Common Stock: Centerra Gold (TSX:CG, OTC: CAGDF)

Current Market Price: $9.65

Market Capitalization: $2.8 billion

Centerra Gold Stock – Summary of the Company

Centerra is a gold mining company focused on the acquisition, exploration, development, and operation of gold mining properties around the world, with a focus on central Asia. The have 3 major mining properties; The Kumtor mine in The Ktygyz Republic, The Mount Milligan mine in British Columbia, Canada, and the Oksut mine in Turkey. The company also has other exploration and development stage projects around the world. Centerra Gold was founded in 2002 and its headquarters are in Toronto, Canada. They currently employ around 3,400 people.

Revenue and Cost Analysis

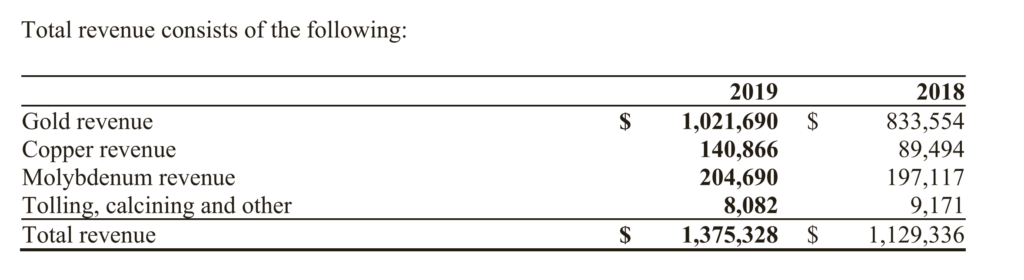

In 2019 Centerra produced 783,000 ounces of gold at an all in sustaining cost of $708 per ounce. Total revenue was $1.37 billion in 2019, an increase from $1.12 billion in 2018. This increase in revenue is due to a higher realized gold price and significantly more copper being sold.

Centerra had a net loss of $93.5 million in 2019. In 2018, the company had a net profit of $107.5 million. The large accounting loss in 2019 is due in mostly to a $230.5 million impairment charge related to the Milligan mine.

Centerra increased exploration expenditure 34% year-over-year in 2019 to $28 million.

Most the company’s revenue comes for the sale of gold. With some revenue coming from copper and molybdenum sales.

Centerra Gold – Royalty and Streaming Agreements

The company has a streaming arrangement with Royal Gold related to its Mount Mlliigan property entitling Royal Gold to 35% and 18.75% of gold and copper sales respectively. Royal Gold will pay $435 per ounce of gold and 15% of the spot price for copper. There is also a 2% production royalty on the Mount Milligan

Centerra Gold – Reserves

Centerra has “proven and probable” reserves totaling 11.1 million ounces of gold and 1.5 million pounds of copper.

Balance Sheet Analysis

Centerra has a strong balance sheet with good liquidity. At year end 2019 current assets totaled $932.6 million, including $42.7 million in cash and $774 million in inventory. Current liabilities were $244.8 million.

Most of the company’s assets are long term assets like property and equipment. At year end 2019 Centerra had total assets of $2.7 billion compared to total liabilities of $635.9 million.

Centerra Gold – Debt Analysis

The company had $88.3 million in long term debt and lease obligations. They also have a senior secured revolving facility worth $500 million. As of year-end 2019 this revolving facility was undrawn.

In 2019 Centerra paid down $111 million in debt with cash.

Centerra Gold Stock – Share Dynamics and Capital Structure

Centerra had 293.8 million common shares outstanding as of March 2020. They also have options and share based compensation outstanding. Fully diluted shares outstanding is around 299 million shares.

Although there is senior debt and some dilutive instruments outstanding, the debt appears manageable and potential dilution is not excessive. Therefore, I believe the company’s capital structure is acceptable for common stock holders.

Centerra Gold Stock – Dividends

Centerra paid a dividend of $.04 CAD per share in April 2020. This is the company’s first dividend payment since 2016.

Management – Skin in the game

Over the last 12-18 months’ insiders at Centerra have been net buyers of the company’s stock. This is generally viewed as a bullish signal as it aligns interests between management and shareholders.

Centerra Gold Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$635.9 million/ $2 billion=.3

A debt to equity ratio of .3 indicates the company is primarily financed with equity capital and not overly reliant on debt to finance itself.

Price to Book Ratio

Current Share Price/Book Value per Share.

$9.65/$7.03=1.3

Based on fully diluted shares outstanding, Centerra has a book value per share of $7.03. At the current market price this implies a price to book ratio of 1.3. A price to book ratio of 1.3 means Centerra stock currently trades at a slight premium to the book value of its assets.

Working Capital Ratio

Current Assets/Current Liabilities

$932.6 million/$244.8 million =3.8

A working capital ratio of 3.8 indicates the company has a strong liquidity position and is likely to be able to meet its short-term obligations.

Gold Market – Economic Factors and Competitive Landscape

Gold mining is a highly competitive, capital intensive business. The company will need to compete fiercely for both new projects and capital. However, given the current economic environment of global money printing and zero or negative interest rates, it would appear gold companies are poised to benefit from a strong economic tailwind.

Centerra Gold Stock – Summary and Conclusions

Centerra has 3 strong producing assets as well as a promising portfolio of exploration and development stage projects. The company has a strong balance sheet that improved significantly in 2019 when the company paid down a significant portion of its debt. It has sufficient liquidity to fund itself for the foreseeable future.

Debt levels are manageable and improving. The capital structure is not excessively dilutive. The most concerning financing arrangement is the streaming arrangement with Royal Gold, however this arrangement was acquired with the Milligan property, so it is not reflective of Centerra’s managements attitude towards shareholder assets.

The company recently paid its first dividend since 2016, indicating managements willingness to return capital to shareholders. The company appears fairly valued relative to the book values of its assets.

Given the company’s strong financial position and significant upside, I believe Centerra stock can be purchased with an adequate margin of safety to compensate for the risks associated with the company’s operations. The stock should perform well within a diversified portfolio of gold stocks.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.