Common Stock: Dundee Precious Metals (TSX:DPM, OTC: DPMLF)

Current Market Price: $5.18

Market Capitalization: $937 million

Dundee Precious Metals – Summary of the Company

Dundee precious metals is an international gold mining company focused on the acquisition, development, exploration, and operation of gold mining properties around the world. The company has 3 operating mines; Ada Tepe in Bulgaria, Chelopech in Bulgaria, and Tsumeb in Nambia. They also have a late stage development project in Serbia, and other exploration stage projects around the world. Dundee was founded in 1983 and is headquartered in Toronto, Canada.

Revenue and Cost Analysis

Total production was 230,592 ounces of gold and 37.2 million pounds of copper in 2019. The company’s all-in sustaining cost per ounce of gold of $725. Total revenue in 2019 was $419 million, an increase from $377 million in 2018. This increase is due to increased production.

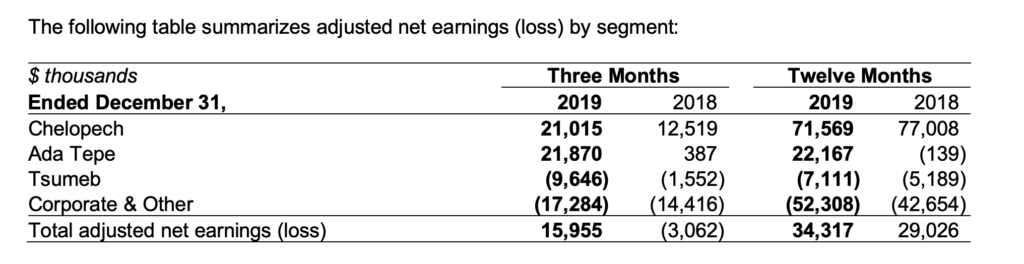

The company had an accounting net loss of $62 million in 2019, mostly due to an impairment charge of $107 million related to its Tsumeb mine. In 2018 Dundee had net income of $37 million.

Exploration expense was $14.4 million in 2019, a slight increase from $12.6 million in 2018.

Balance Sheet Analysis

Dundee has an OK balance sheet, but I would not consider it strong. Current assets were $105 million, including $23 million in cash at year end 2019. Current liabilities were $109.5 million.

Most of the company’s assets are long term assets such as property and equipment. At the end of 2019 total assets were $784.7 million compared to $191.8 million in total liabilities. The company had a significant asset write down of $107 million in 2019.

Dundee Precious Metals – Debt Analysis

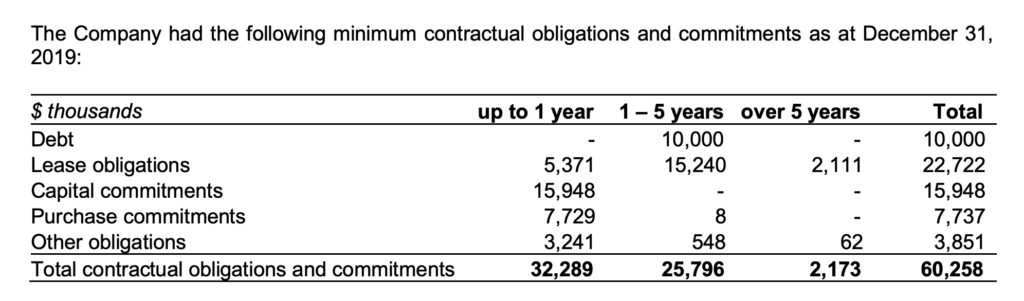

The company has total debt of $10 million as well as lease obligations totaling $22 million. As of year-end 2019 the company was in compliance with all its debt covenants.

Dundee Precious Metals Stock – Share Dynamics and Capital Structure

As of February 2020, Dundee has 180.5 million common shares outstanding. They also have 3.1 million options outstanding. Fully diluted shares outstanding is around 183.6 million shares.

The company has senior debt which appears manageable and a capital structure which is not excessively dilutive. Therefore, I believe the capital structure is acceptable for common stock holders.

Dundee Precious Metals – Dividends

Dundee paid its first ever dividend of $.02 per share in 2019. It believes it will be able to maintain this dividend level in the future.

Management – Skin in the game

Over the past 12 months’ insiders at Dundee have been net sellers of the company’s stock. Additionally, insiders own a low percentage of the outstanding equity, less than 1%.

Low insider ownership coupled with insider selling is generally viewed as a bearish signal for the stock.

Dundee Precious Metals – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$191 million/$586 million= .32

A debt to equity ratio of .32 indicates the company is financed mostly through equity capital and not overly reliant on debt to fund itself.

Price to Book Ratio

Current Share Price/Book Value per Share.

$5.18/$3.23=1.6

Based on fully diluted shares outstanding, Dundee has a book value per share of $3.23. At the current market price this implies a price to book ratio of 1.6 A price to book ratio of 1.6 means Dundee is currently trading at a small premium to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$105 million/$109.5 million= .96

A working capital ratio of .96 indicates the company has sufficient near term liquidity, however their liquidity position is not strong and they have little margin for error.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Dundee Precious Metals – Summary and Conclusions

Dundee has 3 producing assets and possibly a fourth in the near future. The company is generating positive operating cash flows and has a low cost of production. They are also investing significant amounts into exploration.

Their balance sheet is adequate, but not strong, with sufficient short term liquidity. They have some debt in their capital structure, but it appears manageable. They also have some dilutive instruments outstanding but they are not excessive.

Dundee declared its first ever dividend in 2019 and at the current market price yields around 1.5%. It currently trades at a slight premium to the book value of its assets.

Although the company’s balance sheet is not strong, it trades at a fair value relative to the book value of its assets and returns a small amount of capital to shareholders. Therefore, I believe Dundee stock is an acceptable, but risky, purchase within a highly-diversified portfolio of gold stocks.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.

One Comment

Comments are closed.