Common Stock: Embonor

Current Market Price: Class A Shares: $901 CLP; Class B Shares: $1,100 CLP

Market Capitalization: $513.3 Billion CLP

*All values in this article are expressed in Chilean Pesos (CLP) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Embonor Stock – Summary of the Company

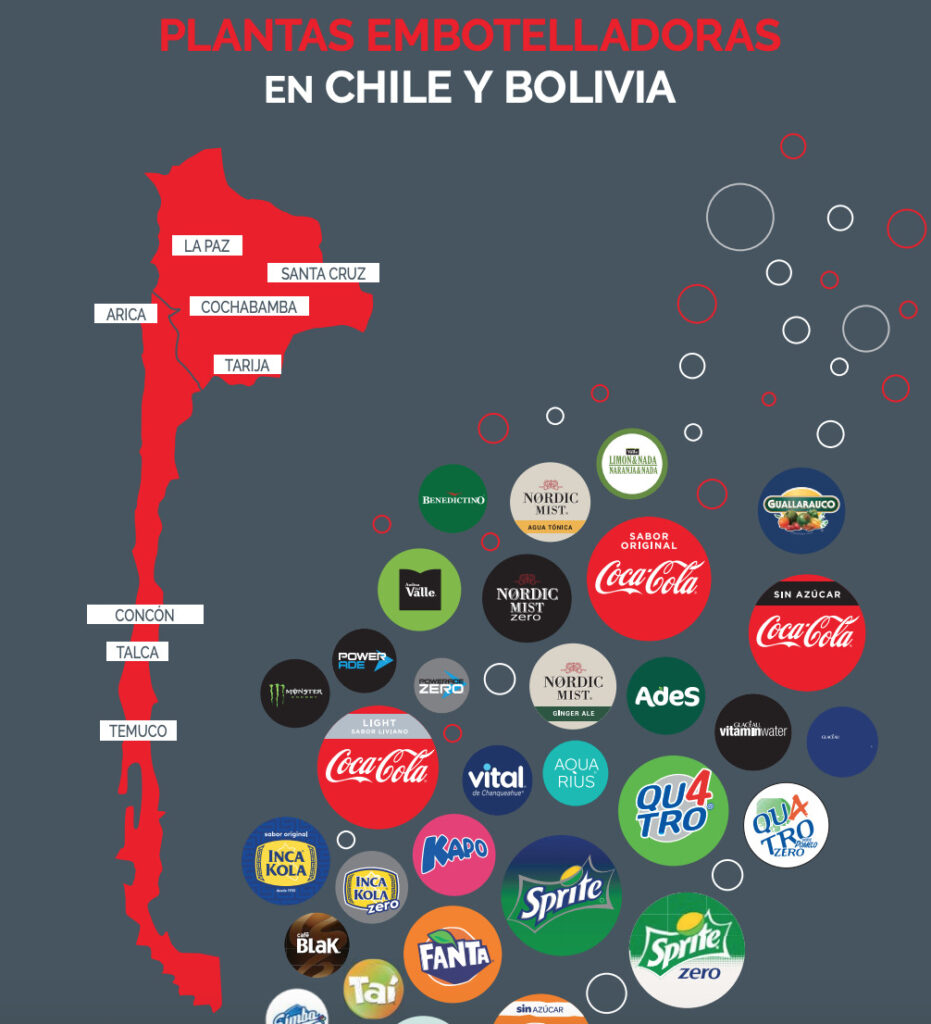

Embonor is a Chilean Coca-Cola bottling company whose operation is focused entirely on the bottling, sale, and distribution of the Coca-Cola product portfolio in Chile and Bolivia.

The Chilean portion of their franchise covers area with a population of 8.2 million people. In 2019 they sold 132.2 million cases to their 62,000 clients in Chile. The Bolivian portion cover an area with a population of 10.8 million people. In 2019 they sold 144.7 million cases to their 117,000 clients in Bolivia.

Embonor was founded in 1962 and is headquartered in Santiago, Chile. The company employs over 4,200 people.

Revenue and Cost Analysis

Embonor had revenue of $624 billion in 2019, a significant increase compared to $564 billion in 2018. Their COGS was $356 billion in 2019, representing a gross margin of 43%, roughly equal to their gross margin the previous year.

The company was profitable in each of the last two year. In 2019 Embonor had net income of $47 billion, representing a profit margin of 7.5%, roughly equal to their profit margin the previous year.

