Common Stock: District Metals (TSXV:DMX)

Current Market Price: $ 0.47 CAD

Market Capitalization: $ 35.2 million CAD

**Note: All values in this article are expressed in Canadian Dollars (CAD) unless otherwise noted.

District Metals Stock – Summary of the Company

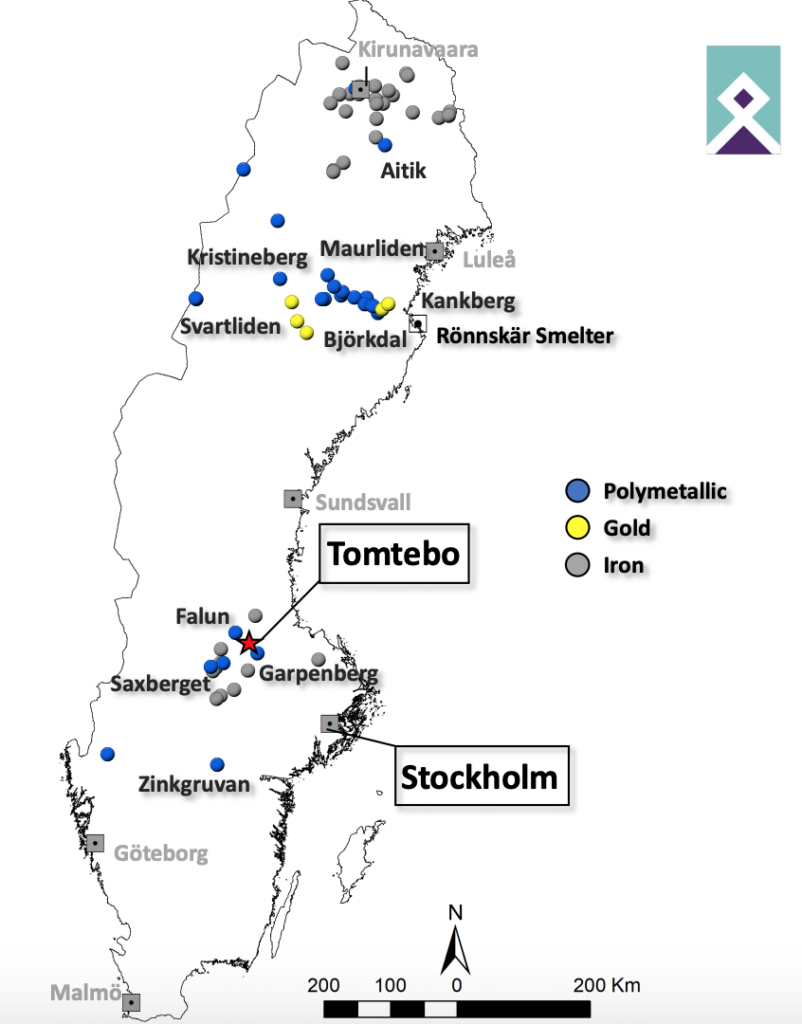

District Metals is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties. The company currently owns two exploration stage properties; one in Sweden and one in British Columbia, Canada. District Metals was founded in 1989 and is headquartered in Vancouver, Canada.

Revenue and Cost Analysis

District Metals does not have any properties that are currently producing and therefore does not have any revenue. The company consistently runs a net loss and is likely to continue to do so for the foreseeable future.

For the fiscal year end June 30, 2020 District Metals had a net loss of $1.1 million, a slight increase from $ 968 thousand in the previous year. The company spent $ 2.1 million on exploration expenses in 2020, a significant increase compared to $ 355 thousand in 2019. These expenses were capitalized.

District Metals – Royalty and Streaming Agreements

The Tomtebo property is subject to a 2.5% net smelter royalty payable to EMX Royalties. The Bakar property is subject to a 2% net smelter royalty.

Balance Sheet Analysis

District Metals has a sound balance sheet. They have a strong liquidity position and low liability levels, including no long term liabilities.

District Metals – Debt Analysis

As of the fiscal year end June 2020 the company does not have any debt outstanding.

