Common Stock: Industrias Romi (ROMI3)

Current Market Price: R$ 13.19

Market Capitalization: R$ 967.2 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Industrias Romi Stock – Summary of the Company

Industrias Romi is a Brazilian manufacturing company that produces and sells products including machine tools, plastic injection molding machines, industrial equipment and accessories, tools, castings and parts, as well as providing system analysis and developing data processing software related to the production, sale, and use of machine tools and plastic injectors; the manufacture and sale of rough cast parts and machined cast parts. Romi was founded in 1930 and is headquartered in Sao Paulo, Brazil.

Revenue and Cost Analysis

Romi had revenue of R$ 765.5 million in 2019, an increase from R$ 743.4 million in 2018. Their COGS was R$ 556.8 million in 2019, representing a gross margin of 27%, approximately equal to their gross margin in both 2018 and 2017. Around 40% of their 2019 revenue was from international markets.

The company has been profitable in each of the past three years. Romi had net income of R$ 129.9 million in 2019, representing a profit margin of 17%. This is a significant improvement over the company’s profit margin of 11% and 6% in 2018 and 2017 respectively.

Balance Sheet Analysis

Romi has a sound balance sheet. They have sufficient liquidity and a solid base of long term assets. Liability levels are reasonable, although the current portion of their debt is relatively high.

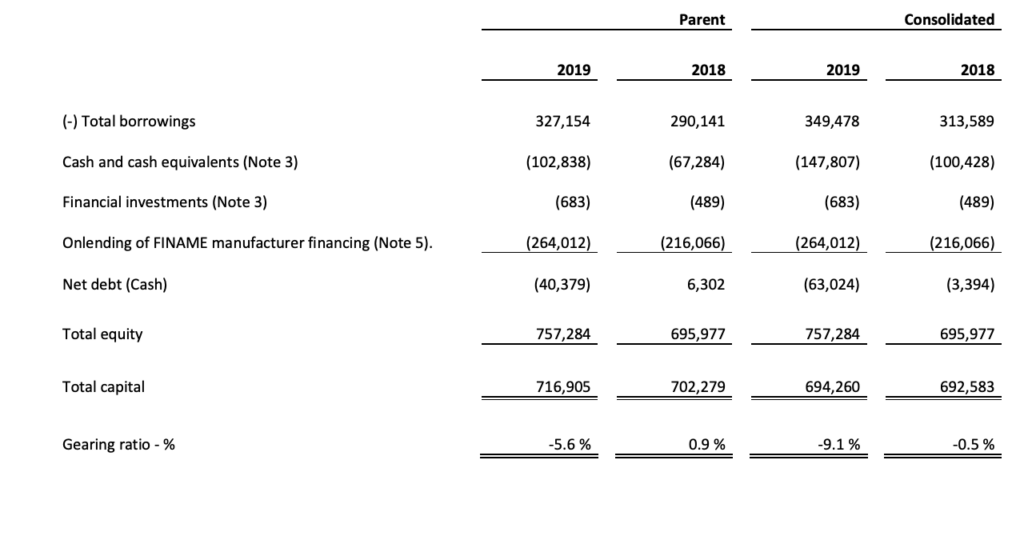

Industrias Romi – Debt Analysis

As of year-end 2019 Romi has total borrowings of R$ 349.4 million, R$ 173.8 million of which is classified as current.

Industrias Romi Stock – Share Dynamics and Capital Structure

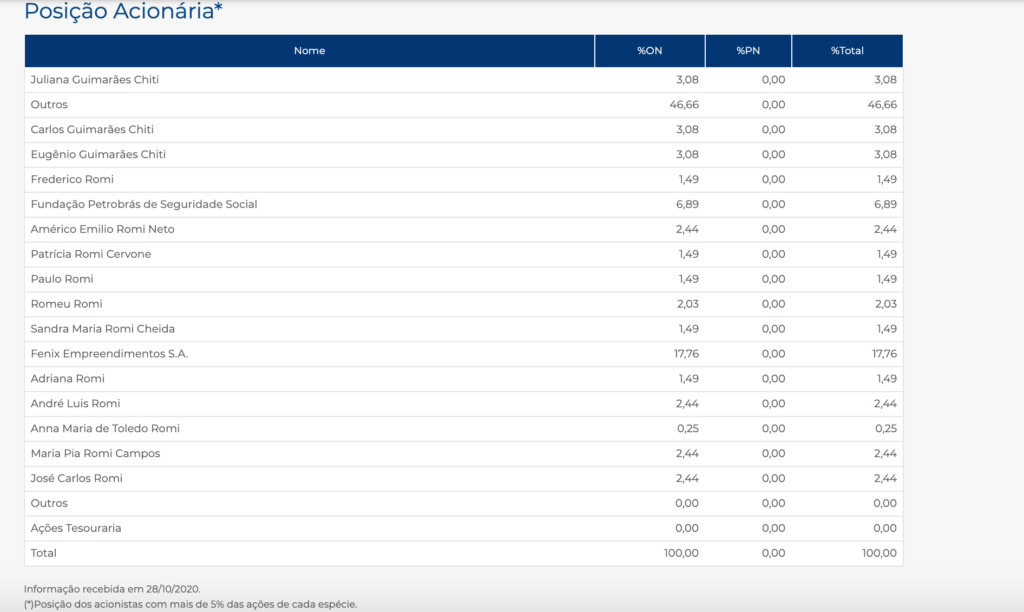

As of October 2020 Romi has 73.3 million common shares outstanding. Insiders and several institutional investors own around 53% of the company’s shares, with the remaining 47% being held by smaller shareholders with an ownership position of less than 5%.

Industrias Romi Stock – Dividends

Based on 2019’s results, the company has paid out R$ 0.25 cents per share thus far and has approved additional payments to shareholders totaling R$ 1.40 per share.

Industrias Romi Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 608.3 million / R$ 758.8 million = .8

A debt to equity ratio of .8 indicates that Romi uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 760.1 million / R$ 395.4 million = 1.9

A working capital ratio of 1.9 indicates a sufficient but not strong liquidity position. Romi should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 13.19 / R$ 10.35 = 1.2

Based on total shares outstanding Industrias Romi has a book value per share of R$ 10.35. At the current market price this implies a price to book ratio of 1.2, meaning the company’s stock currently trades at a slight premium to the book value of the company.

Industrias Romi Stock – Summary and Conclusions

Industrias Romi is a solid company. For the past three years they have been able to improve top line sales and profit margins at the same time. Their revenue is diversified, with around 40% coming from outside Brazil. Their balance sheet is sound, with sufficient liquidity and reasonable liability levels, although they do have a relevant amount of debt.

From a purely financial perspective, Industrias Romi stock appears to be investable. It trades at a reasonable valuation relative to its book value and has returned capital to shareholders. However I am not well enough informed about their products and market, particularly their technology products. For that reason I am not willing to invest in Industrias Romi stock, yet. I will research their business further and if their 2020 financials show continued growth and an improving financial position, I will seriously consider investing. I will be comparing Romi to other Brazilian companies on my watch list, such as Metalfrio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.