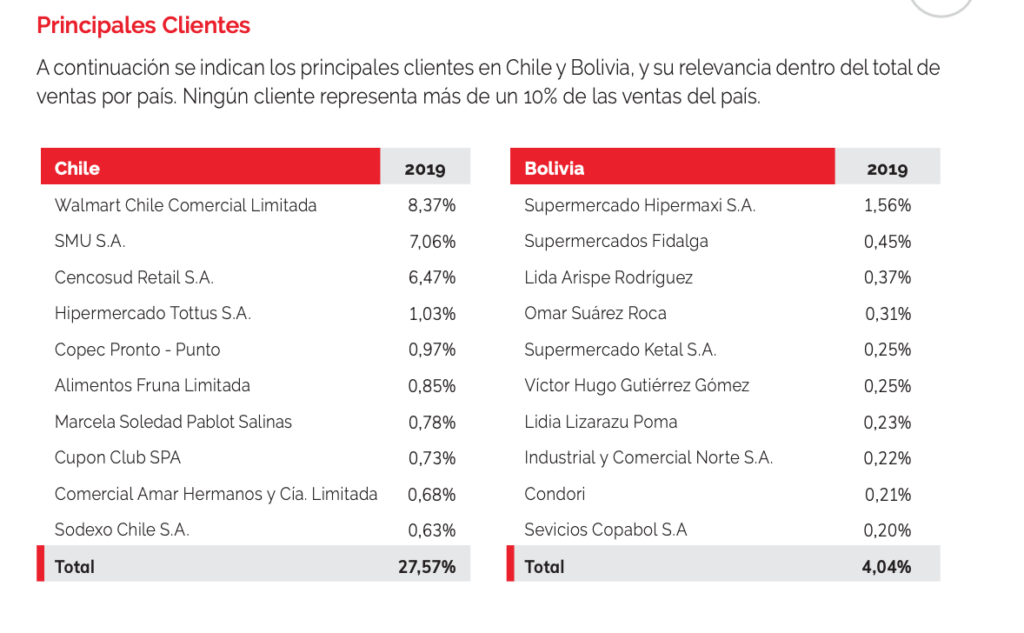

The company does not have any single client that represents more than 9% of revenue.

Balance Sheet Analysis

Embonor has a decent, but leveraged balance sheet. They have solid base of long term assets, and a sufficient, but not strong near term liquidity position. They have significant liabilities, including debt.

