Common Stock: K92 Mining (TSXV: KNT, OTC: KNTNF)

Current Market Price: $2.65

Market Capitalization: $536.5 million

K92 Mining Stock – Summary of the Company

K92 mining is a gold mining company focused on the exploration, development, and operation of mining properties in Papua New Guinea. Their keystone project in the country is the Kainantu property. K92 was founded in 2010 and is headquartered in Vancouver, Canada.

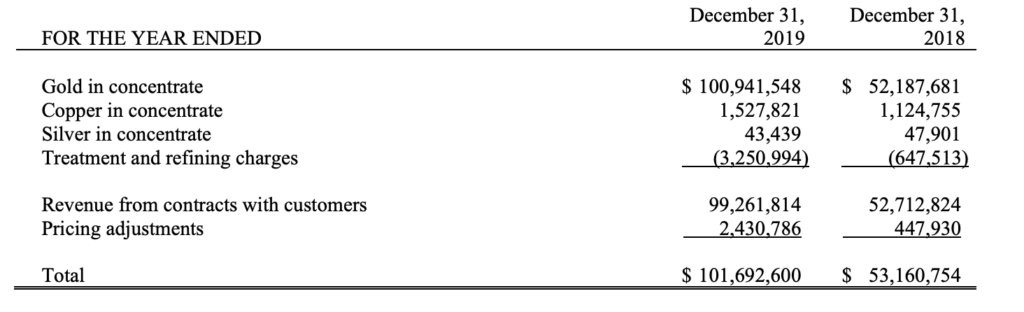

Revenue and Cost Analysis

K92 mining produced 79,838 ounces of gold in 2019, a huge increase over the 45,810 ounces it produced in 2018. Revenue also saw significant growth, totaling $101.7 million in 2019 compared to $53.2 million in 2018

All in sustaining cost were $680 per ounce. K92 had net income of $32 million in 2019. This is down from $38 million net income in 2018. This decrease is due in part to a significant increase in exploration expenditures in 2019, which totaled $8 million.

Almost all of the company’s revenue comes from the sale of gold concentrate, they also have small, non-relevant, sales of copper and silver.

K92 Mining – Royalty and Streaming Agreements

The company pays a 2% net smelter royalty and .5% of gross mine revenues to the Papua New Guinea government.

Balance Sheet Analysis

K92 has a strong balance sheet. At the end of 2019, current assets totaled $47.2 million, including $21.6 million in cash. Current liabilities totaled $22.1 million and total liabilities were $30.3 million. The company’s liabilities are primarily accounts payable and debt.

The company had total balance sheet assets of $155 million, including $78 million in property, plant, and equipment and a $29.3 million deferred income tax asset.

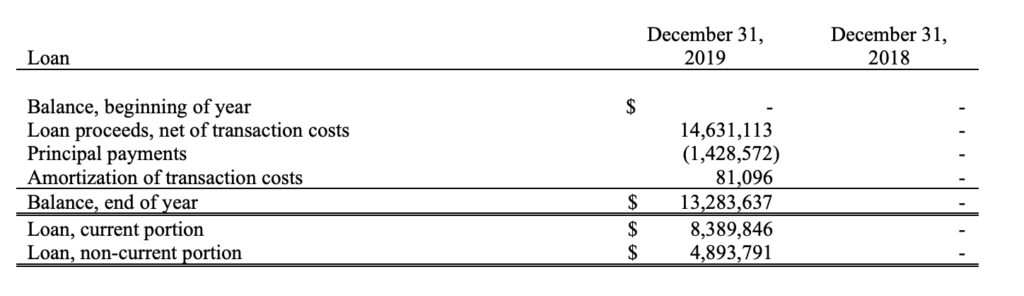

K92 Mining – Debt Analysis

In July 2019, the company took out a 2 year, $15 million-dollar loan. The loan carry’s an interest rate of 10% plus 3 month LIBOR.

If the loan is not repaid it becomes convertible into common shares at a price of $1.37 per share.

K92 Mining Stock – Dividends

The company does not pay a dividend and plans to retain future earnings.

K92 Mining Stock – Share Dynamics and Capital Structure

At year end 2019, the company had 213 million common shares outstanding. They also have 16 million options outstanding, therefore fully diluted shares outstanding is 229 million.

K92 mining has a dilutive capital structure. In addition to the options outstanding, their debt is also convertible. Management has proven willing to dilute common shareholders in the past, for example a significant amount of warrants were exercised in 2019. Investors should carefully consider their place in the capital structure before investing.

Management – Skin in the game

Insider ownership of K92 stock is relatively low, less than 2%. Over the last 12-18 months’ insiders at the company have been net sellers of the stock, and one director divested 100% of his position.

Insider selling and low insider ownership is generally viewed as a bearish signal for the stock.

K92 Mining Stock – 3 Metrics to Consider

Working Capital Ratio

Current Assets/Current Liabilities

$47 million/$22.1 million = 2.2

A working capital ratio of 2.2 indicates the company has sufficient liquidity in the short term and is likely to be able to meet its short-term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$2.65/$.54 = 4.9

Based on my estimate of fully diluted shares outstanding, K92 has a book value per share of $.54. At the current market price, this implies a price to book ratio of 4.9. A price to book ratio of 4.9 means the company trades at a significant premium to the book value of its assets.

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$30.3 million/ $124.7 million = .24

A debt to equity ratio of .24 means the company is financed primarily through equity. They do have some debt in the capital structure, but are not overly reliant on debt to finance themselves.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

K92 Mining Stock – Summary and Conclusions

K92 mining is a single property stock in a risky jurisdiction. In 2019, the Papua New Guinea doubled the mining royalty paid on gross mine revenue. The mine is profitable, with a low production cost and the company has a strong balance sheet with significant liquidity.

However, the capital structure is dilutive and KNT stock currently trades at a significant premium to the book value of its assets. Given the capital structure and jurisdictional risk, I don’t believe K92 stock can be purchased with a significant margin of safety and I won’t be investing at current valuations.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.