Common Stock: Cinesystem (CNSY3)

Current Market Price: N/A

Market Capitalization: N/A

*All values in this article are expressed in Brazilian Reais (BRL) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Cinesystem Stock- Summary of the Company

Cinesysem is a Brazilian movie theater company. They operate 160 theaters in 19 different cities, making them the 5th largest movie theater operator in Brazil. Their main revenue sources are ticket and food sales; however, the company has begun to add alternative revenue streams such as corporate events and escape room events. Cinesystem was founded in 1999 and is headquartered in the state of Parana, Brazil.

Cinesystem shares do not currently float as all the outstanding shares are tightly held by institutional investors.

Revenue and Cost Analysis

Cinesystem has seen steady growth in sales for the past several years. In 2017 sales were R$ 105.7 million, increasing to R$ 166.5 million in 2019. The company’s COGS were R$ 125 million in 2019, representing a gross margin of 25%.

The company was profitable in both 2019 and 2017, however had a net loss in 2018, due mostly to an increase in the company’s COGS. Cinesystem had net income of R$2.7 million in 2019 representing a profit margin of around 2%.

Balance Sheet Analysis

Cinesystem has a weak balance sheet. The company has low liquidity and is highly levered with significant liability levels, including debt.

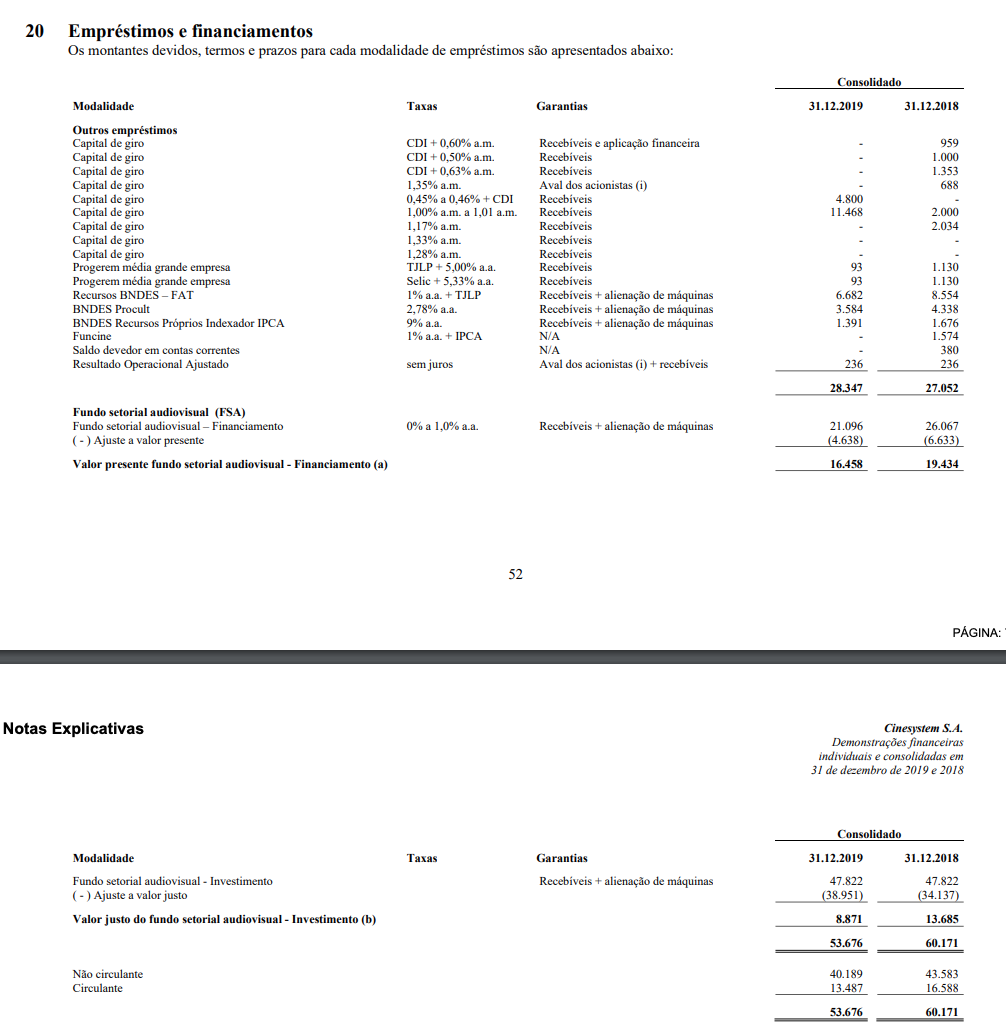

Cinesystem – Debt Analysis

As of year-end 2019 the company has R$53.6 million in debt outstanding, of which R$13.5 million is classified as current.

Cinesystem Stock- Share Dynamics and Capital Structure

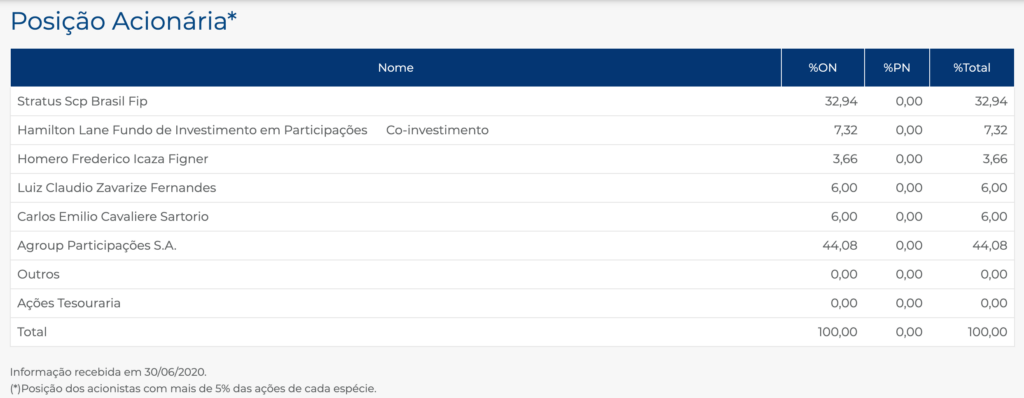

As of year-end 2019 Cinesystem has 31 million common shares outstanding. The company’s shares are tightly held by several individuals and institutional investors, including private equity firm Hamilton Lane.

Cinesystem Stock – Dividends

The company did not pay a dividend in 2019.

Cinesystem Stock – 2 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

R$ 165.3 million / R$ 43.6 million = 3.8

A debt to equity ratio of 3.8 indicates that Cinesystem uses a large amount of debt in its capital structure. This high level of leverage increases risk to common shareholders.

Working Capital Ratio

Current Assets/Current Liabilities

R$16.6 million / R$45.4 million = .37

A working capital ratio of .37 indicates a weak liquidity position. Cinesystem may have difficulties meeting its short-term obligations.

Cinesystem Stock – Summary and Conclusions

It is currently not possible to buy Cinesystem shares, but if it were I still wouldn’t invest. The company is in poor financial health, with excessive levels of debt relative to its operations. Furthermore, they likely got crushed by the coronavirus crisis and may not recover for a long time, if at all. I would prefer to allocate my resources to more promising Brazilian companies such as Dohler.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.