Embonor – Debt Analysis

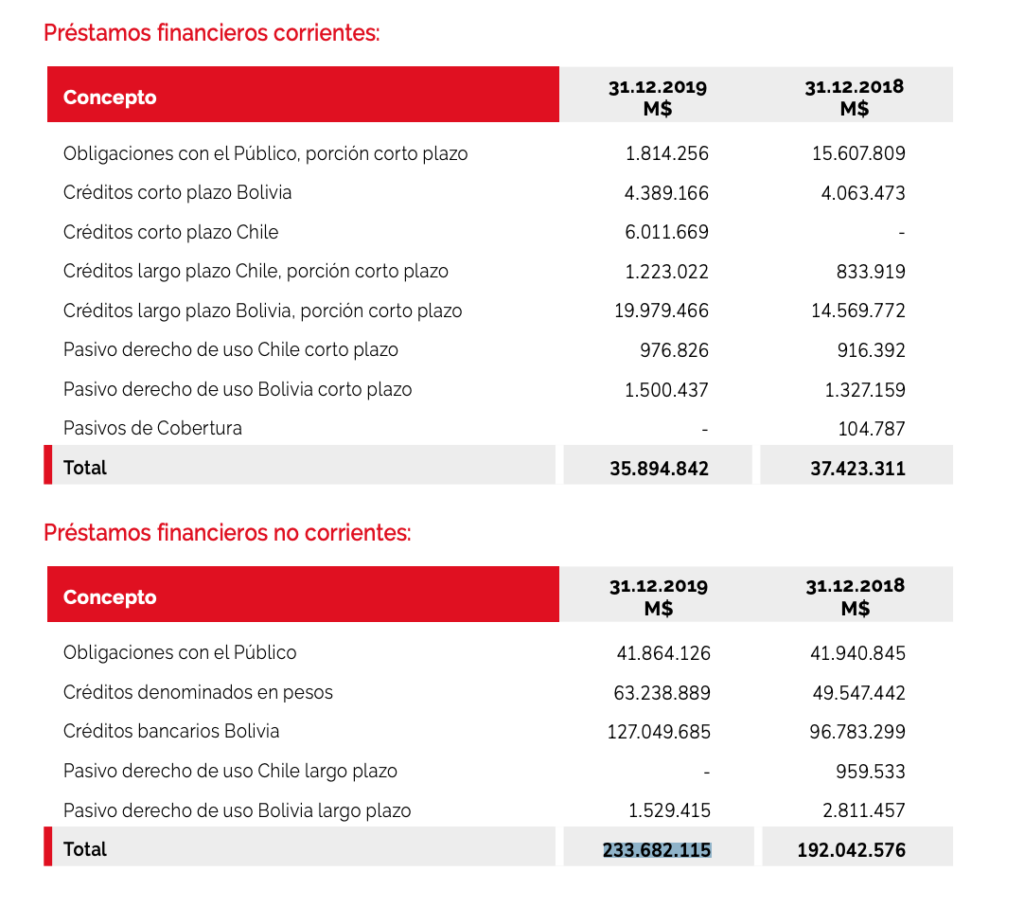

As of year-end 2019 the company has $269.6 billion in total debt outstanding, $35.9 billion of which is classified as current.

Embonor Stock – Share Dynamics and Capital Structure

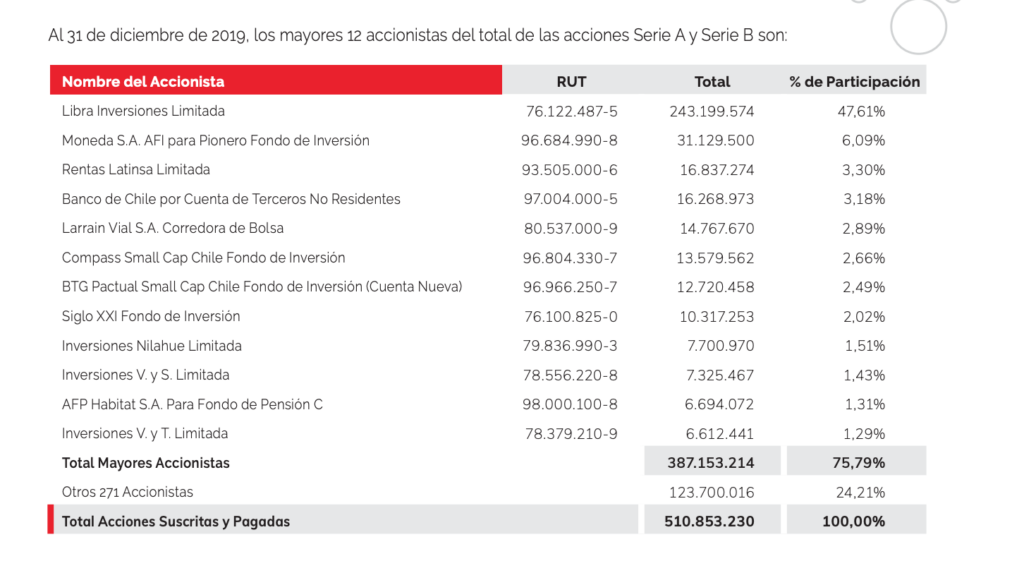

As of year-end 2019 the company has 244.4 million class A voting shares outstanding and 266.4 million class B non-voting shares outstanding. Total shares outstanding is 510.8 million shares. Their 12 largest shareholders own a combined 75.8% of the company.

Embonor Stock – Dividends

In 2019 the company paid total dividends of $60.95 per class A share and $64.00 per class B share. At their current market prices this implies dividend yields of 6.8% for class A shares and 5.8% for class B shares.

Embonor Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$469 billion / $390 billion = 1.2

A debt to equity ratio of 1.2 indicates that Embonor uses a mix of debt and equity in its capital structure, but is leveraged, and relies more heavily on debt financing.

Working Capital Ratio

Current Assets/Current Liabilities

$222 billion / $213 billion = 1.04

A working capital ratio of 1.04 indicates a sufficient, but not strong liquidity position. Investors should monitor the company’s liquidity closely for any signs of deterioration.

Price to Book Ratio

Current Share Price/Book Value per Share.

$1,100 / $763 = 1.4

Based on total shares outstanding Embonor has a book value per share of $763. At the current market price of the class B shares, this implies a price to book ratio of 1.4, meaning the company’s stock currently trades at a premium to the book value of the company.

Embonor Stock – Summary and Conclusions

Embonor is a solid company. They own a large Coca-Cola franchise covering an area with a population of around 19 million. The company is in a decent financial position, having grown top line sales significantly in 2019 and still maintaining their profit. However their balance sheet is not particularly strong, and is leveraged. Debt levels are concerning.

I will need to compare Embonor to the other Chilean Coco-Cola bottler Andina. At this point I will wait for both companies to release their 2020 financials, and do a more detailed analysis of both to determine which is the stronger Coca-Cola franchise in Chile.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.