Common Stock: Enka

Current Market Price: $ 11.40 COP

Market Capitalization: $ 134 billion COP

*All values in this article are expressed in Colombian Pesos (COP) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Enka Stock – Summary of the Company

Enka de Colombia is a Colombian manufacturing company that produces and sells synthetic fibers. They produce chemical polymers and fibers, used as industrial raw materials in the form of resins, fibers, textile and industrial filaments and tire cord. Their current production capacity is over 100,000 tons per year. Enka was founded in 1964 and is headquartered in Medellin, Colombia.

Revenue and Cost Analysis

Enka had revenue of $ 402 billion pesos in 2019, a decrease compared to $ 411 billion in 2018. Their COGS was $ 337 billion pesos, representing a gross margin of 16%, an increase compared to 14% the previous year.

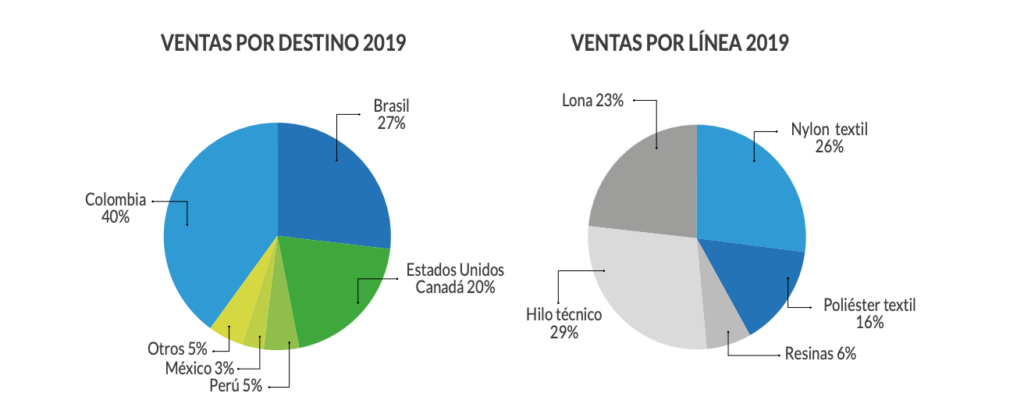

Exports account for a significant portion of Enka’s revenue, around 45% of total revenue in 2019. Brazil, The United States, and Canada are the company’s largest export locations. Peru, Mexico, and Argentina are small but relevant markets for Enka.

The company was profitable in each of the past two years. In 2019 Enka had net income of $ 15 billion, a significant increase compared to $ 4.3 billion in 2018. Although sales declined year over year, the company’s profit margin improved from 1% in 2018 to 4% in 2019. This improved margin is due almost entirely to a smaller loss derived from their currency position.

Balance Sheet Analysis

Enka has a sound balance sheet. They have a solid base of long term assets, mostly property, plant and equipment, as well as a sound liquidity position in the near term. Their liability levels are reasonable and the company is not over leveraged.

Enka – Debt Analysis

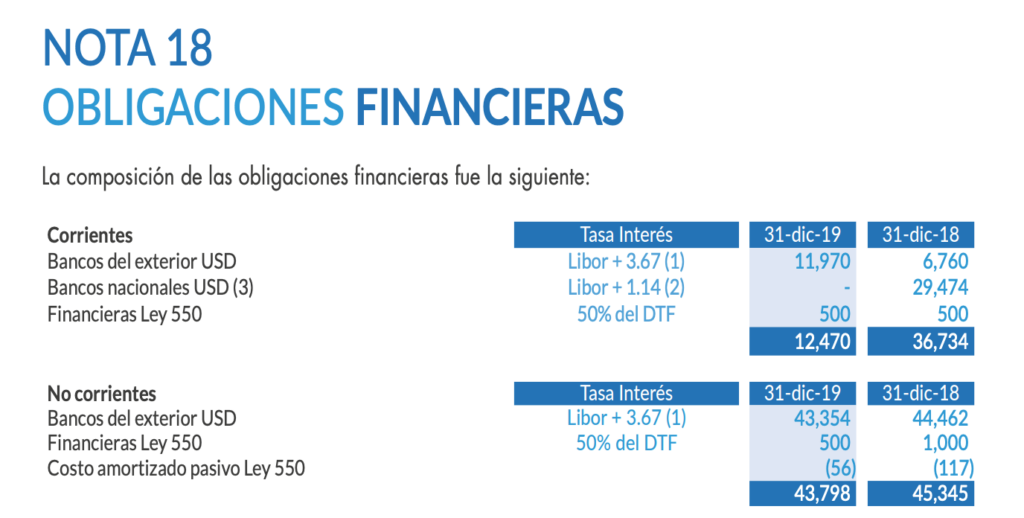

As of year-end 2019 Enka has $ 56.3 billion in total debt outstanding, $ 12.5 billion of which is classified as current. Almost all of the company’s debt is denominated in US Dollars, exposing them to the negative effects of a depreciating Colombian Peso.

Enka Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 11.8 billion common shares outstanding.

Enka Stock – Dividends

The company does not currently pay a dividend.

Enka Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 182 billion / $ 398 billion = .46

A debt to equity ratio of .46 indicates that Enka uses a mix of debt and equity in its capital structure, but relies more heavily on equity financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$ 211 billion / $ 82 billion = 2.5

A working capital ratio of 2.5 indicates a solid liquidity position. Enka should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 11.40 / $ 33.80 = .34

Enka has a book value per share of $ 33.80. At the current market price this implies a price to book ratio of .34, meaning Enka stock currently trades at a significant discount to the book value of the company,

Enka Stock – Summary and Conclusions

Enka is a decent company. They are regional leader in several of the markets in which they operate, deriving a relevant portion of their revenue from exports. The company is financially healthy, with a sound liquidity position and having been profitable in each of the last two years.

Although they are not over leveraged, the company’s debt is relevant. Enka has significant exposure to the COP/USD carry trade. Almost all of their debt is denominated in US Dollars, while only a small portion of their revenue is derived from USD sales. This exposes them to a depreciating Colombian Peso and could be a significant drag on earnings moving forward.

There is a lot to like about Enka stock, but I do not like to invest in company’s heavily exposed to the US Dollar carry trade. I will leave Enka on my watch list and revisit their 2020 results. If their USD debt position improves significantly, I will reconsider my investment decision.

Investors can compare Enka Stock to other LATAM manufacturers, such as the Brazilian manufacturer Metalfrio.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.