District Metals Stock – Share Dynamics and Capital Structure

As of December 2020 District Metals has 75.7 million common shares outstanding. In addition they have 7.3 million options and 8 million warrants outstanding. Fully diluted shares outstanding is around 91 million shares.

District Metals has a dilutive capital structure. Investors should carefully consider the effects of dilution before investing.

District Metals Stock – Dividends

The company does not currently pay a dividend and is unlikely to do so for the foreseeable future.

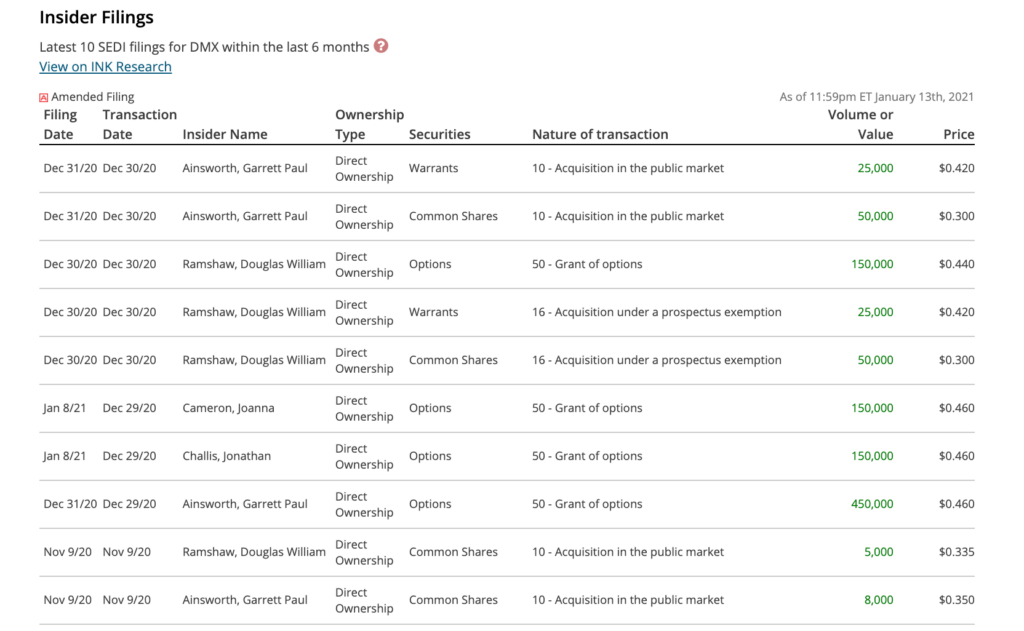

Management – Skin in the game

Insiders at District Metals have been net buyers of the company’s stock in the recent past. This is generally viewed as a bullish signal by investors.

It is also worth noting one of the company’s directors, Doug Ramshaw, is also a director of Minera Alamos. I am a shareholder of Minera Alamos stock and have been pleased with management and the company’s progress. Seeing Doug buy shares on the open market is a positive signal in my opinion.

District Metals Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$ 263 thousand / $ 4.5 million = .06

A debt to equity ratio of .06 indicates that District Metals uses almost no debt in its capital structure and is reliant almost entirely on equity financing to fund itself.

Working Capital Ratio

Current Assets/Current Liabilities

$ 2.5 million / $ 263 thousand = 9.5

A working capital ratio of 9.5 indicates a strong liquidity position. District Metals should not have a problem meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$ 0.47 / $ 0.05 = 9.5

Based on fully diluted shares outstanding District Metals has a book value per share of $ 0.05. At the current market price this implies a price to book ratio of 9.5, meaning District Metals stock trades at a significant premium to the book value of the company.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

District Metals Stock – Summary and Conclusions

District Metals stock is a solid early stage exploration investment opportunity. The company owns two projects with high potential, each located in a good jurisdiction. Both projects are very early stage and do not have a mineral resource estimate yet. However the company is sound financially and recently closed a private placement that will allow them to continue to exploration. I like management and the fact that EMX royalties backed the Sweden property.

I will continue to monitor the project and if I decide to allocate to new exploration stage companies, District Metals stock will be at the top of my list.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.