Common Stock: Cementos Pacasmayo (CPAC)

Current Market Price: $6.17 PEN

Market Capitalization: $2.6 Billion PEN

*All values in this article are expressed in Peruvian Soles (PEN) unless otherwise noted.

**The bulk of this analysis is based on the company’s most recent audited financial report, which can be found by following this link.

Cementos Pacasmayo Stock – Summary of the Company

Cementos Pacasmayo is one of the leading cement and building materials manufacturers in Peru. They currently operate 3 plants and have a total production capacity of 4.9 million tons of cement per year, making them the 2nd largest cement manufacturer in Peru. Cementos Pacasmayo was founded in 1957 and is headquartered in Lima, Peru. In addition to trading on the Peruvian stock exchange the company has an ADR that trades on the New York Stock Exchange.

Revenue and Cost Analysis

In 2019 Cementos Pacasmayo had revenue of $1.39 billion, a significant increase compared to $1.26 billion in 2018. Their COGS was $905.8 million in 2019, representing a gross margin of 35%, a decrease compared to 37% the previous year and 40% in 2017.

The company has been profitable in each of the past three years. In 2019 Cementos Pacasmayo had net income of $132 million, representing a profit margin of 9.5%, an improvement compared to 5.9% and 6.6% in 2018 and 2017 respectively.

This improvement in profitability can be attributed mostly to lower financing costs and an improvement in their derivatives positions.

Balance Sheet Analysis

Cementos Pacasmayo has a decent balance sheet. They have sufficient liquidity and a solid base of long term assets. However they are slightly leveraged with a significant amount of debt outstanding.

It is worth noting that the company uses derivatives to hedge its currency and interest rate exposures. Thus derivatives book should be analyzed in detail by investors, especially considering it has had a significant impact on the company’s financial results in the past.

Cementos Pacasmayo – Debt Analysis

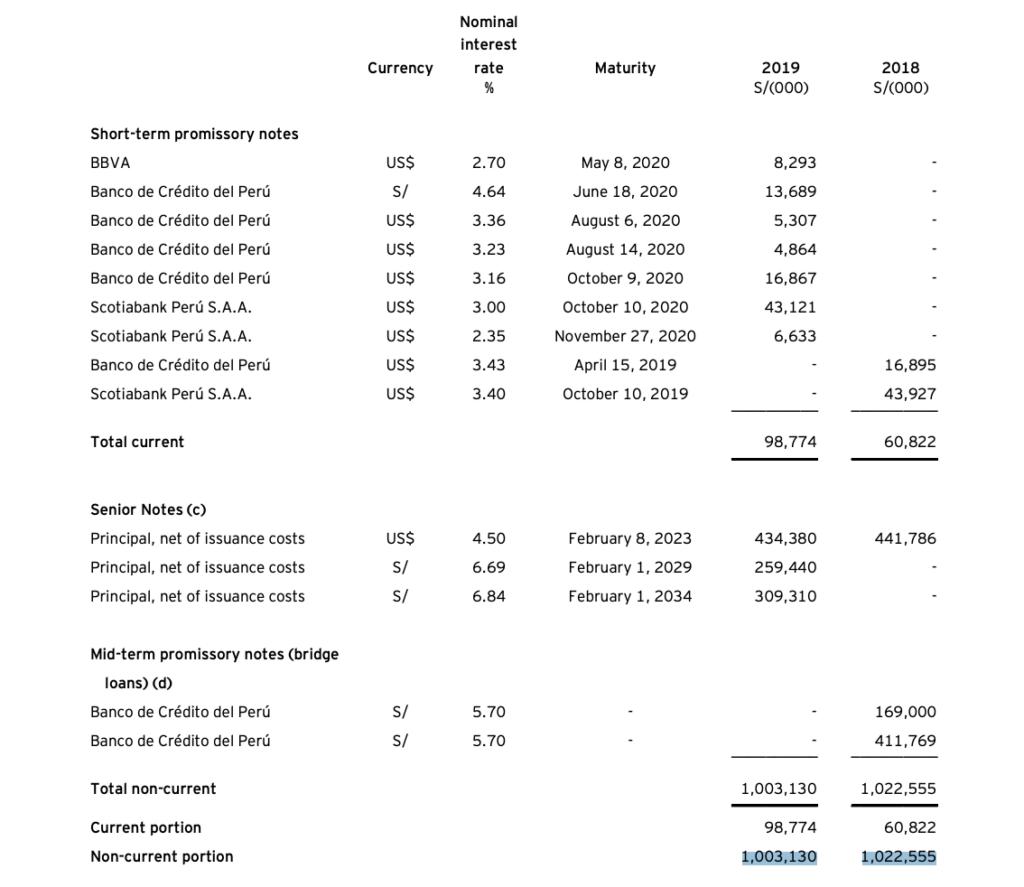

As of year-end 2019 the company has $1.1 billion in total debt outstanding, $98.8 million of which is classified as current. A significant portion of the debt is denominated in US Dollars, potentially exposing the company to the negative effects of a depreciating local currency.

Cementos Pacasmayo Stock – Share Dynamics and Capital Structure

As of year-end 2019 the company has 423.9 million common shares outstanding, 31 million of which are listed and traded on the New York Stock Exchange. The company only has one shareholder with a position larger than 10%.

Cementos Pacasmayo Stock – Dividends

The company paid total dividend of $0.36 cents per share in 2019. At the current market price this implies a dividend yield of 5.8%.

Cementos Pacasmayo Stock – 3 Metrics to Consider

Debt to Equity Ratio

Total Liabilities/Total Share Holder Equity

$1.5 billion / $1.4 billion = 1.06

A debt to equity ratio of 1.06 indicates that Cementos Pacasmayo uses a mix of debt and equity in its capital structure, but is slightly leveraged, relying slightly more on debt financing for funding.

Working Capital Ratio

Current Assets/Current Liabilities

$748.3 million / $352.7 million = 2.1

A working capital ratio of 2.1 indicates a sound liquidity position. Cementos Pacasmayo should not have problems meeting its near term obligations.

Price to Book Ratio

Current Share Price/Book Value per Share.

$6.17 / $3.35 = 1.84

Cementos Pacasmayo has a book value per share of $3.35. At the current market price this implies a price to book ratio of 1.84, meaning Cementos Pacasmayo stock currently trades at a slight premium to the book value of the company.

Cementos Pacasmayo Stock – Summary and Conclusions

Cementos Pacasmayo is a very intriguing investment opportunity. They are the second largest cements manufacturer in Peru. They have 3 plants and have invested heavily in modernizing their operations. The company is financially healthy, with sufficient liquidity and reasonable liability levels. They have been consistently profitable and return capital to shareholders via a dividend.

However debt levels are concerning, particularly their US Dollar denominated debt. Also concerning is they company’s deteriorating gross margin. I will be very interested to see the company’s full year 2020 financials. If they can maintain or improve margins as well as their debt position, then I may take a position in Cementos Pacasmayo stock.

Investors can compare Cementos Pacasmayo stock to other building materials manufacturers I the region, such as Brazilian tile manufacturer Portobello.

Disclaimer

This is not investment advice. Nothing in this analysis should be construed as a recommendation to buy, sell, or otherwise take action related to the security discussed. If I own a position in the security discussed, I will clearly state it.

This is not intended to be a comprehensive analysis and you should not make an investment decision based solely on the information in this analysis. I hope this serves as a useful starting point for a more comprehensive analysis, and hopefully draws attention to aspects of the company that were overlooked or merit further investigation. This is by no means intended to be a complete analysis. Again, this is not investment advice, do your own research.