Common Stock: GPC Participações (GPCP3)

Current Market Price: R$ 19.85

Market Capitalization: R$ 622 million

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

GPC Participações Stock – Summary of the Company

GPC Participações operates as a holding company, which engages in the distribution of chemical products and steel pipes throughout Brazil. It operates through the following segments: Chemical, Steel Tubes, and Others. The Chemical segment deals with resins for wood panels. The Steel Tubes segment produces various types of tubes such as carbon steel, conductors, structural, industrial, galvanized, and others. The holding company was founded in 1997 but some of the company’s operations date back as far as 1929. GPC Participações is headquartered in Rio de Janeiro, Brazil

Revenue and Cost Analysis

GPC has significantly increased sales over the past several years. Total revenue in 2019 was R$ 797.7 million, a large increase compared to R$ 483.8 million in 2017 and R$ 735 million in 2018. The company had COGS of R$ 651.5 million in 2019, representing a gross margin of 18%. The company has also steadily improved its gross margins, which have increased from 15% in 2017.

The company was profitable in each of the last three years. In 2019 GPC had net income of R$ 22 million, representing a profit margin of around 3%.

Balance Sheet Analysis

GPC has a decent, but not strong balance sheet. Liquidity is sufficient in the short term and the company has a solid base of long term assets. However liability levels are high, including debt, which makes the company’s leverage fairly high.

GPC Participações – Debt Analysis

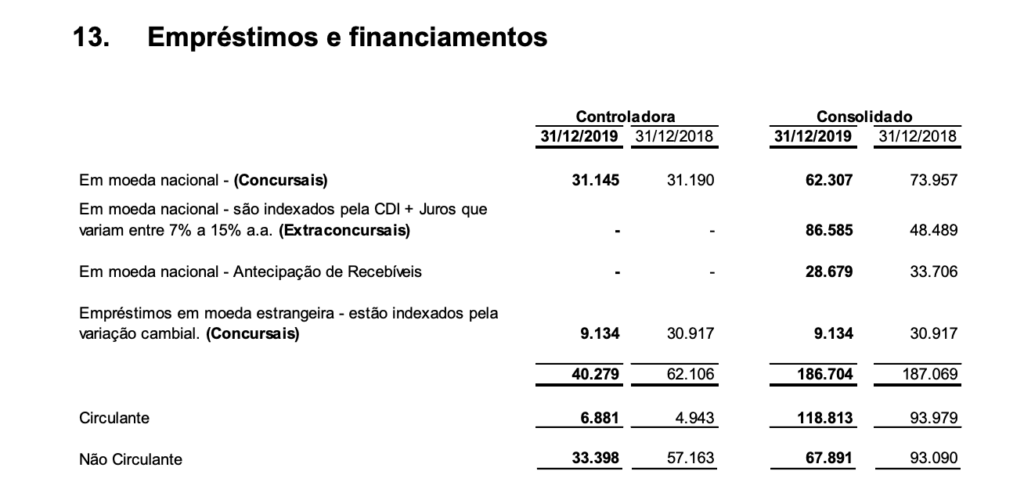

As of year-end 2019 the company has R$ 186.7 million in total debt outstanding, of which R$ 118.8 million is classified as current. The company’s debt levels have increased significantly over the past several years.

Furthermore the company has R$ 9.2 million in debt denominated in US Dollars, meaning the depreciating Brazilian Real will cause a drag on 2020 earnings.

GPC Participações Stock – Share Dynamics and Capital Structure

In August 2020 the company split its stock 5 for 1. The company currently has 29.4 million common shares outstanding and 1.9 million preferred shares outstanding. Total shares outstanding is around 31.3 million shares.

Around 47% of the company’s shares are owned by small shareholders with less than a 5% stake. The remaining 53% is held by over thirty descendants of the Peixoto de Castro family that founded the original company in 1929.

GPC Participações Stock – Dividends

In 2019 the company paid a dividend of R$ .30 per common share and R$ 1.5 per preferred share.

GPC Participações Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 613.5 million / R$ 200.7 million = 3.05

A debt to equity ratio of 3.05 indicates that GPC is highly leveraged and relies heavily on debt financing in its capital structure.

Working Capital Ratio

Current Assets/Current Liabilities

R$ 268.7 million / R$ 221.8 million = 1.2

A working capital ratio of 1.2 indicates a sufficient but not strong liquidity position.

Price to Book Ratio

Current Share Price/Book Value per Share.

R$ 19.85 / R$ 6.41 = 3.1

Based on total shares outstanding (common + preferred) GPC has a book value per share of R$ 6.41. At the current market price this implies a price to book ratio of 3.1, meaning GPC stock currently trades at a premium to the book value of the company.

GPC Participações Stock – Summary and Conclusions

GPC Participações is an interesting company. They have a long history, and appear to have emerged from 2013 bankruptcy proceedings in a stable financial position. They have grown sales significantly since 2017, while at the same time improving gross margins. The company is profitable and returns capital to shareholders via a dividend.

However GPC does not have a strong balance sheet. Although liquidity is sufficient in the near term, debt levels are high, and increasing. GPC Participações stock is by no means cheap. It currently trades at a premium to book value and the stock price has increased around 900% in just over a year.

I don’t see a reason to chase this stock. I will add it to my watchlist and reconsider investing if the stock comes back down to more reasonable valuation levels. I will revisit the company based on 2020 earnings, and compare their results to other Brazilian manufacturing companies such as Dohler and Baumer.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.