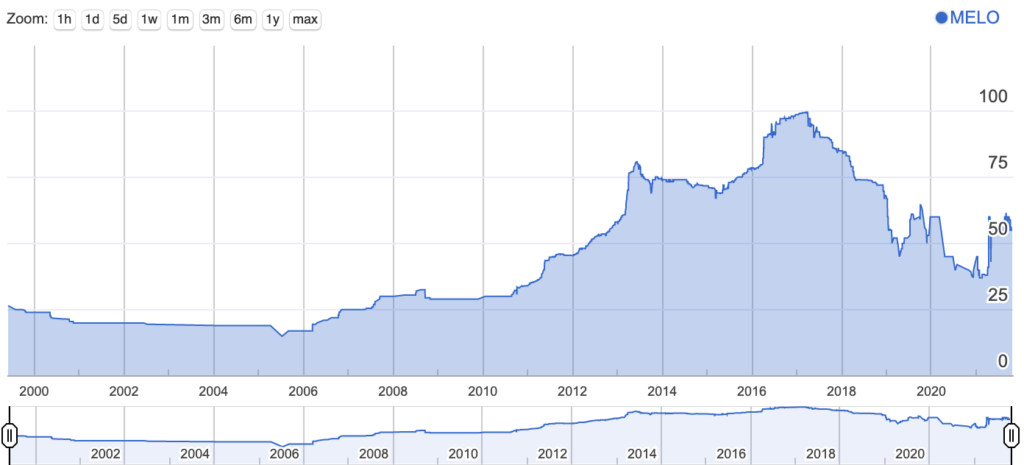

Common Stock: Grupo Melo

Current Market Price: $55

Market Capitalization: $130.1 Million

*All values in this article are expressed in Panamanian Balboas (PAB) unless otherwise noted. The Panamanian Balboa is pegged 1-1 with The United States Dollar (USD).

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Grupo Melo Stock- Summary of the Company

Grupo Melo is a Panamanian conglomerate with two distinct operating divisions; The Food Group and The Commercial Group. The Foods Group gathers all integrated poultry activities and facilities that provide the national market with fresh poultry and eggs, as well as a variety of value-added poultry products. The Commercial Group operates a chain of agricultural supply stores, two chains of pet and garden stores, two construction material chains, a fast-food restaurant chain, a chain of machinery and vehicle dealerships, and develops real estate projects.

The Food Group accounts for 40% of the company’s revenues, with the remaining 60% coming from the various businesses within the commercial group.

Grupo Melo was founded in 1978 and is headquartered in Panama City, Panama. They currently employ over 5,000 people.

Revenue and Cost Analysis

The company had total revenue of $365 million in 2020, a significant decrease compared to $431 million in 2019. This is not unexpected, as some of the groups businesses, for example restaurants, were hard hit by the Coronavirus lockdowns.

Despite the drop in revenue the company was able to maintain its gross margin at 46% and stay profitable. Grupo Melo had net income of $10.3 million in 2020, representing a profit margin of 2.8%, equal to their profit margin in 2019.

Balance Sheet Analysis

Grupo Melo has a solid balance sheet. They have a good base of long term assets and a strong near term liquidity position. Liability levels are reasonable and the company is not leveraged, however they do have a relevant amount of debt outstanding.

Debt Analysis

As of year-end 2020 the company has $123 million in total debt outstanding, $107 million of which is classified as long term.

Grupo Melo Stock- Share Dynamics and Capital Structure

As of year-end 2020 the company has 2.4 million common shares outstanding.

Dividends

Grupo paid total dividends of $1.36 in 2020. At the current market price this implies a dividend yield of 2.5%.

Grupo Melo Stock- 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$179.7 million / $194.4 million = .92

A debt to equity ratio of .92 indicates that Grupo Melo is not leveraged and uses nearly equal parts debt and equity in its capital structure.

Working Capital Ratio

Current Assets/Current Liabilities

$178.6 million / $72.4 million = 2.5

A working capital ratio of 2.5 indicates a strong liquidity position. Grupo Melo should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$55 /$82 = .67

Grupo Melo has a book value per share of $82. At the current market price this implies a price to book ratio of .67, meaning the company’s stock currently trades at a significant discount to the book value of the company.

Grupo Melo Stock- Summary and Conclusions

Grupo Melo stock is an interesting investment vehicle to gain exposure to the Panamanian market. The company is extremely well diversified in its business lines and in good financial health. They weathered the COVID storm well in 2020 and should continue to grow in line with Panama’s overall economy moving forward. Management has a solid track record and returns capital to shareholders via a dividend.

I am intrigued by Grupo Melo and will revisit the company in more detail after I have analyzed more Panama companies. Investors can also consider other Central American stocks such as the Costa Rican company Florida Ice and Farm Company.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.