company announced its largest ever investment and expansion program valued at R$ 9.1 billion. The investments will be uses to build 2 new paper machines. It will take 24 months for the investments to be fully allocated.

It is worth noting that Klabin has a derivative book comprised of swaps it uses to hedge its foreign currency exposure. Investors should analyze these derivatives in detail before investing.

Klabin – Debt Analysis

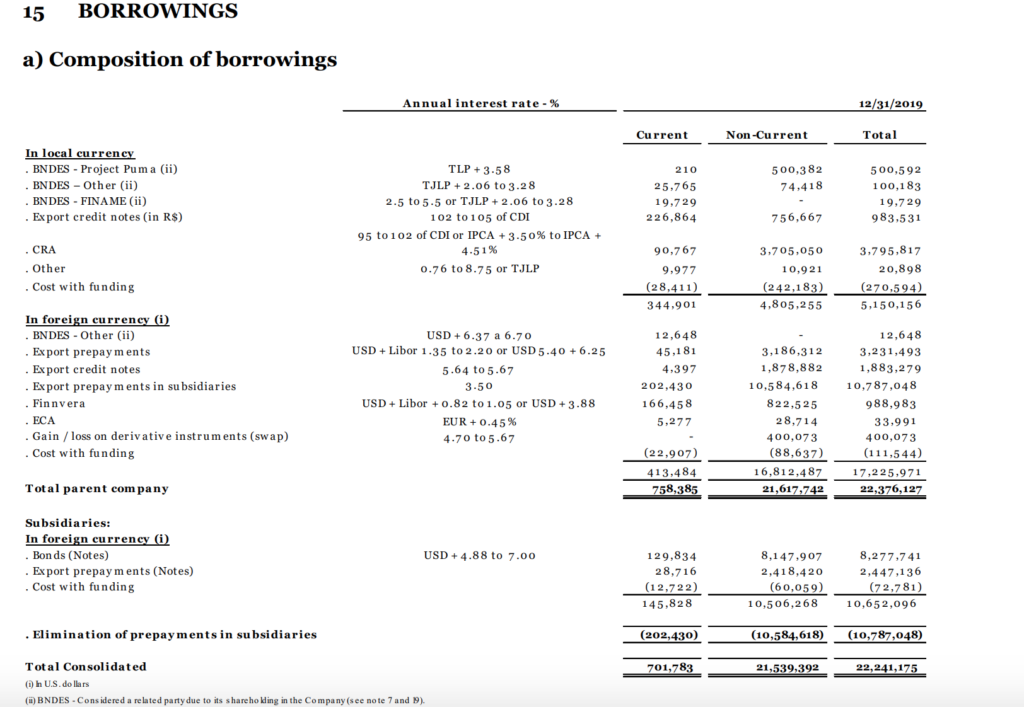

The company has 4 active bonds/notes, maturing in 2024, 2027, 2029, and 2049. As of year-end 2019 Klabin had total debt outstanding of R$ 22.2 billion, R$ 701.7 million of which is classified as current. The majority of these borrowings are denominated in foreign currency, mainly the US dollar, exposing the company to the negative effects of a depreciating Brazilian Real.

Klabin Stock – Share Dynamics and Capital Structure

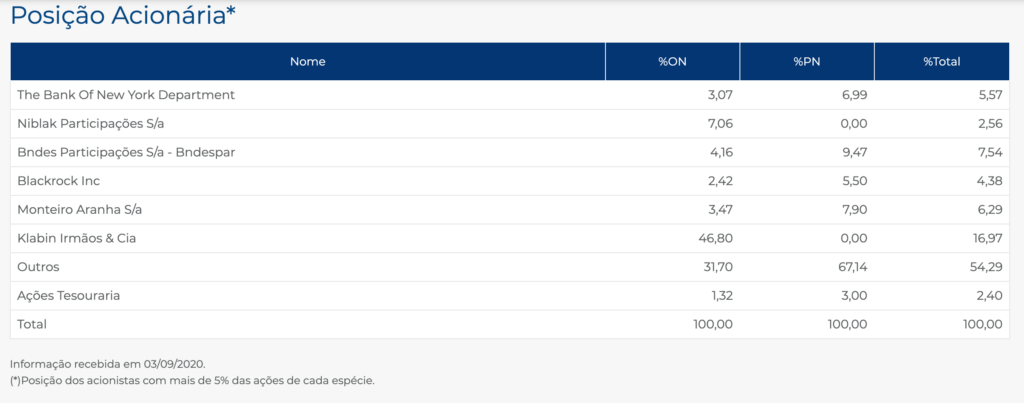

As of year-end 2019 Klabin has 2 billion common shares outstanding and 3.4 billion preferred shares outstanding. Total shares outstanding is around 5.4 billion shares. Insiders, institutional investors, and the company’s treasury own around 46% of the shares, with the remaining 54% being held by smaller investors with an ownership stake of less than 5%.

Klabin Stock – Dividends

The company did not pay a dividend to common shareholders based on 2019’s results.

Klabin Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 28.2 billion / R$ 6.5 billion = 4.3

A debt to equity ratio of 4.3 indicates that Klabin has a leveraged balance sheet and relies heavily on debt financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 13.7 billion / R$ 3.1 billion = 4.4

A working capital ratio of 4.4 indicates a strong liquidity position. Klabin should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 4.74 / R$ 1.20 = 3.9

Based on total shares outstanding Klabin has a book value per share of R$ 1.20. At the current market price this implies a price to book ratio of 3.9, meaning Klabin stock currently trades at a premium to the book value of the company.

Klabin Stock – Summary and Conclusions

Klabin is a solid company with over 120 years of history. They are fully integrated and derive a significant portion of their revenue from exports. Their current financial position is healthy, given their strong liquidity position and low current liability levels. Klabin is profitable and is investing heavily in its future growth.

However the company is leveraged due to their high levels of long term debt. If the company cannot continue to extend this debt, then they may face significant financial difficulties starting in 2024. Given this significant debt and the preferred shares that supersede common shares in the capital structure, I am not willing to invest in Klabin stock. I am very interested in the company’s business, so I will keep them on my watchlist and reconsider investing should their debt position improve. Investors can compare to Klabin stock to other Brazilian equities with a forestry business, such as Battistella.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

2 Comments

Comments are closed.