Common Stock: Hering (HGTX3)

Current Market Price: R$ 17.97

Market Capitalization: R$ 2.9 billion

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Hering Stock – Summary of the Company

Hering is a Brazilian clothing manufacturer and retailer. They operate through 4 distinct brands and use a hybrid production model where they manufacturer on average 80% of the items they sell, with the remaining 20% coming from hired 3rd party manufacturers and outsourced purchases. This model allows them the speed and flexibility needed to meet the demands of their market. They sell their products through wholly owned stores, franchised stores, multi brand resellers, and e-commerce.

The company has 3 manufacturing and distribution centers in Brazil and a total of 741 stores, 721 of which are in Brazil, they employ around 5,300 people. Hering was founded in 1880 and is headquartered in Blumenau in the state of Santa Catarina Brazil.

Revenue and Cost Analysis

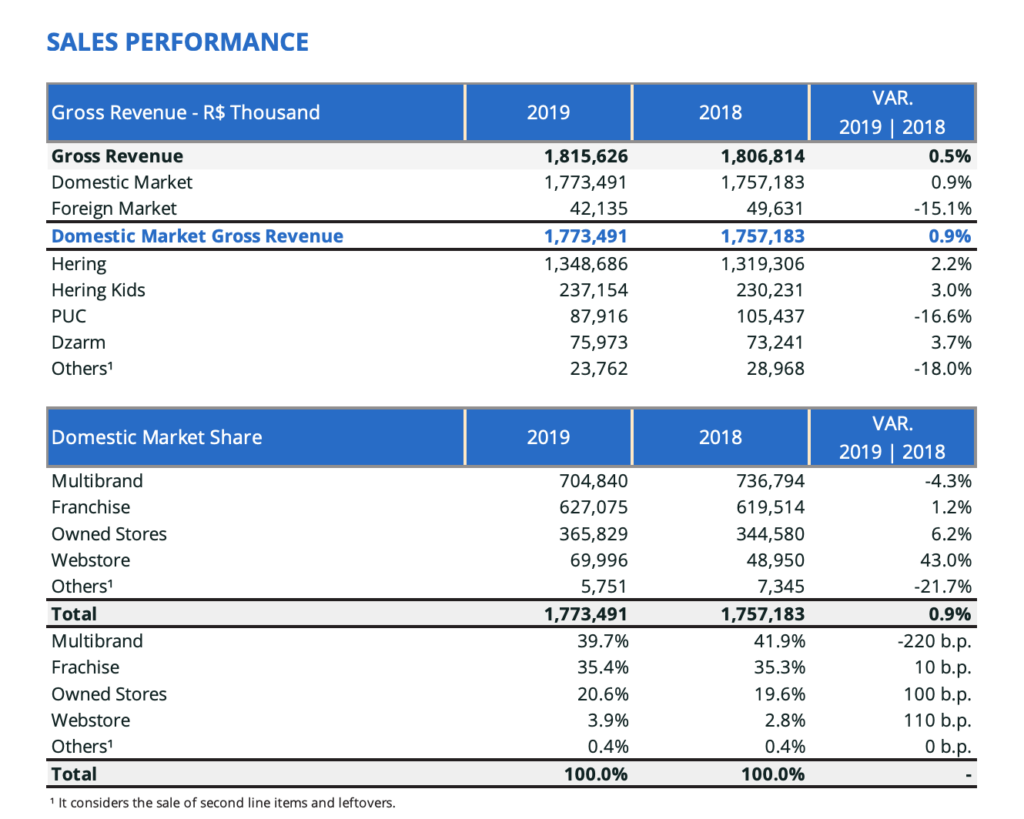

Hering had net revenue of R$ 1.5 billion in 2019, equal to their net revenue in both 2018 and 2017. Their COGS was R$ 870.5 million in 2019, representing a gross margin of 43.8%, on par with their gross margin 42.6% and 44% in 2018 and 2017 respectively.

The company was profitable in each of the last 3 years. Hering had net income of R$ 214.7 million in 2019, representing a profit margin of 13.8%, a decrease compared to 15.5% and 16.8% in 2018 and 2017 respectively.

Balance Sheet Analysis

Hering has a strong balance sheet. They have a strong liquidity position, a solid base of assets, and low liability levels. The company made significant investments in 2019, remodeling 101 of its stores.

It is worth noting that Hering has a defined benefit pension obligation, which appears to be reasonably well funded, but should be analyzed in detail before investing.

Hering – Debt Analysis

As of year-end 2019 Hering has R$ 65.4 million in total debt outstanding, R$ 26.8 million of which is classified as current.

Hering Stock – Share Dynamics and Capital Structure

As of year-end 2019 Hering has 162.5 million common shares outstanding. Insiders, institutional investors, and the company’s treasury own around 38% of the shares, with the remaining 62% being held by smaller shareholders with an ownership position of less than 5%.

Hering Stock – Dividends

Hering paid total dividends of R$ 0.81 cents per share in 2019. At the current market price this implies a dividend yield of 4.5%.

Hering Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 385.4 million / R$ 1.4 billion = .27

A debt to equity ratio of .27 indicates that Hering uses a mix of debt and equity in its capital structure, but is not highly leveraged and relies mostly on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

R$1.2 billion / R$ 325.2 million = 3.7

A working capital ratio of 3.7 indicates a strong liquidity position. Hering should not have problems meeting its short term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 17.97 / R$ 8.78 = 2.05

Hering has a book value per share of R$ 8.78. At the current market price this implies a price to book ratio of 2.05, meaning Hering stock currently trades at a premium to the book value of the company.

Hering Stock – Summary and Conclusions

Hering is an impressive company. I am always amazed by companies with an operating history as long as Hering’s. They have a presence throughout brazil and continue to invest in new sales channels and modernizing their stores. Their E-commerce sales are still small, but growing. The company is in a sound position financially, with strong liquidity and very reasonable liability levels. Hering was profitable in each of the last 3 years, and management returns capital to shareholders via a dividend.

I like the company and it appears to be trading at a reasonable valuation. It is conservatively run and appears to be a sound long term Brazilian retail play, despite their stagnate top line sales. Since 2020 is almost over, I will wait to see Hering’s full 2020 financials and how they performed during the coronavirus crisis. I will compare Hering stock to other Brazilian apparel retailers such as Alpargatas.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.